Rheinmetall (XTRA:RHM) Valuation Check After Rising Investor Focus On European Defense Spending

Why recent geopolitical tension matters for Rheinmetall shares

President Trump’s intervention in Venezuela has sharpened concerns about global security, drawing fresh investor attention to defense contractors. Rheinmetall (XTRA:RHM), closely linked to Europe’s military spending ambitions, recently saw its share price move 7% higher on this backdrop.

See our latest analysis for Rheinmetall.

For context, Rheinmetall’s recent 1-day share price return of 9.36% and 7-day return of 14.81% come after a 90-day share price decline of 7.03%. Its 1-year total shareholder return of 190.38% and very large 5-year total shareholder return point to strong longer term momentum.

If geopolitical tension has you looking more closely at defense, this could be a useful moment to scan other opportunities across aerospace and defense stocks for ideas beyond Rheinmetall.

With Rheinmetall trading at €1,752, some valuation models and analyst targets sit higher and hint at a possible discount, but recent gains are sharp. Is this a fresh buying opportunity, or is future growth already priced in?

Most Popular Narrative Narrative: 21.2% Undervalued

Against Rheinmetall’s last close of €1,752, the most followed narrative points to a higher fair value, built on aggressive defense growth assumptions and margin shifts.

The substantial increase in European and NATO defense budgets, particularly Germany's multiyear boost in core defense spend to 3.5% of GDP, combined with Rheinmetall's strong positioning and minimal competition in critical vehicle and ammunition programs, indicates a large, sustainable order intake pipeline (expected €80-120 billion backlog by mid-2025/2026), directly supporting robust top-line revenue growth for years to come.

Curious what has to happen for that higher fair value to stack up? Revenue and earnings forecasts, margin upgrades, and a punchy future P/E all sit at the core of this narrative. The full set of assumptions is where the story really gets interesting.

Result: Fair Value of €2,221.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat story could be knocked off course if European defense budgets soften or if Rheinmetall stumbles on execution as it scales capacity.

Find out about the key risks to this Rheinmetall narrative.

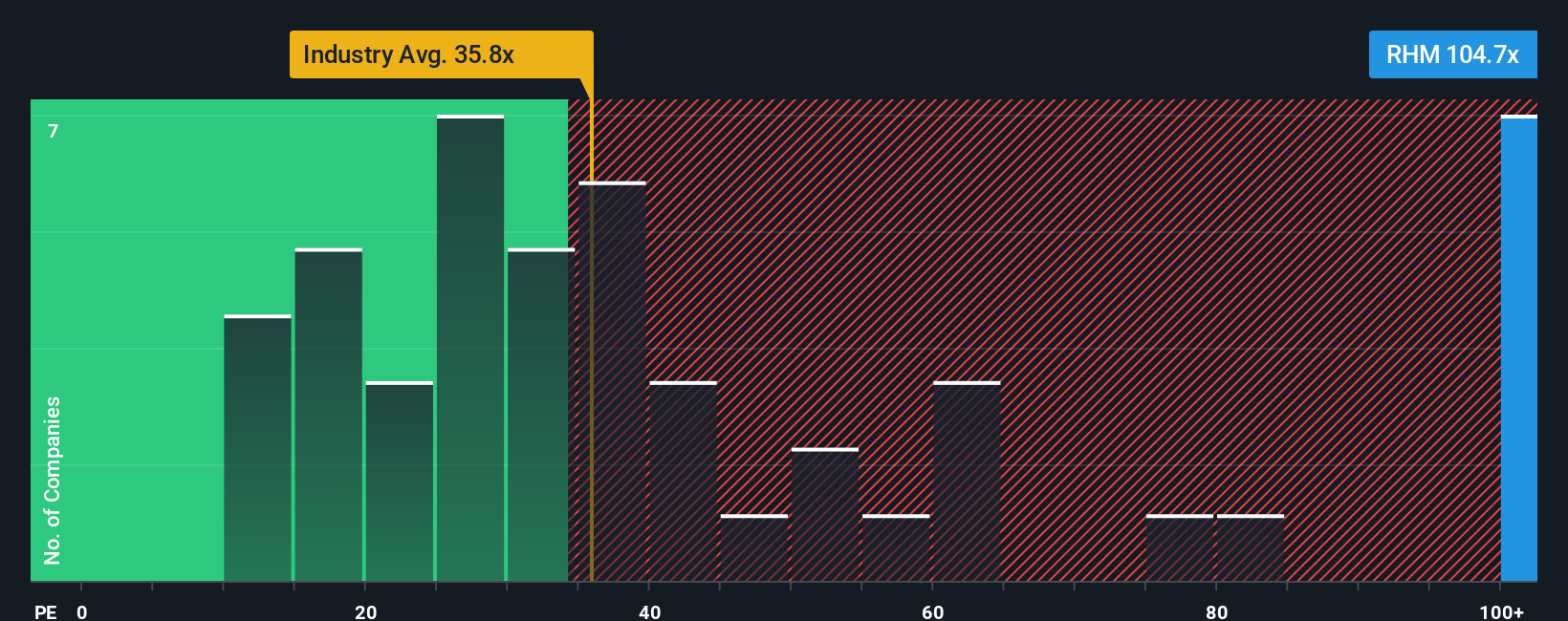

Another View: Rich P/E multiples muddy the undervaluation story

The narrative and fair value work up suggest Rheinmetall looks 21.2% undervalued, yet the P/E picture pulls in the opposite direction. The current P/E of 93.3x is far higher than the European Aerospace & Defense average of 31.4x and the peer average of 49.5x.

Our fair ratio for Rheinmetall sits at 48.1x P/E, roughly where the market could drift if expectations cool. That gap points to clear valuation risk rather than a simple bargain. The real question is whether you think current earnings power and forecasts justify such a premium.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rheinmetall Narrative

If parts of this story do not quite fit your view, you can dig into the numbers yourself and shape a custom thesis in minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Rheinmetall.

Looking for more investment ideas?

If Rheinmetall has your attention, do not stop here. The market is full of other angles that could suit your style just as well.

- Spot potential future standouts early by scanning these 3557 penny stocks with strong financials that already show solid financial underpinnings.

- Target cutting edge growth themes with these 25 AI penny stocks that are tied to real business models rather than hype.

- Focus on price versus fundamentals by checking these 877 undervalued stocks based on cash flows that may trade below what their cash flows suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal