High Growth Tech Stocks To Watch In January 2026

As we enter January 2026, global markets show a mix of resilience and caution, with U.S. stocks experiencing a slight decline in the holiday-shortened week despite closing 2025 with robust gains. Economic indicators such as rising pending home sales and lower unemployment claims highlight underlying strengths in the economy, while divisions among Federal Reserve policymakers suggest ongoing uncertainties about future interest rate paths. In this environment, high-growth tech stocks stand out for their potential to capitalize on technological advancements and shifting market dynamics, making them noteworthy candidates for investors seeking opportunities amidst evolving economic conditions.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.94% | 32.84% | ★★★★★★ |

| Hacksaw | 32.86% | 37.50% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| CD Projekt | 33.20% | 51.75% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

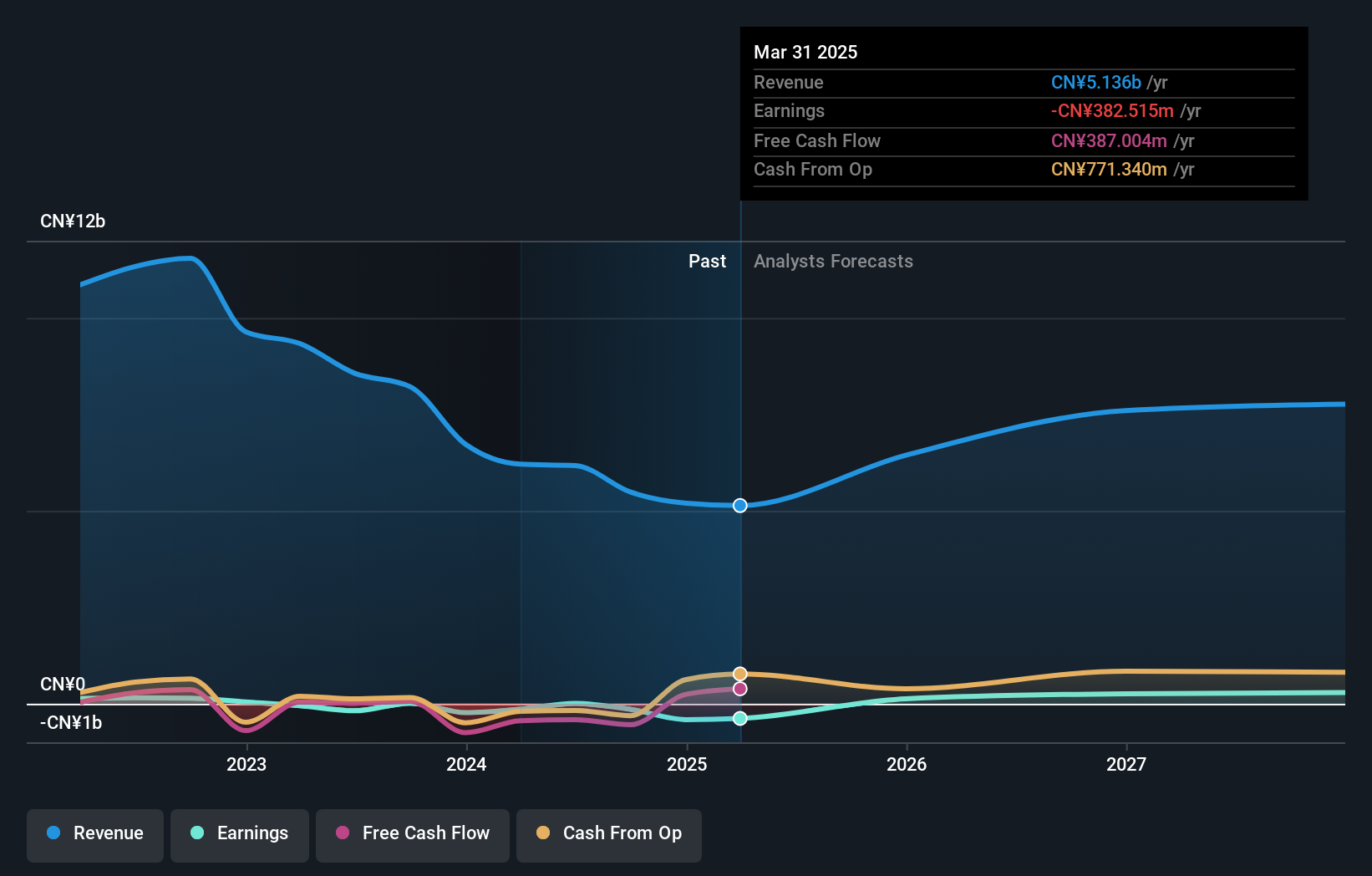

China National Software & Service (SHSE:600536)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China National Software & Service Company Limited offers independent software products and industry solutions in China, with a market capitalization of approximately CN¥43.50 billion.

Operations: The company generates revenue primarily through its Software Service Business, which accounts for CN¥5.48 billion.

China National Software & Service (CNSS) is navigating a transformative phase, evident from its robust revenue growth forecast at 15.7% annually, outpacing the broader Chinese market's 14.5%. Despite current unprofitability, the firm is on a trajectory to profitability within three years, with earnings expected to surge by an impressive 97.3% per year. This growth is underpinned by strategic R&D investments and operational adjustments reflected in recent quarters where CNSS significantly reduced its net loss to CNY 104.04 million from CNY 337.55 million year-over-year as of September 2025. The company's aggressive focus on innovation and market expansion suggests promising prospects despite a challenging competitive landscape.

- Unlock comprehensive insights into our analysis of China National Software & Service stock in this health report.

Learn about China National Software & Service's historical performance.

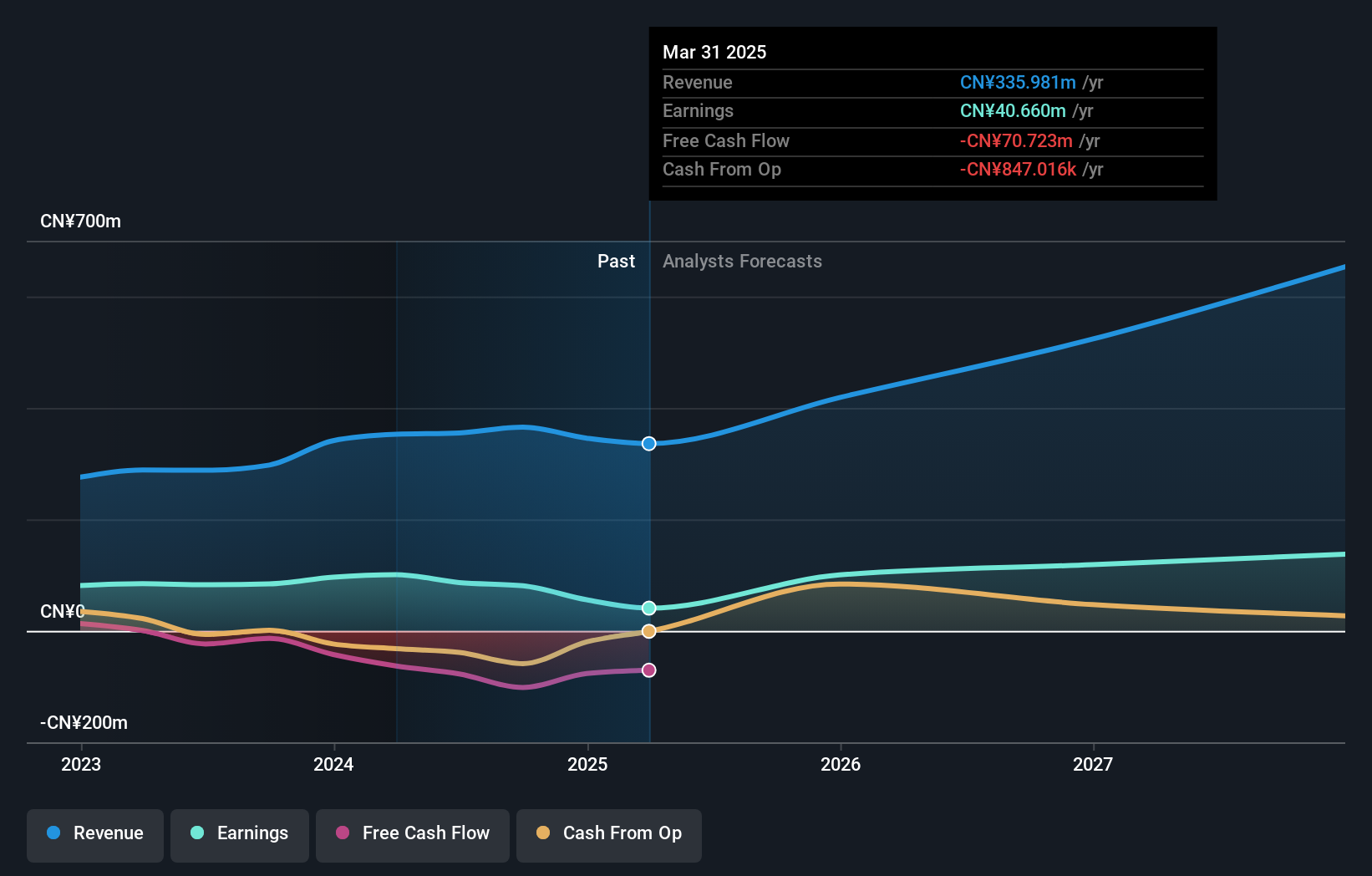

NanJing GOVA Technology (SHSE:688539)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NanJing GOVA Technology Co., Ltd. is involved in the research, design, development, production, and sale of sensors and sensor network systems in China with a market cap of CN¥9.13 billion.

Operations: GOVA Technology generates revenue primarily from its electronic test and measurement instruments segment, which contributes CN¥371.28 million. The company's operations are centered on the development and sale of advanced sensor technologies within China.

NanJing GOVA Technology has demonstrated notable growth, with recent earnings revealing a revenue increase to CNY 272.86 million from CNY 247.35 million year-over-year, and net income rising to CNY 51.99 million from CNY 45.22 million. This performance underscores a robust annualized revenue growth of 24.9%, outstripping the broader Chinese market's expansion rate of 14.5%. Despite facing challenges such as a highly volatile share price and negative earnings growth of -22.8% over the past year, the company's strategic focus on R&D and operational efficiencies may bolster future prospects, particularly as its earnings are expected to surge by an impressive 27.19% annually over the next three years.

- Take a closer look at NanJing GOVA Technology's potential here in our health report.

Assess NanJing GOVA Technology's past performance with our detailed historical performance reports.

Wuhan Dameng Database (SHSE:688692)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wuhan Dameng Database Company Limited specializes in database product development services in China and has a market cap of CN¥30.15 billion.

Operations: The company's primary revenue stream is from its data processing segment, which generated CN¥1.25 billion. With a market capitalization of CN¥30.15 billion, Wuhan Dameng Database Company Limited focuses on database product development services in China.

Wuhan Dameng Database has rapidly expanded its financial footprint, with a revenue surge to CNY 830.24 million from CNY 629.47 million year-over-year, reflecting a robust annualized growth of 24.2%. This performance is complemented by an impressive increase in net income to CNY 329.73 million, up from CNY 174.36 million, marking a significant earnings growth of approximately 46.9% over the past year—well above the software industry's average growth rate of just 0.4%. The company's commitment to innovation is evident in its strategic R&D investments and recent shareholder meetings suggest ongoing efforts to steer future operations towards sustained profitability and market competitiveness.

Make It Happen

- Click this link to deep-dive into the 246 companies within our Global High Growth Tech and AI Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal