Are Rising WT Earnings Estimates Reframing WisdomTree’s ETF And Digital Finance Growth Narrative?

- Recently, analysts highlighted WisdomTree, Inc. as a strong growth stock, pointing to favorable rankings and upward revisions to earnings estimates that outpace industry averages.

- This renewed focus on WisdomTree’s earnings and sales potential underscores how analyst expectations can shape perceptions of the company’s growth profile and business momentum.

- Now we’ll explore how these upgraded earnings expectations may interact with WisdomTree’s existing growth narrative built around ETFs and digital finance.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

WisdomTree Investment Narrative Recap

To own WisdomTree, you need to believe in its ability to keep scaling its ETF franchise while turning digital finance initiatives into durable fee and platform revenues. The recent analyst upgrades around earnings and sales expectations reinforce the near term catalyst of growing profitability, but they do not materially change the biggest current risk, which is pressure on fees as ETFs and model portfolios become increasingly commoditized.

Among recent announcements, the expansion of WisdomTree Connect to host 13 SEC registered tokenized funds across multiple blockchains looks most relevant. It ties directly into the upgraded earnings narrative by illustrating how the firm is trying to convert early investments in tokenization and digital funds into incremental growth channels, while also adding new layers of regulatory, operational and technology risk that could influence future outcomes.

Yet beneath the upbeat earnings revisions, investors should be aware of how ongoing fee compression could...

Read the full narrative on WisdomTree (it's free!)

WisdomTree's narrative projects $600.8 million revenue and $227.8 million earnings by 2028. This requires 10.6% yearly revenue growth and a $168.2 million earnings increase from $59.6 million today.

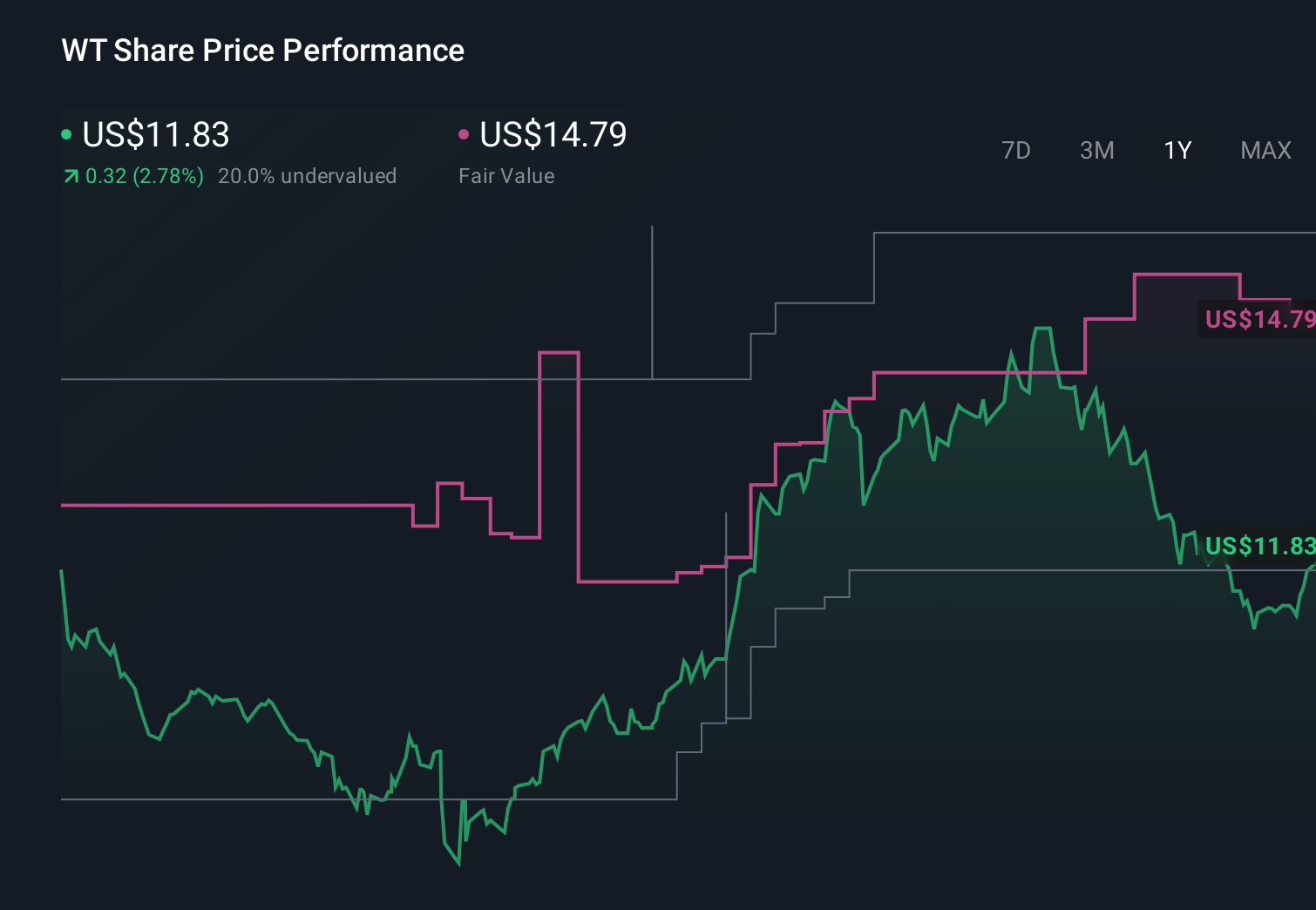

Uncover how WisdomTree's forecasts yield a $14.79 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span a wide band from about US$6.20 to US$14.79 per share, underlining how far opinions can diverge. When you set those varied views against WisdomTree’s push into tokenized funds and digital finance, it becomes even more important to compare multiple perspectives on how those initiatives might influence future earnings resilience and business quality.

Explore 2 other fair value estimates on WisdomTree - why the stock might be worth as much as 13% more than the current price!

Build Your Own WisdomTree Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WisdomTree research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free WisdomTree research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WisdomTree's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal