A Look At Vail Resorts (MTN) Valuation After A Mixed Quarterly Update And Share Price Weakness

Vail Resorts (MTN) is back in focus after its latest quarterly report showed 4.1% year-over-year revenue growth, a slight revenue miss versus expectations, stronger than anticipated skier visits, and ongoing efforts to support visitation heading into the 2025/2026 season.

See our latest analysis for Vail Resorts.

The latest quarter and weather related headlines come against a weaker backdrop for investors, with the share price down 6.3% since results and a 1 year total shareholder return decline of 19.57%. Multi year total shareholder returns also show prolonged weakness, which suggests momentum has been fading rather than building.

If earnings updates at Vail have you reassessing your watchlist, it could be a useful moment to broaden your search with fast growing stocks with high insider ownership.

With revenue growth, a mixed quarterly reaction, and the share price well below some analyst targets, the key question now is whether Vail Resorts is trading at a discount or whether the market already prices in its future growth potential.

Most Popular Narrative: 22.7% Undervalued

At a last close of US$134.35 versus a narrative fair value of US$173.73, the current price sits well below where this widely followed view places Vail Resorts.

The Epic Pass and Epic Day Pass programs are expected to continue growing, with a 7% average price increase for the 2025-2026 season, which should contribute positively to lift ticket revenue and overall EBITDA.

Curious how a relatively steady revenue outlook, firm margins and a richer future P/E all add up to that fair value? The key assumptions are more ambitious than they look at first glance.

Result: Fair Value of $173.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative hinges on visitation holding up and currency headwinds staying contained, and both could pressure the earnings and valuation story if conditions worsen.

Find out about the key risks to this Vail Resorts narrative.

Another Angle on Valuation

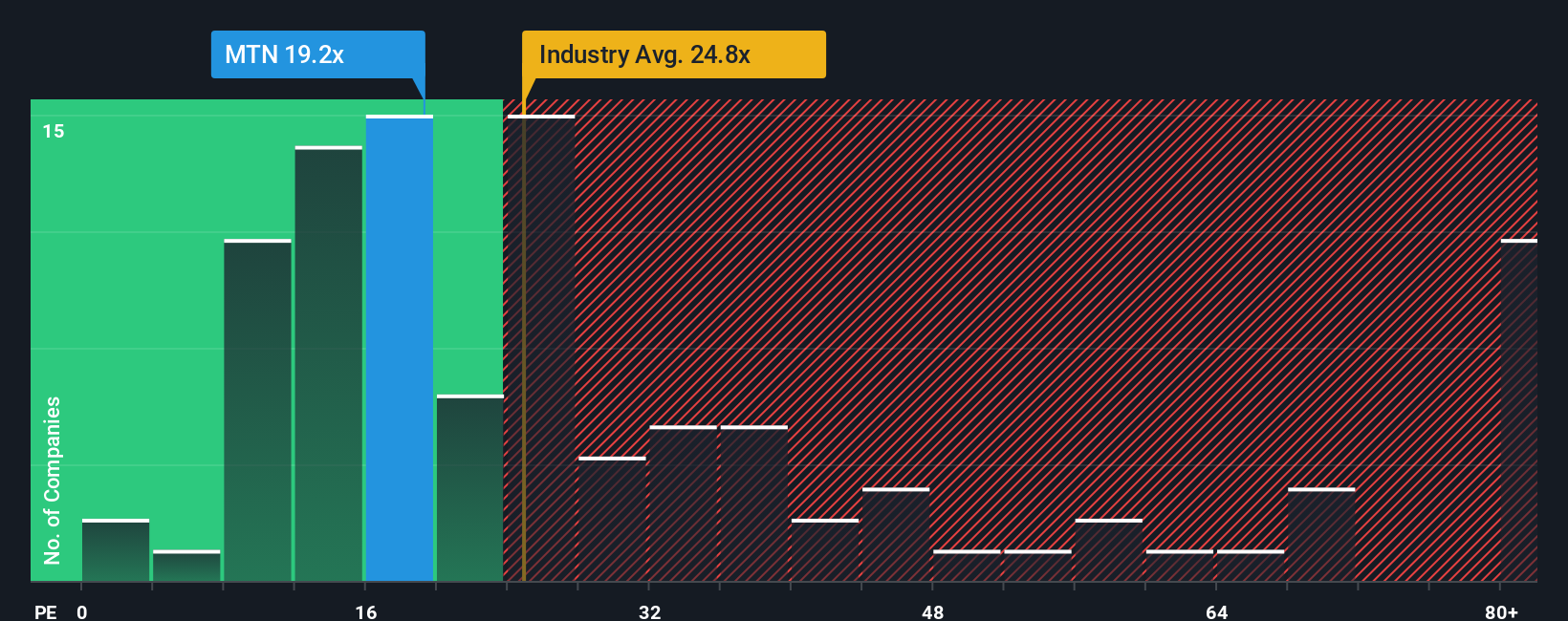

There is a clear tension between the popular 22.7% undervalued narrative and how the current P/E stacks up. Vail Resorts trades on about 18x earnings, compared with a peer average of 21.5x, yet our fair ratio sits slightly lower at 17.3x. That mix of discount to peers but premium to the fair ratio raises a simple question: is this a pricing gap you see as risk or opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vail Resorts Narrative

If you see the numbers differently, or prefer to test the assumptions yourself, you can build a full view in minutes with Do it your way.

A great starting point for your Vail Resorts research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Vail Resorts has sharpened your thinking, do not stop here. Broaden your watchlist with a few focused stock ideas that match what you care about most.

- Target income and stability by scanning these 14 dividend stocks with yields > 3% that could help you build a more predictable cash flow stream.

- Explore growth potential in technology with these 25 AI penny stocks that are tied to artificial intelligence themes.

- Add a value tilt to your research by checking these 877 undervalued stocks based on cash flows that might be trading below what their cash flows suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal