Global Penny Stocks With Market Caps Under US$4B

As global markets navigate a complex landscape, with U.S. stocks experiencing declines amid light trading volumes and European indices reaching new highs, investors are keenly observing potential opportunities across various sectors. Penny stocks, often associated with smaller or newer companies, remain an intriguing area of interest due to their affordability and growth potential. Despite being a somewhat outdated term, penny stocks can still highlight firms that offer significant value when paired with strong financials and solid fundamentals. This article explores three such penny stocks that stand out for their financial strength and potential upside in today's market conditions.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.45 | HK$909.23M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.62 | THB1.1B | ✅ 3 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.34 | £498.41M | ✅ 5 ⚠️ 0 View Analysis > |

| IVE Group (ASX:IGL) | A$3.03 | A$465.68M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.1B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.47 | SGD13.66B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.70 | $406.93M | ✅ 4 ⚠️ 2 View Analysis > |

| RGB International Bhd (KLSE:RGB) | MYR0.21 | MYR323.58M | ✅ 4 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £186.68M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,554 stocks from our Global Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Zhefu Holding Group (SZSE:002266)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhefu Holding Group Co., Ltd. operates through its subsidiaries to manufacture and sell hydropower equipment both in China and internationally, with a market cap of CN¥21.59 billion.

Operations: The company does not report specific revenue segments.

Market Cap: CN¥21.59B

Zhefu Holding Group has shown a stable financial performance with revenue of CN¥16.15 billion for the nine months ending September 2025, a slight increase from the previous year. The company maintains a satisfactory net debt to equity ratio of 2% and its interest payments are well covered by EBIT at 25.5x, indicating strong financial management. However, its return on equity is low at 8.5%, and earnings growth over the past five years has been negative despite recent improvements. The stock trades at a favorable price-to-earnings ratio compared to the broader Chinese market, suggesting potential value for investors in penny stocks seeking stability amidst volatility.

- Click here to discover the nuances of Zhefu Holding Group with our detailed analytical financial health report.

- Explore Zhefu Holding Group's analyst forecasts in our growth report.

Beijing Orient Landscape& EnvironmentLtd (SZSE:002310)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Beijing Orient Landscape & Environment Ltd (SZSE:002310) operates in the environmental landscape design and construction industry with a market cap of CN¥11.98 billion.

Operations: The company's revenue comes entirely from its operations in China, amounting to CN¥348.60 million.

Market Cap: CN¥11.98B

Beijing Orient Landscape & Environment Ltd faces challenges with declining revenue, reporting CN¥156.24 million for the nine months ending September 2025, a significant drop from the previous year. Despite having more cash than total debt and a reduced debt-to-equity ratio from 105.2% to 3.7% over five years, the company remains unprofitable with negative return on equity at -99.45%. Short-term assets of CN¥788.2 million do not cover liabilities, and management's inexperience is notable with an average tenure of less than one year. However, it has a cash runway exceeding three years if free cash flow remains stable.

- Get an in-depth perspective on Beijing Orient Landscape& EnvironmentLtd's performance by reading our balance sheet health report here.

- Gain insights into Beijing Orient Landscape& EnvironmentLtd's historical outcomes by reviewing our past performance report.

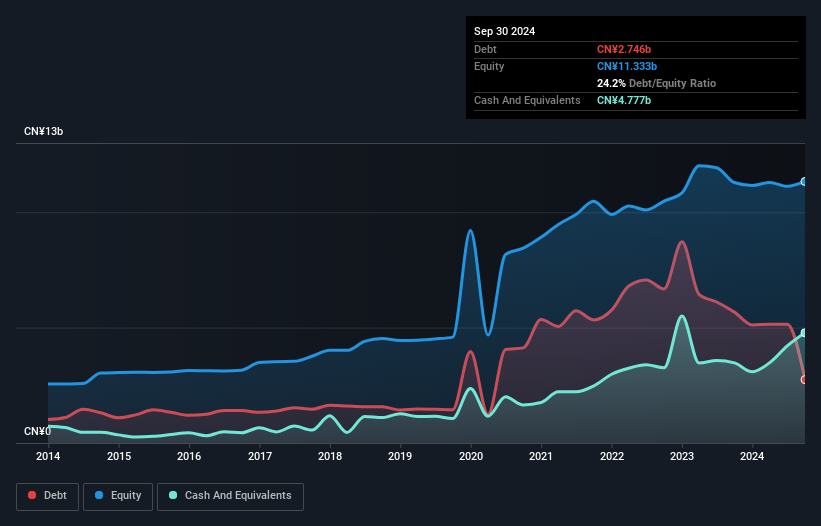

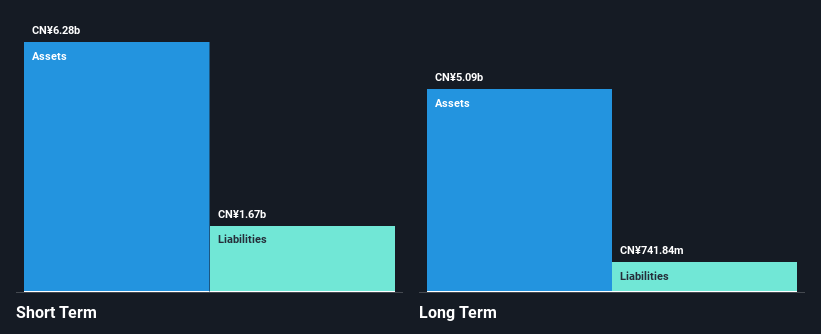

Tianjin Chase Sun PharmaceuticalLtd (SZSE:300026)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tianjin Chase Sun Pharmaceutical Co., Ltd is involved in the research, development, production, and sale of pharmaceutical products both in China and internationally with a market cap of CN¥10.81 billion.

Operations: No specific revenue segments are reported for Tianjin Chase Sun Pharmaceutical Co., Ltd.

Market Cap: CN¥10.81B

Tianjin Chase Sun Pharmaceutical Co., Ltd. has experienced a decline in revenue, reporting CN¥4.15 billion for the nine months ending September 2025, down from CN¥4.44 billion the previous year, with net income also decreasing to CN¥80.76 million from CN¥168.36 million. Despite being unprofitable and removed from major stock indices, the company maintains financial stability with short-term assets of CN¥5.9 billion exceeding both its short- and long-term liabilities and having more cash than total debt. The management team is experienced, although recent governance changes could impact future operations and strategic direction.

- Unlock comprehensive insights into our analysis of Tianjin Chase Sun PharmaceuticalLtd stock in this financial health report.

- Examine Tianjin Chase Sun PharmaceuticalLtd's earnings growth report to understand how analysts expect it to perform.

Summing It All Up

- Get an in-depth perspective on all 3,554 Global Penny Stocks by using our screener here.

- Seeking Other Investments? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal