A Look At Arcellx (ACLX) Valuation After New US$209.2 Million Shelf Registration Filing

Arcellx (ACLX) has filed a shelf registration to offer up to $209.2 million in common stock, covering 3,208,367 shares tied to an employee stock ownership plan, which is raising fresh questions about future capital needs.

See our latest analysis for Arcellx.

The shelf registration comes after a roughly 30% decline in the 90 day share price return and an 11% drop over 30 days, even though the 3 year total shareholder return is close to a 2x gain. Some investors may see the capital raising flexibility as adding financing risk, while others may focus on longer term value creation potential implied by that multi year total shareholder return.

If this kind of capital raising activity has you reassessing your watchlist, it could be a good moment to look at other healthcare stocks that are moving on clinical and funding news of their own.

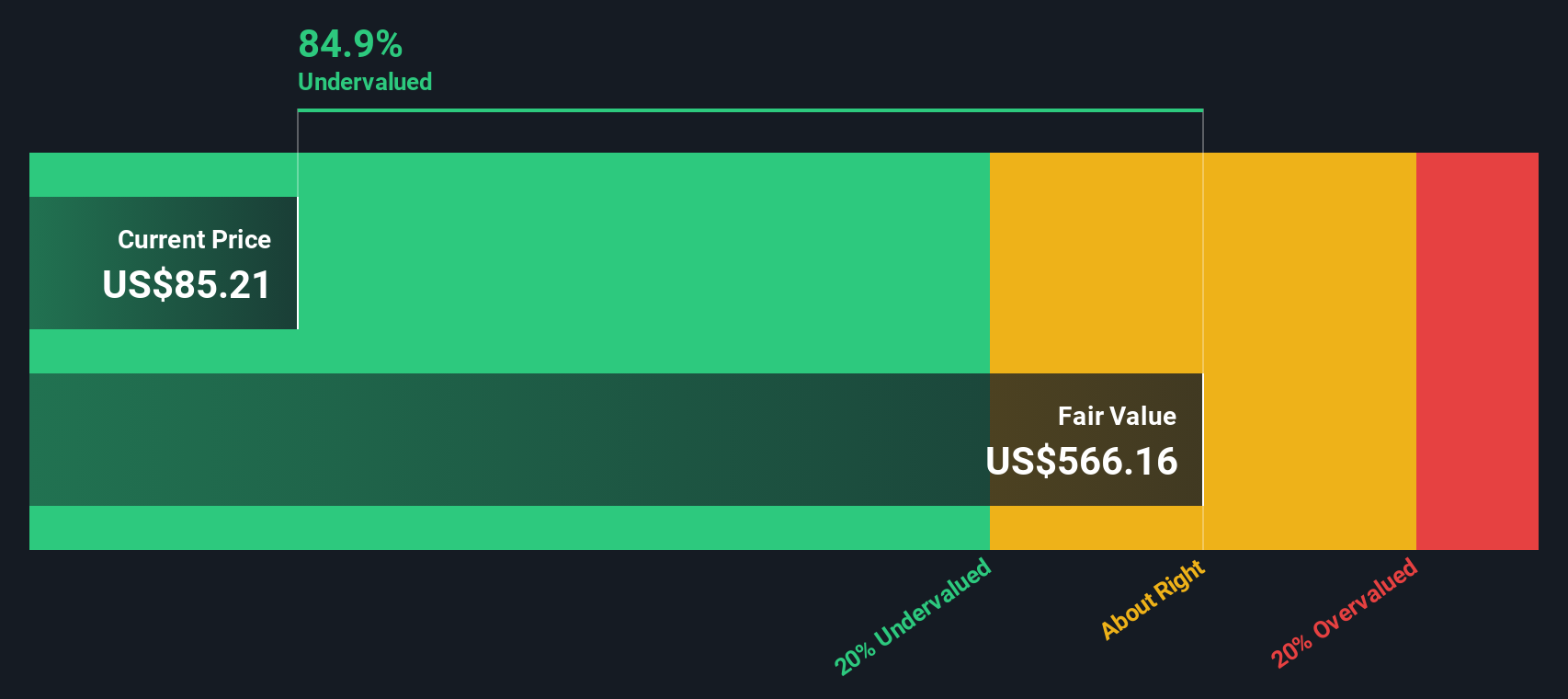

With the share price down over the past year, but a 3-year total return close to 2x and the stock trading below some valuation estimates, you have to ask: is Arcellx undervalued, or is future growth already priced in?

Price to Book of 8.1x: Is it justified?

Arcellx is trading on a P/B of 8.1x at a last close of US$61.83, which looks cheap against some peers yet expensive versus the wider US biotech group.

P/B compares the company’s market value to its net assets, which matters for a clinical stage biotech where tangible equity and cash resources are key reference points for investors.

According to Simply Wall St’s valuation checks, Arcellx is described as good value when you compare its 8.1x P/B to a peer average of 15.9x, which suggests the market is not assigning the same premium as it does to similar names. Against the broader US Biotechs industry though, the same 8.1x P/B is labelled expensive relative to the 2.7x industry average. This is a strong reminder that this is a higher priced stock on a balance sheet basis compared to the sector overall.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-book of 8.1x (ABOUT RIGHT)

However, you still have to weigh the recent share price declines and the ongoing net loss of US$217.903 million, which may act as potential pressure points for sentiment and funding expectations.

Find out about the key risks to this Arcellx narrative.

Another View: Our DCF Model Paints A Very Different Picture

If you put the P/B ratio to one side and look at the SWS DCF model, the gap is striking. Arcellx is described as trading about 87.1% below an estimated fair value of US$478.38, which is a very large discount. Is this a mispricing or a reflection of the risks around future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Arcellx for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Arcellx Narrative

If you want to weigh the same numbers differently or focus on your own set of assumptions, you can build a personalised view of Arcellx in just a few minutes with Do it your way.

A great starting point for your Arcellx research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready to hunt for more stock ideas?

If Arcellx is only one piece of your watchlist, now is the time to cast a wider net and pressure test your next investment moves.

- Target potential mispricings by reviewing these 877 undervalued stocks based on cash flows that line up with your view on risk and reward.

- Spot early tech themes by scanning these 25 AI penny stocks that tie artificial intelligence to real business models.

- Evaluate opportunities for cash distributions by checking out these 14 dividend stocks with yields > 3% that may suit an income focused portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal