High Growth Tech Stocks in the United Kingdom for January 2026

The United Kingdom's market has recently experienced some turbulence, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China, highlighting the challenges faced by companies closely tied to global economic shifts. In this context of fluctuating market sentiment and economic indicators, identifying high growth tech stocks involves looking for companies with innovative solutions that can navigate these uncertainties while capitalizing on emerging opportunities.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Kainos Group | 9.28% | 23.05% | ★★★★★☆ |

| Pinewood Technologies Group | 25.37% | 49.21% | ★★★★★☆ |

| One Media iP Group | 6.76% | 32.48% | ★★★★☆☆ |

| M&C Saatchi | -17.95% | 33.24% | ★★★★☆☆ |

| Made Tech Group | 10.10% | 21.55% | ★★★★☆☆ |

| Beeks Financial Cloud Group | 11.54% | 32.46% | ★★★★☆☆ |

| Skillcast Group | 14.52% | 31.61% | ★★★★☆☆ |

| Xaar | 16.14% | 126.43% | ★★★★☆☆ |

| Itim Group | 8.33% | 109.98% | ★★★★☆☆ |

| Raspberry Pi Holdings | 16.78% | 40.87% | ★★★★☆☆ |

Click here to see the full list of 12 stocks from our UK High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Kainos Group (LSE:KNOS)

Simply Wall St Growth Rating: ★★★★★☆

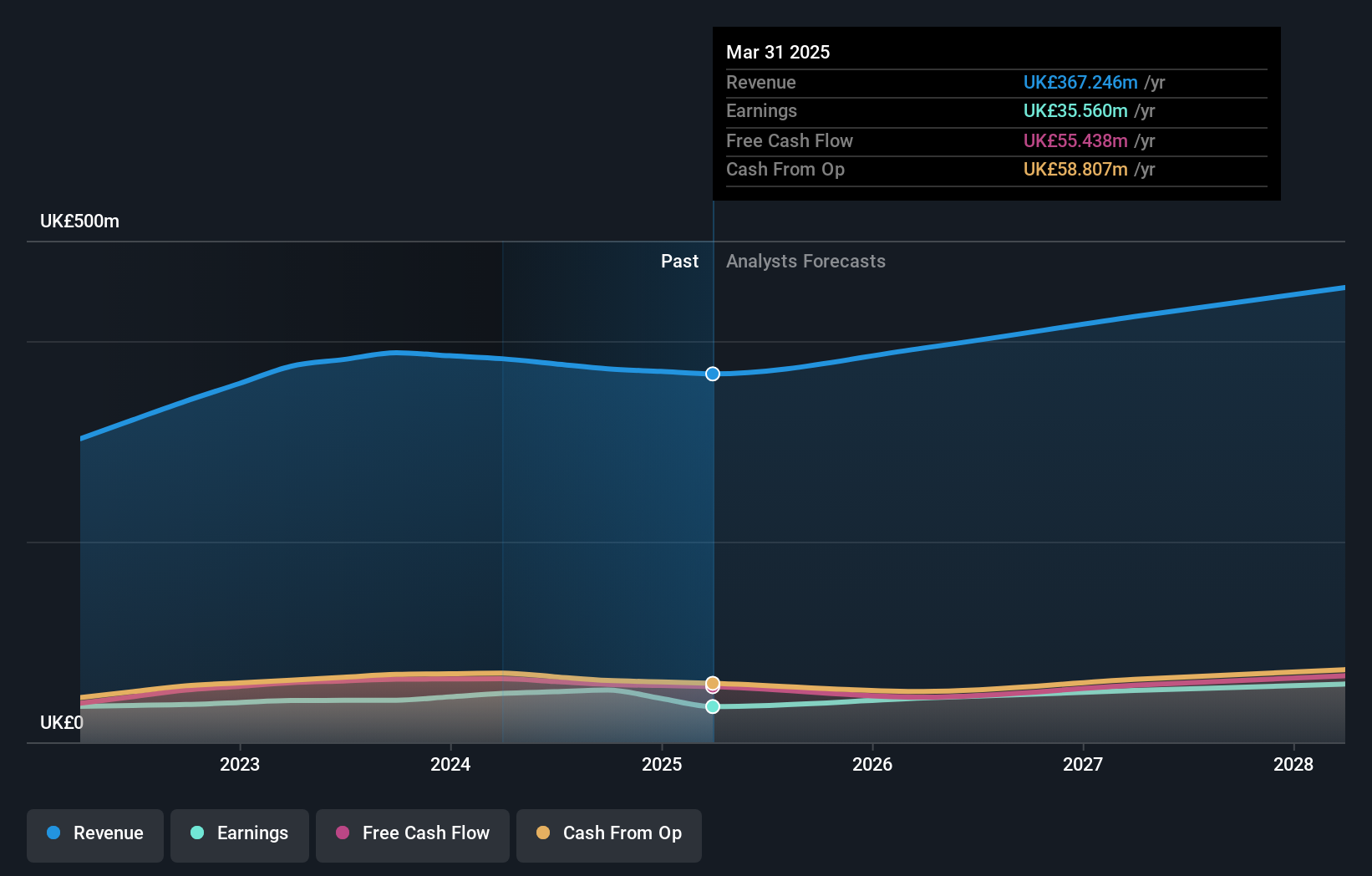

Overview: Kainos Group plc provides digital technology services across the United Kingdom, Ireland, the Americas, Central Europe, and internationally with a market capitalization of £1.19 billion.

Operations: Kainos Group plc generates revenue through three primary segments: Digital Services (£203.43 million), Workday Products (£76.28 million), and Workday Services (£100.56 million).

Kainos Group, a UK-based tech firm, showcases robust growth metrics with a projected annual revenue increase of 9.3% and earnings growth of 23%, outpacing the UK market averages of 4.3% and 13.7%, respectively. Despite recent challenges indicated by a year-over-year profit decline of nearly 41%, the company remains proactive in shareholder value enhancement through strategic share repurchases, as evidenced by the recent buyback announcement on November 19, where up to £30 million worth of shares will be repurchased and cancelled by May 2026. This approach not only reflects Kainos's commitment to capital management but also underscores its resilience in navigating market fluctuations while still focusing on long-term growth initiatives like potential acquisitions that align with its disciplined execution strategy.

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Growth Rating: ★★★★★☆

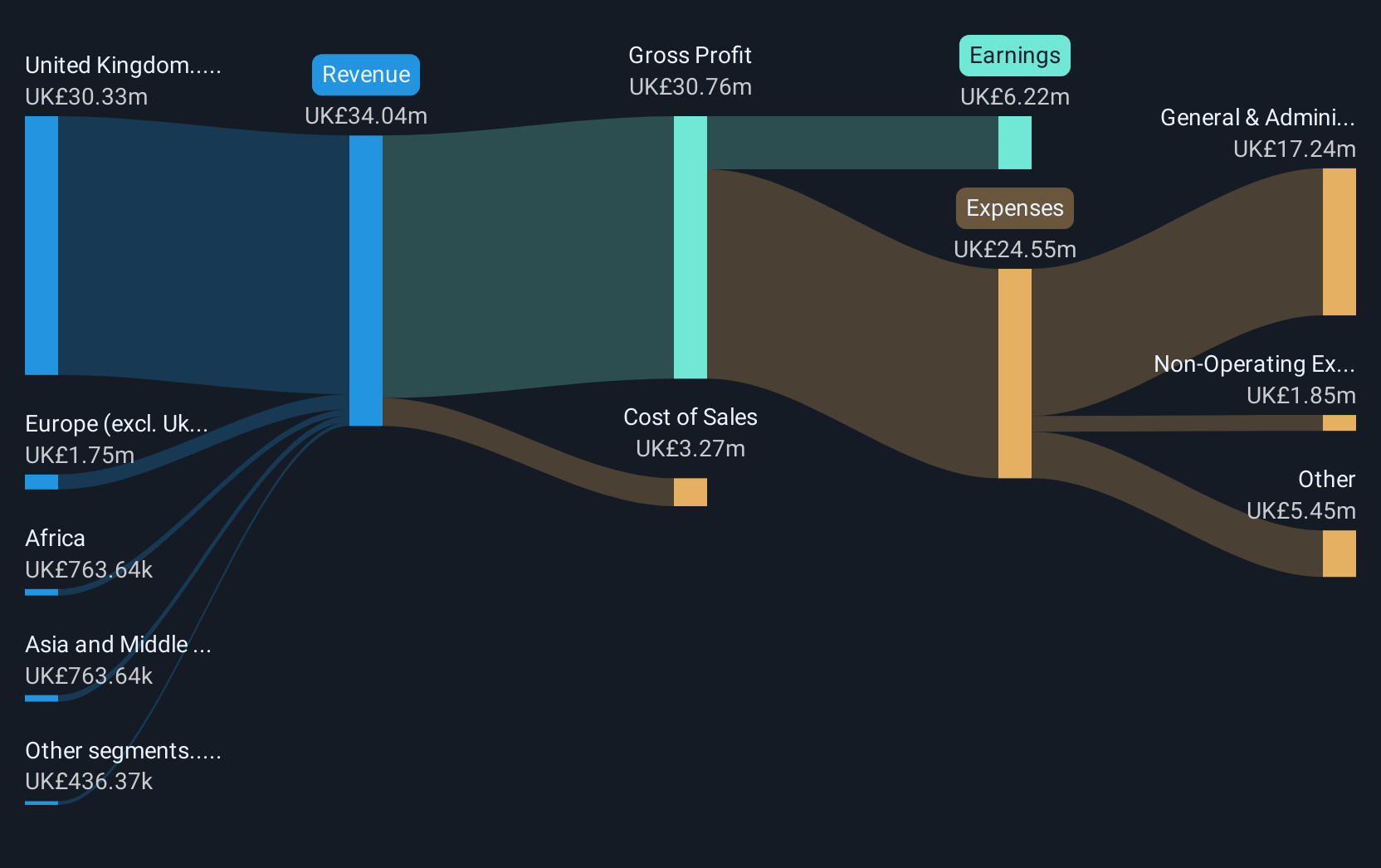

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider operating in the United Kingdom, Europe, Africa, Asia, and the Middle East with a market capitalization of £411.47 million.

Operations: Pinewood Technologies Group generates revenue through its cloud-based dealer management software solutions across multiple regions, including Europe, Africa, Asia, and the Middle East. The company focuses on providing comprehensive software services to automotive dealers globally.

Despite recent setbacks, including being dropped from multiple FTSE indices, Pinewood Technologies Group has demonstrated a strong growth trajectory with a notable 25.4% annual revenue increase and an impressive 49.2% surge in earnings growth over the past year, outpacing both its industry and broader UK market averages. The addition of seasoned executives such as Shruthi Chindalur and Dr. Robert Plant to its board promises to infuse new strategic insights, potentially enhancing its innovative edge in the tech sector. These leadership changes align well with Pinewood's significant R&D commitment, positioning it favorably for sustained advancements in software technology amidst dynamic market conditions.

- Click here to discover the nuances of Pinewood Technologies Group with our detailed analytical health report.

Gain insights into Pinewood Technologies Group's past trends and performance with our Past report.

Raspberry Pi Holdings (LSE:RPI)

Simply Wall St Growth Rating: ★★★★☆☆

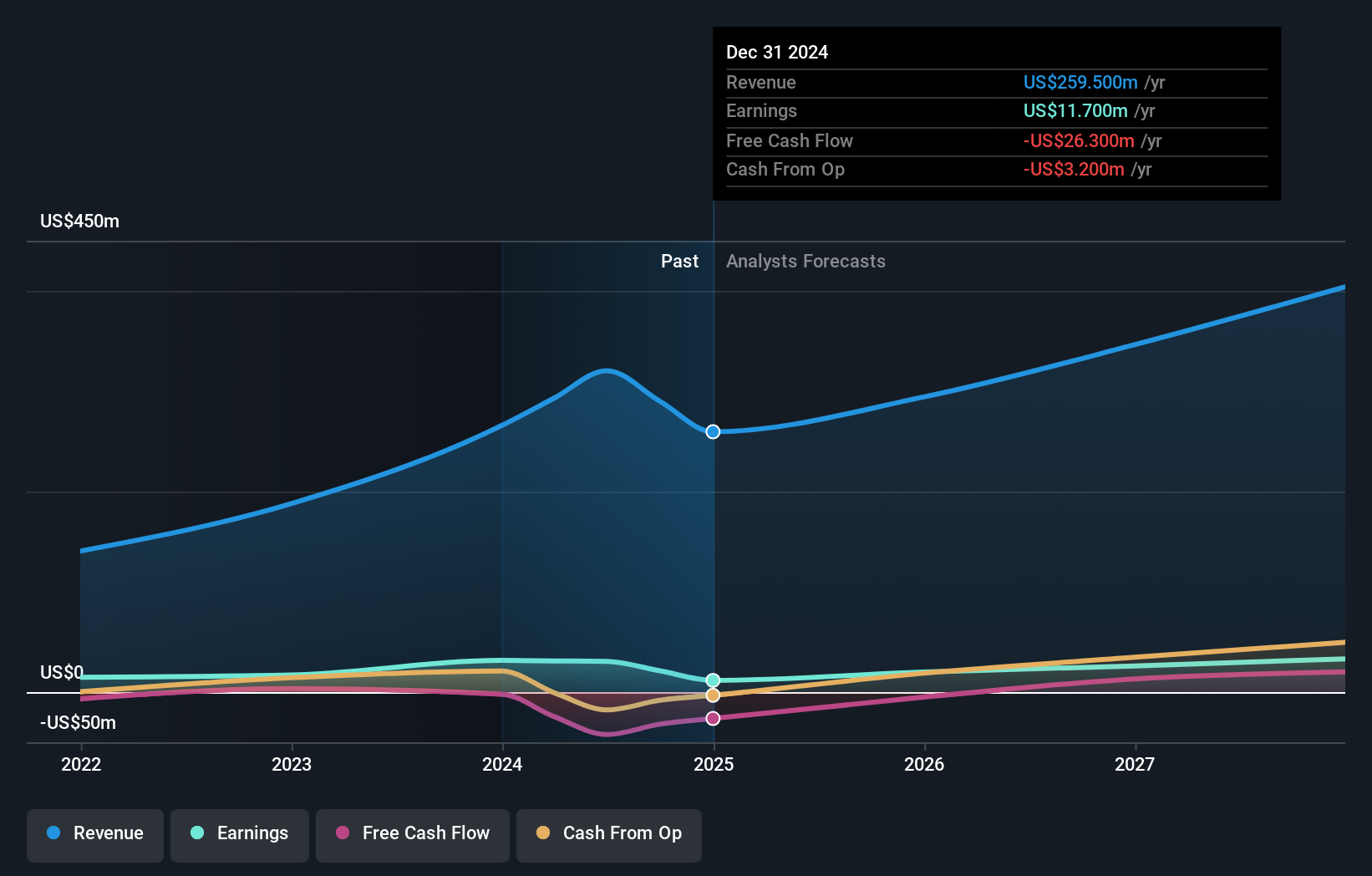

Overview: Raspberry Pi Holdings plc designs and develops single-board computers, compute modules, and semiconductors for a global market, with a market cap of £547.71 million.

Operations: Raspberry Pi Holdings generates revenue primarily from its computer hardware segment, which accounts for $251 million. The company operates in the UK, Europe, the US, and Asia Pacific.

Amidst a challenging backdrop, Raspberry Pi Holdings has managed to secure an impressive 16.8% annual revenue growth and an even more notable 40.9% surge in earnings growth. This performance starkly contrasts with the broader UK market's slower pace, highlighting RPI's ability to outperform amidst adversity. The upcoming departure of CFO Richard Boult marks a pivotal moment for the company, initiating a search for fresh financial leadership aimed at steering RPI through its next growth phase. Despite recent struggles with profit margins and industry comparisons, RPI’s substantial investment in innovation—evidenced by its aggressive R&D spending—positions it well to capitalize on future tech trends and maintain its competitive edge in a rapidly evolving sector.

- Delve into the full analysis health report here for a deeper understanding of Raspberry Pi Holdings.

Assess Raspberry Pi Holdings' past performance with our detailed historical performance reports.

Make It Happen

- Get an in-depth perspective on all 12 UK High Growth Tech and AI Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal