Undiscovered Gems in Middle East Featuring Three Promising Stocks

As Middle Eastern markets experience fluctuations due to weak oil prices and regional tensions, there remains a glimmer of optimism with healthy growth in the non-oil economy and potential monetary easing on the horizon. In this dynamic landscape, identifying promising stocks involves looking for companies with solid fundamentals that can weather current market challenges while capitalizing on future opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nofoth Food Products | NA | 21.36% | 25.28% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| MOBI Industry | 13.81% | 5.67% | 19.69% | ★★★★★★ |

| Amanat Holdings PJSC | 10.86% | 27.51% | -0.92% | ★★★★★☆ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| Ajman Bank PJSC | 53.89% | 16.11% | 18.02% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Ipek Dogal Enerji Kaynaklari Arastirma ve Üretim (IBSE:TRENJ)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ipek Dogal Enerji Kaynaklari Arastirma ve Üretim A.S., along with its subsidiaries, is involved in the research, development, and production of oil, natural gas, and energy resources in Turkey, with a market capitalization of TRY25.10 billion.

Operations: Ipek Dogal Enerji Kaynaklari Arastirma ve Üretim generates revenue primarily from its mining segment, which accounts for TRY12.80 billion. The company has a market capitalization of TRY25.10 billion.

Ipek Dogal Enerji Kaynaklari Arastirma ve Üretim has shown a remarkable turnaround. In the third quarter, sales reached TRY 5.66 billion, up from TRY 2.69 billion the previous year, while net income soared to TRY 783 million from a loss of TRY 278 million. This performance highlights its strong earnings quality and ability to outpace industry growth rates. Despite a modest increase in the debt-to-equity ratio to 0.1% over five years, it holds more cash than total debt and covers interest payments comfortably. Trading at an attractive valuation of 85% below estimated fair value suggests potential for future gains.

Abdullah Saad Mohammed Abo Moati for Bookstores (SASE:4191)

Simply Wall St Value Rating: ★★★★★★

Overview: Abdullah Saad Mohammed Abo Moati for Bookstores Company operates in the retail and wholesale trading of stationery, computers, and accessories within Saudi Arabia, with a market capitalization of SAR959.20 million.

Operations: The company's primary revenue stream is derived from retail and wholesale trade, contributing SAR260.05 million, with an additional SAR4.65 million from the inks sector. The net profit margin indicates a specific trend in profitability over the periods analyzed.

Abo Moati for Bookstores, a smaller player in the specialty retail sector, has shown promising financial health with earnings growth of 9.7% over the past year, outpacing the industry average of 4.7%. The company's debt situation appears well-managed as its net debt to equity ratio stands at a satisfactory 16.8%, and interest payments are comfortably covered by EBIT at 5.7 times. Recent results highlight an increase in net income to SAR 11.13 million for Q2 and SAR 16.6 million for six months ending September 2025, alongside a cash dividend distribution of SAR 0.5 per share for H1 fiscal year ending March 2026.

Tiv Taam Holdings 1 (TASE:TTAM)

Simply Wall St Value Rating: ★★★★☆☆

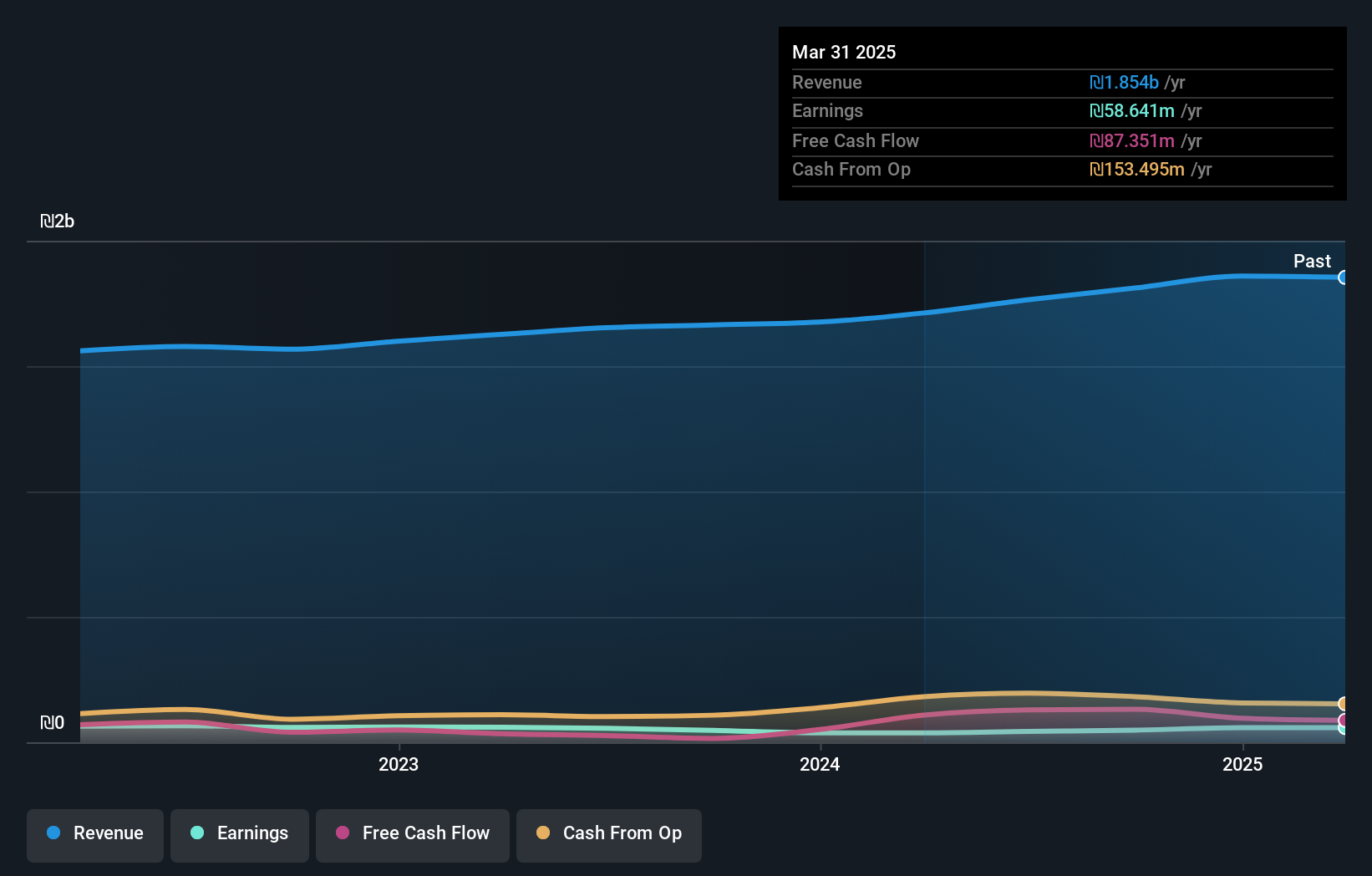

Overview: Tiv Taam Holdings 1 Ltd. is involved in the production, marketing, and importation of food products in Israel with a market capitalization of ₪1.21 billion.

Operations: Tiv Taam generates revenue primarily from its retail segment, which accounts for ₪1.59 billion, and the manufacture, import, and marketing of food products segment contributing ₪506.75 million.

Tiv Taam Holdings 1, a compact player in the Middle East retail sector, has shown resilience with high-quality earnings and a net debt to equity ratio of just 0.9%, indicating financial stability. The company is trading at 41% below its estimated fair value, suggesting potential undervaluation. Over the past year, earnings surged by 38.8%, outpacing industry growth of 14.2%. Recent results for Q3 showed sales climbing to ILS 528 million from ILS 457 million last year, while net income rose to ILS 15.55 million from ILS 10 million previously, reflecting robust operational performance amidst industry challenges.

Where To Now?

- Discover the full array of 186 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal