Royal Caribbean’s Upgraded 2025 Outlook and Expansion Plans Might Change The Case For Investing In RCL

- Royal Caribbean Cruises has recently raised its full-year 2025 earnings guidance and outlined multi-year expansion plans, including new ships and exclusive destination resorts, following a strong post-pandemic recovery in passengers and profitability.

- An interesting angle for investors is the company’s aim to grow earnings per share by 20% annually through 2027 while also preserving its investment-grade bond rating, highlighting a balance between growth ambitions and balance sheet discipline.

- We’ll now look at how Royal Caribbean’s upgraded 2025 earnings guidance and expansion plans might influence its existing investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Royal Caribbean Cruises Investment Narrative Recap

To own Royal Caribbean, you need to be comfortable with a cruise business that leans on discretionary travel demand and relatively high debt, but is currently growing earnings and passenger volumes. The upgraded 2025 earnings guidance and multi‑year expansion plans support the near term earnings growth catalyst, while the biggest risk remains a potential pullback in consumer spending that could pressure pricing and close in bookings. This news does not materially change that core risk balance.

Among recent developments, the company’s target of growing earnings per share by 20% annually through 2027, while preserving its investment grade bond rating, is most closely tied to the new guidance. It links near term performance to a longer term plan that depends on filling a larger fleet at acceptable prices and managing fuel and financing costs, which directly intersects with the key catalyst of sustained travel demand.

Yet investors should be aware that if consumer spending softens or close in bookings slow, then ...

Read the full narrative on Royal Caribbean Cruises (it's free!)

Royal Caribbean Cruises’ narrative projects $22.4 billion revenue and $5.9 billion earnings by 2028. This requires 9.2% yearly revenue growth and about a $2.3 billion earnings increase from $3.6 billion today.

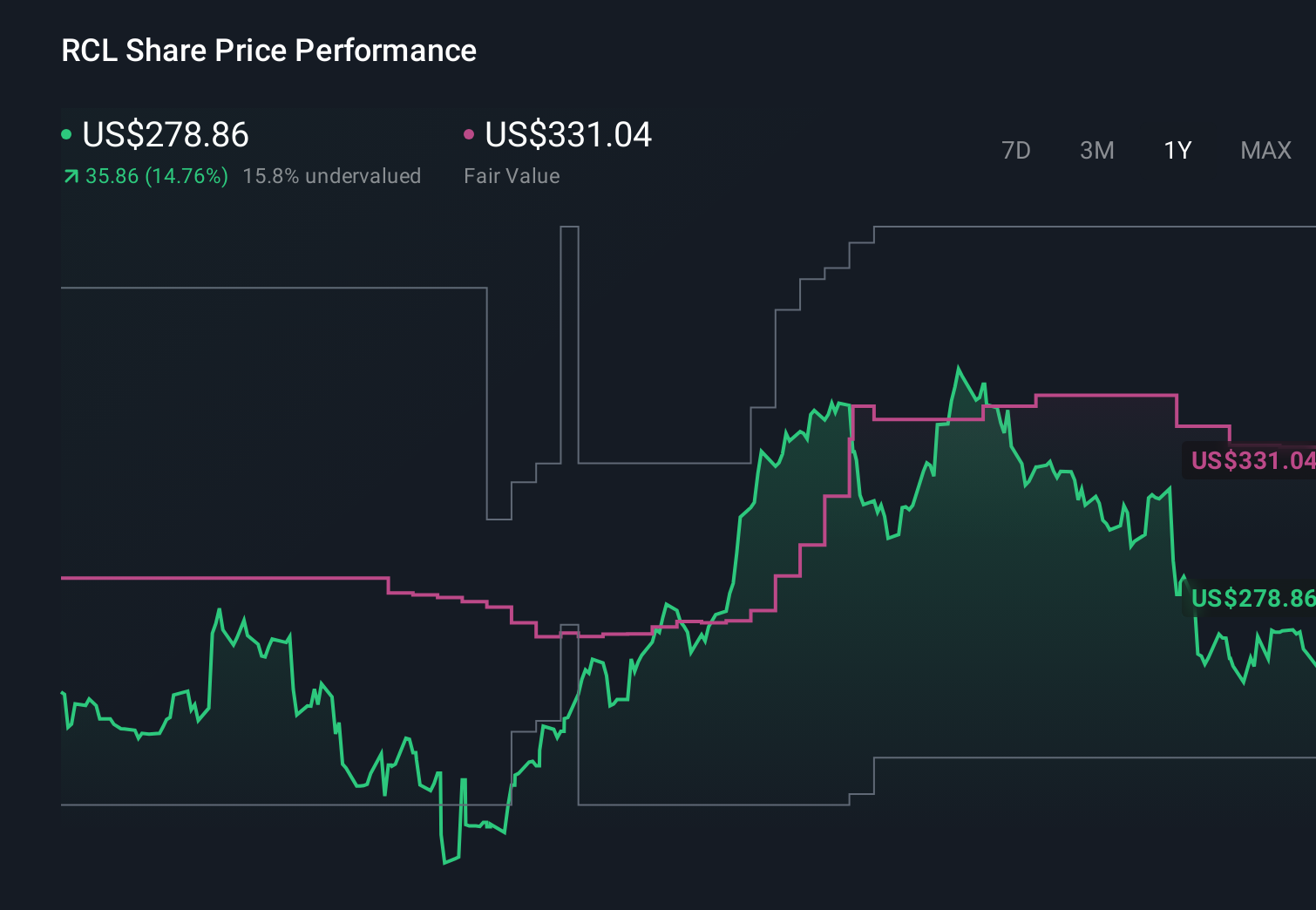

Uncover how Royal Caribbean Cruises' forecasts yield a $331.04 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Ten Simply Wall St Community fair value estimates for Royal Caribbean range from US$215.93 to US$440.34, underscoring how far apart individual views can be. When you weigh those against the company’s upgraded 2025 earnings guidance and ongoing reliance on discretionary travel spending, it becomes even more important to compare several independent perspectives on the stock’s potential and risks.

Explore 10 other fair value estimates on Royal Caribbean Cruises - why the stock might be worth 23% less than the current price!

Build Your Own Royal Caribbean Cruises Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Royal Caribbean Cruises research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Royal Caribbean Cruises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Royal Caribbean Cruises' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal