Global Stocks Trading Below Estimated Value In January 2026

As global markets navigate a complex landscape marked by fluctuating indices and geopolitical tensions, investors are keenly observing opportunities that may arise from recent economic shifts. In this environment, identifying undervalued stocks becomes crucial, as these can offer potential value when broader market conditions create discrepancies between a stock's current price and its estimated intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990) | HK$432.00 | HK$851.22 | 49.2% |

| Recupero Etico Sostenibile (BIT:RES) | €6.56 | €12.99 | 49.5% |

| PharmaResearch (KOSDAQ:A214450) | ₩433000.00 | ₩864963.85 | 49.9% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.465 | €4.88 | 49.4% |

| NEUCA (WSE:NEU) | PLN835.00 | PLN1647.82 | 49.3% |

| Mobvista (SEHK:1860) | HK$15.43 | HK$30.64 | 49.6% |

| LINK Mobility Group Holding (OB:LINK) | NOK33.60 | NOK66.30 | 49.3% |

| Jæren Sparebank (OB:JAREN) | NOK380.00 | NOK751.23 | 49.4% |

| CURVES HOLDINGS (TSE:7085) | ¥807.00 | ¥1588.13 | 49.2% |

| ASE Technology Holding (TWSE:3711) | NT$271.50 | NT$534.38 | 49.2% |

Let's dive into some prime choices out of the screener.

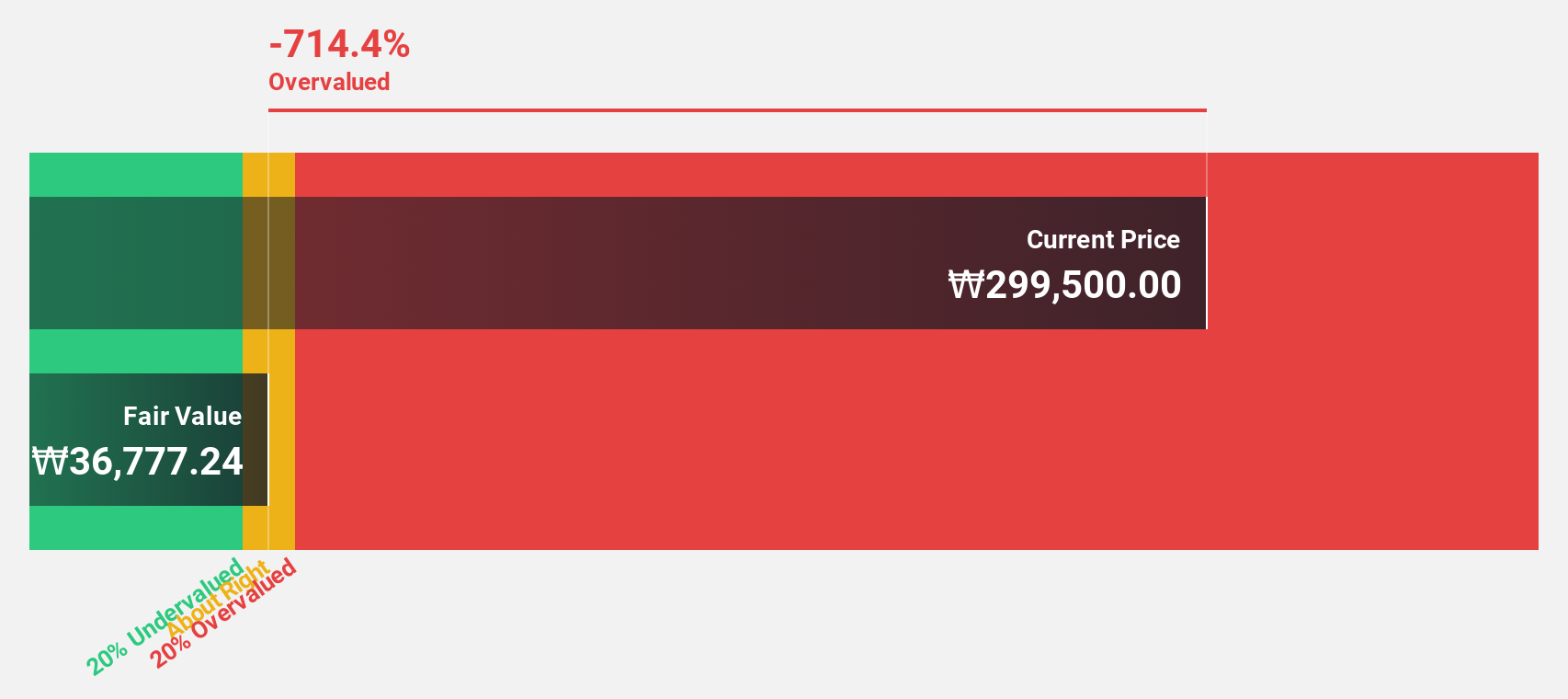

Samsung SDI (KOSE:A006400)

Overview: Samsung SDI Co., Ltd. manufactures and sells batteries across South Korea, Europe, China, North America, Southeast Asia, and internationally with a market cap of approximately ₩21.48 trillion.

Operations: Samsung SDI Co., Ltd. generates revenue primarily from the manufacturing and sale of batteries across various regions including South Korea, Europe, China, North America, and Southeast Asia.

Estimated Discount To Fair Value: 28.8%

Samsung SDI is trading at ₩277,000, significantly below its estimated fair value of ₩388,889.38, indicating it may be undervalued based on cash flows. Despite recent legal challenges and a decline in Q3 net income to KRW 48 billion from KRW 230 billion the previous year, the company is involved in promising strategic collaborations like the all-solid-state battery project with BMW and Solid Power. Earnings are expected to grow annually by over 60%, outpacing market averages.

- Our earnings growth report unveils the potential for significant increases in Samsung SDI's future results.

- Unlock comprehensive insights into our analysis of Samsung SDI stock in this financial health report.

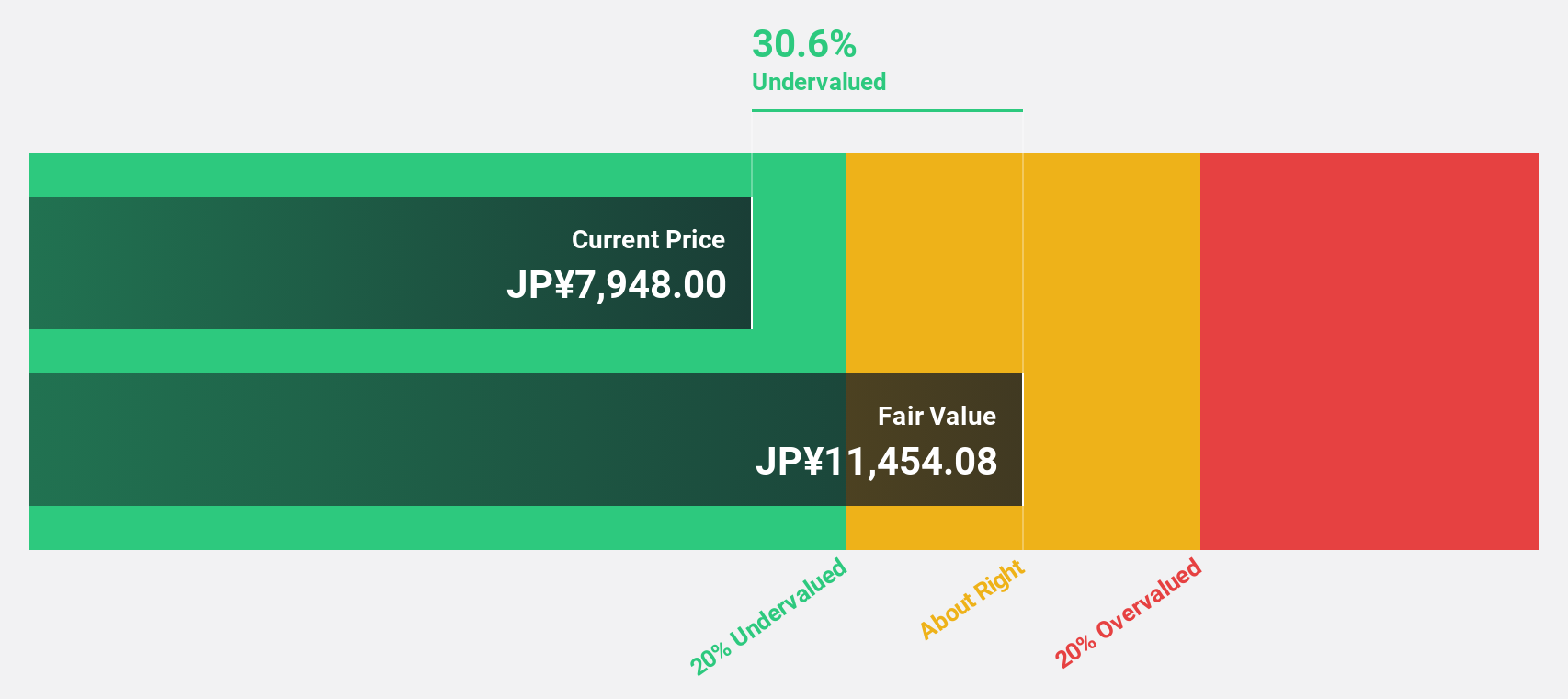

Recruit Holdings (TSE:6098)

Overview: Recruit Holdings Co., Ltd. offers HR technology and business solutions aimed at transforming the world of work, with a market cap of ¥12.68 trillion.

Operations: The company's revenue is derived from three primary segments: Staffing at ¥1.66 billion, HR Technology at ¥1.26 billion, and Marketing Matching Technologies at ¥688.75 million.

Estimated Discount To Fair Value: 30.3%

Recruit Holdings is trading at ¥9,000, below its estimated fair value of ¥12,920.05, highlighting potential undervaluation based on cash flows. The company has revised its earnings guidance upwards for fiscal year ending March 2026, with expected revenue of ¥3.60 trillion and profit attributable to owners of the parent at ¥448.3 billion. Despite recent share price volatility, Recruit completed a significant buyback program aimed at maximizing shareholder returns and improving capital efficiency.

- Our comprehensive growth report raises the possibility that Recruit Holdings is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Recruit Holdings' balance sheet health report.

ASE Technology Holding (TWSE:3711)

Overview: ASE Technology Holding Co., Ltd. and its subsidiaries offer semiconductor manufacturing services across the United States, Taiwan, Asia, Europe, and globally with a market cap of NT$1.15 trillion.

Operations: ASE Technology Holding Co., Ltd. generates revenue primarily from Packaging (NT$297.82 billion), Electronic Manufacturing Services (EMS) (NT$297.91 billion), and Testing (NT$67.29 billion).

Estimated Discount To Fair Value: 49.2%

ASE Technology Holding is trading at NT$271.5, significantly below its estimated fair value of NT$534.38, suggesting undervaluation based on cash flows. Despite high debt levels and a volatile share price, earnings are forecast to grow substantially at 28.92% annually over the next three years, outpacing market growth expectations. Recent strategic moves include a potential acquisition of Analog Devices' Penang facility, which could enhance ASE's operational capabilities and expand its global footprint in IC packaging and testing operations.

- Insights from our recent growth report point to a promising forecast for ASE Technology Holding's business outlook.

- Dive into the specifics of ASE Technology Holding here with our thorough financial health report.

Turning Ideas Into Actions

- Gain an insight into the universe of 484 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal