Global Growth Companies With High Insider Ownership

As global markets navigate a mix of economic signals, from rising U.S. home sales to shifts in European inflation and Japanese monetary policy, investors are keenly observing the landscape for opportunities. In this environment, growth companies with high insider ownership can be particularly attractive as they often indicate strong confidence from those closest to the business and may offer resilience amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 35% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Let's uncover some gems from our specialized screener.

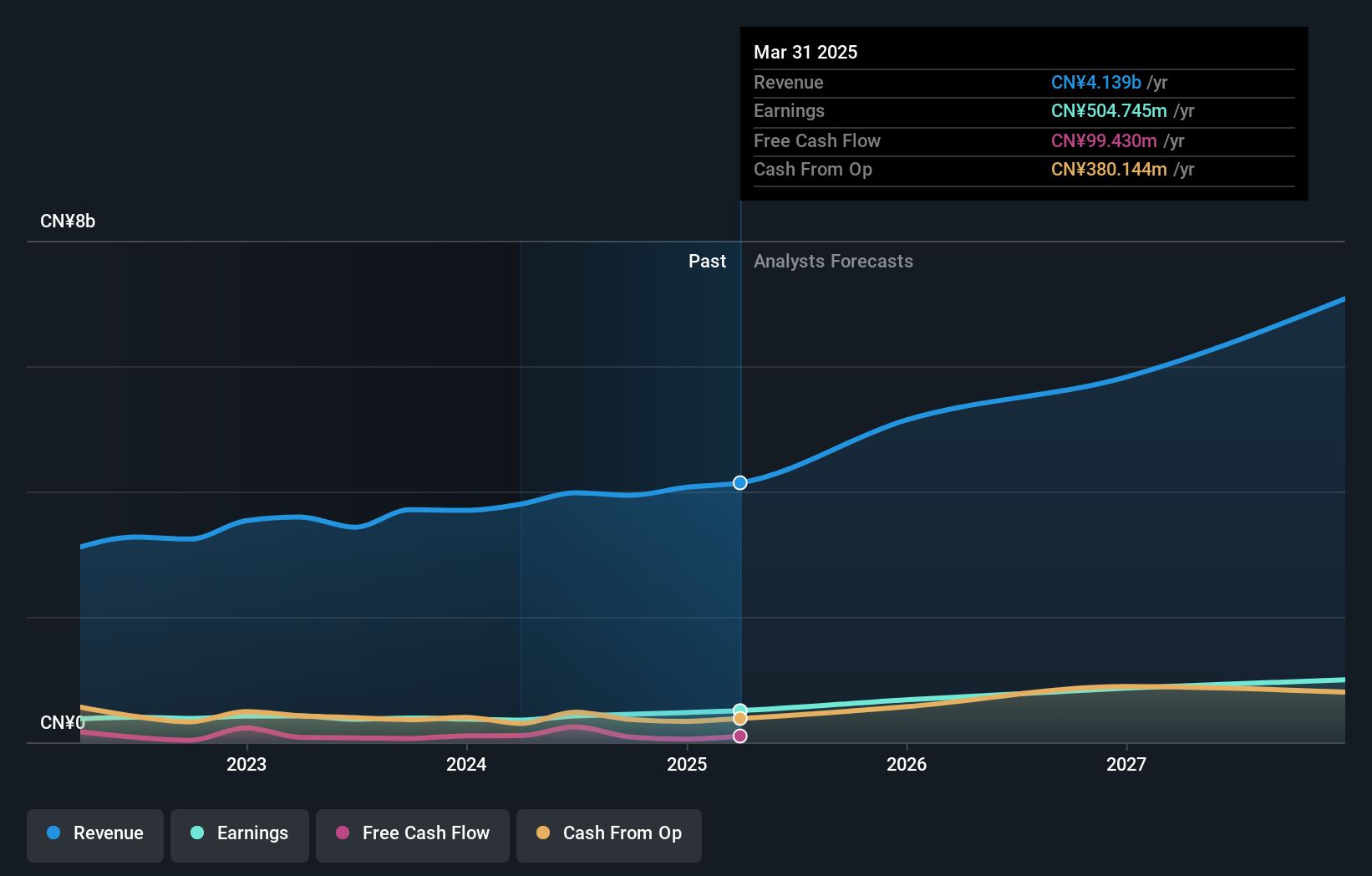

Hubei Zhenhua ChemicalLtd (SHSE:603067)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hubei Zhenhua Chemical Co., Ltd. is involved in the research, development, manufacture, and sale of chromium salt and related products mainly in China, with a market cap of CN¥22.32 billion.

Operations: The company generates revenue through the research, development, manufacture, and sale of chromium salt and related products primarily within China.

Insider Ownership: 39.4%

Earnings Growth Forecast: 25.9% p.a.

Hubei Zhenhua Chemical Ltd. demonstrates robust growth potential with its revenue forecast to increase by 20.1% annually, outpacing the broader Chinese market's growth rate. Despite a highly volatile share price recently, the company reported CNY 3.22 billion in sales for the first nine months of 2025, up from CNY 2.99 billion year-on-year. Earnings are expected to grow significantly over the next three years, although slightly below market averages.

- Unlock comprehensive insights into our analysis of Hubei Zhenhua ChemicalLtd stock in this growth report.

- Our expertly prepared valuation report Hubei Zhenhua ChemicalLtd implies its share price may be too high.

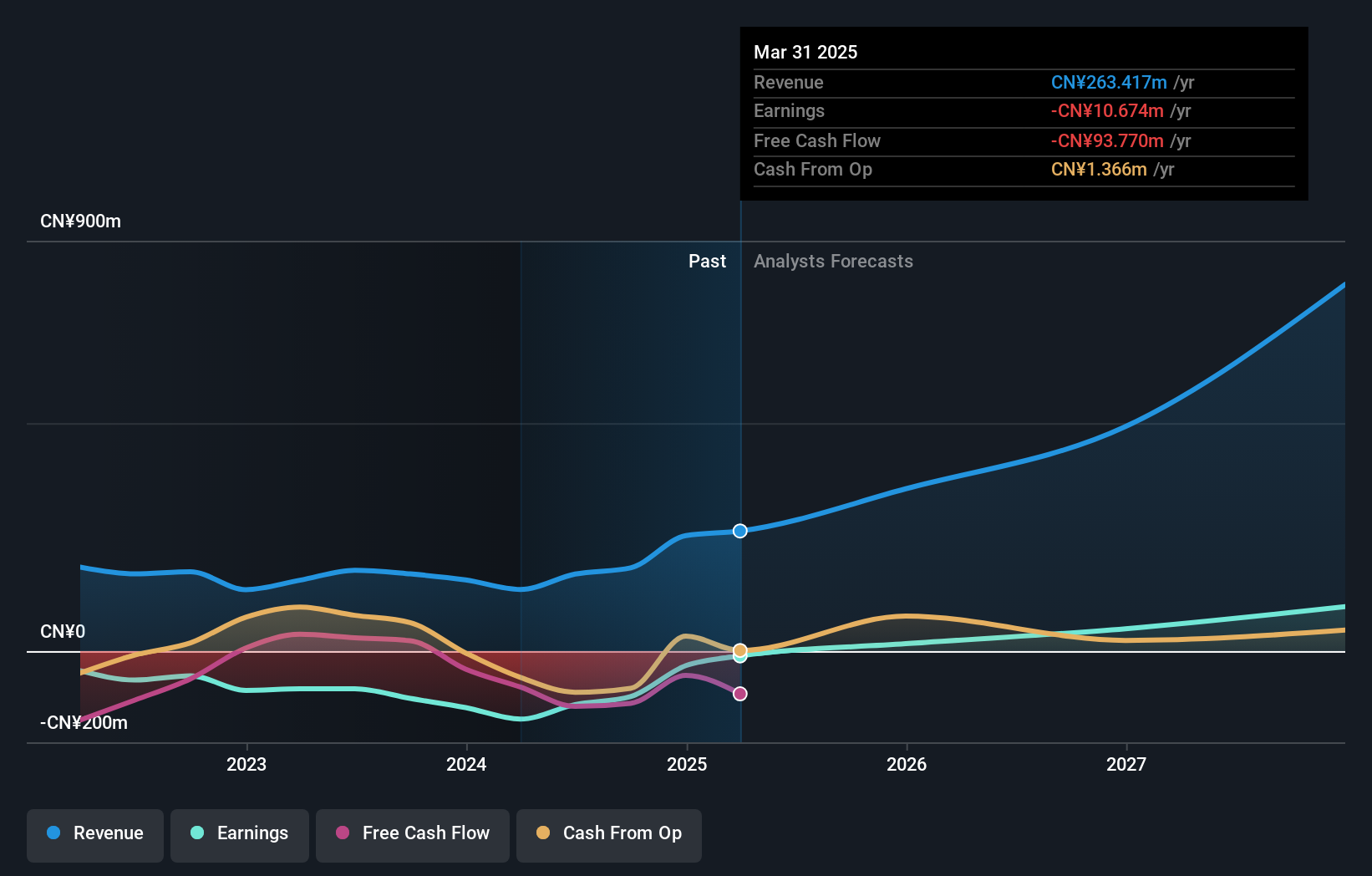

QuantumCTek (SHSE:688027)

Simply Wall St Growth Rating: ★★★★★☆

Overview: QuantumCTek Co., Ltd. operates in China focusing on the research, development, production, and sale of quantum communication, computing, and precision measurement products with a market cap of CN¥54.13 billion.

Operations: QuantumCTek Co., Ltd. generates revenue through its involvement in quantum communication, computing, and precision measurement products within the Chinese market.

Insider Ownership: 12%

Earnings Growth Forecast: 134.7% p.a.

QuantumCTek shows promising growth potential with a forecasted revenue increase of 32.7% annually, surpassing the Chinese market's average. Despite recent share price volatility and past shareholder dilution, the company reported significant sales growth to CNY 189.73 million for the first nine months of 2025 from CNY 99.71 million last year and reduced its net loss to CNY 26.47 million. It is expected to become profitable in three years, indicating above-average market growth expectations.

- Navigate through the intricacies of QuantumCTek with our comprehensive analyst estimates report here.

- The analysis detailed in our QuantumCTek valuation report hints at an inflated share price compared to its estimated value.

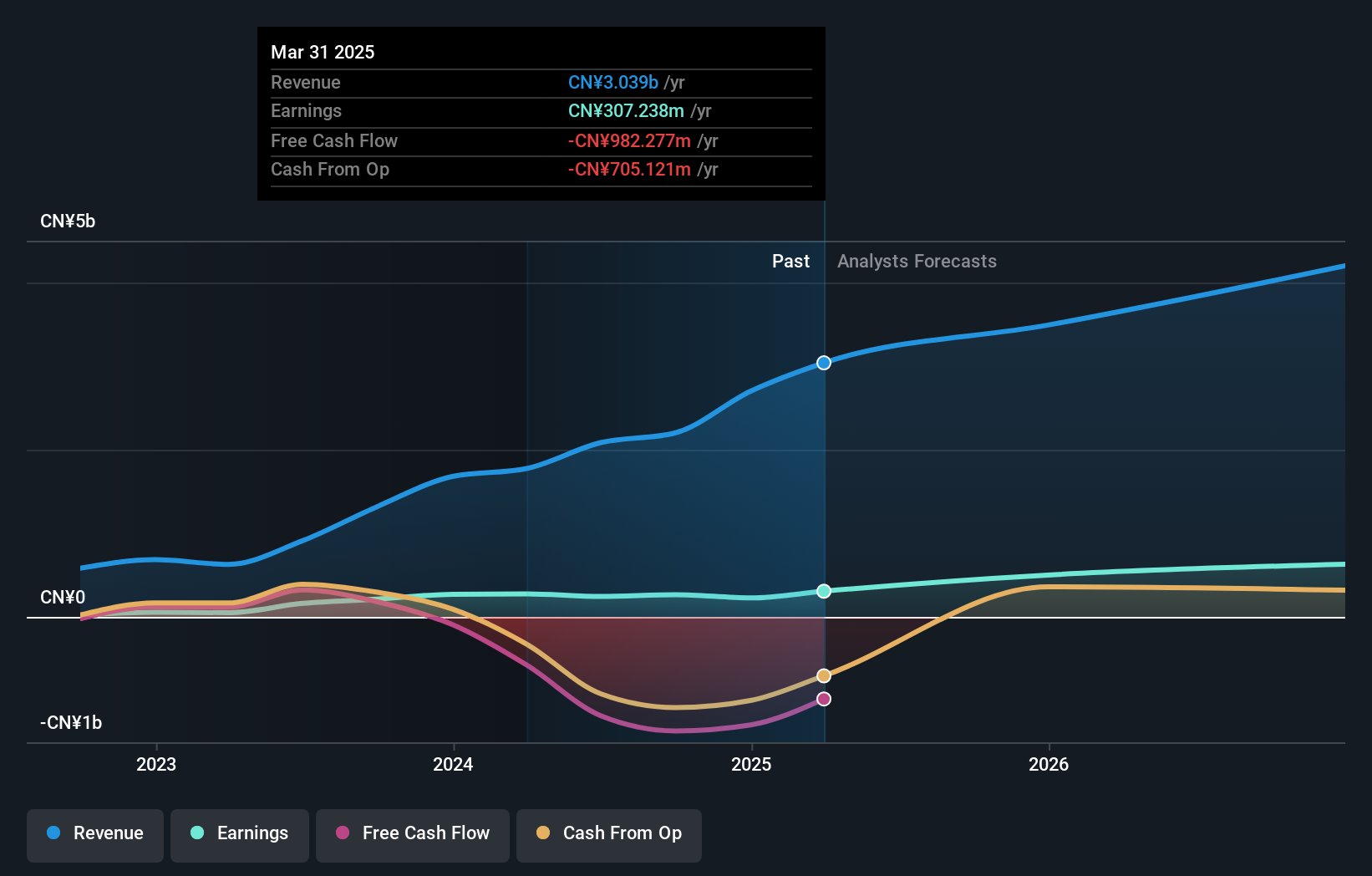

Jiangsu Leadmicro Nano-Equipment Technology (SHSE:688147)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Leadmicro Nano-Equipment Technology Ltd specializes in manufacturing high-end micro-nano equipment for the semiconductor and pan-semiconductor industries, with a market cap of CN¥29.22 billion.

Operations: The company's revenue primarily comes from its Equipment Manufacturing segment, which generated CN¥2.88 billion.

Insider Ownership: 18.8%

Earnings Growth Forecast: 30.6% p.a.

Jiangsu Leadmicro Nano-Equipment Technology is poised for growth with a forecasted annual revenue increase of 24.9%, outpacing the Chinese market average. The company's earnings are expected to rise by 30.6% annually, reflecting strong profit potential despite recent share price volatility. Recent financial results show sales climbing to CNY 1.72 billion and net income reaching CNY 248.5 million for the first nine months of 2025, indicating robust performance amid strategic share buybacks totaling CNY 79.53 million.

- Click here and access our complete growth analysis report to understand the dynamics of Jiangsu Leadmicro Nano-Equipment Technology.

- According our valuation report, there's an indication that Jiangsu Leadmicro Nano-Equipment Technology's share price might be on the expensive side.

Taking Advantage

- Gain an insight into the universe of 857 Fast Growing Global Companies With High Insider Ownership by clicking here.

- Contemplating Other Strategies? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal