How a 2025 Class Action and Bearish Options at Fiserv (FISV) Has Changed Its Investment Story

- In the second half of 2025, law firm Bragar Eagel & Squire, P.C. filed a class action lawsuit against Fiserv, alleging that management issued false and misleading statements around key initiatives and revised 2025 guidance later acknowledged to be based on unrealistic assumptions.

- This lawsuit, alongside an uptick in bearish institutional options activity, has raised fresh questions for investors about Fiserv’s disclosure practices and risk profile.

- Against this backdrop of alleged misleading guidance, we’ll examine how the lawsuit and shifting institutional sentiment affect Fiserv’s existing investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Fiserv Investment Narrative Recap

To own Fiserv, you generally need to believe in its role as a scaled payments and financial technology provider with solid earnings power and active capital returns, despite high debt and recent share price volatility. The new class action and bearish options positioning primarily sharpen the near term focus on disclosure quality and legal overhang rather than changing the core business thesis, while also amplifying the existing risk that execution missteps and guidance issues could weigh on sentiment.

Among recent announcements, the rapid pace of share repurchases stands out, with Fiserv completing US$11,978.23 million of buybacks under its 2023 program and authorizing up to 60,000,000 additional shares in 2025. For investors weighing near term catalysts, this capital allocation stance now has to be viewed alongside legal scrutiny of past guidance and a refreshed leadership and board, which together could influence how confidently the market treats future outlook statements.

Yet beneath the headline lawsuit, investors should be aware that...

Read the full narrative on Fiserv (it's free!)

Fiserv’s narrative projects $24.7 billion revenue and $5.9 billion earnings by 2028. This requires 5.4% yearly revenue growth and roughly a $2.5 billion earnings increase from $3.4 billion today.

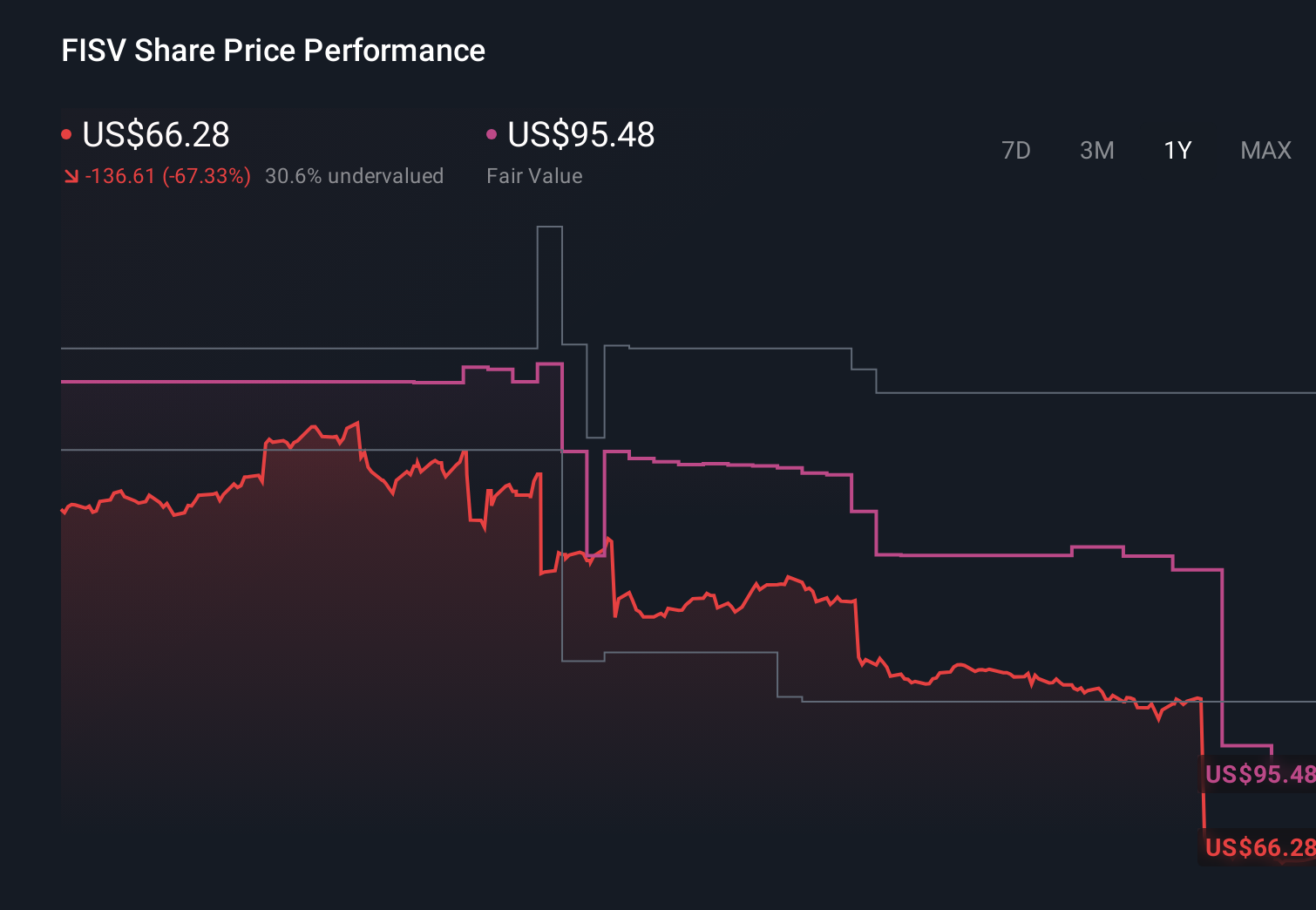

Uncover how Fiserv's forecasts yield a $95.48 fair value, a 43% upside to its current price.

Exploring Other Perspectives

Twenty one members of the Simply Wall St Community value Fiserv between US$50 and about US$231.84, with estimates spread across the full range. As you weigh these views, remember that concerns over execution delays and guidance credibility could have a meaningful impact on how the market ultimately prices Fiserv’s earnings power and resilience.

Explore 21 other fair value estimates on Fiserv - why the stock might be worth over 3x more than the current price!

Build Your Own Fiserv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fiserv research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fiserv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fiserv's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal