Discover ITM Power And 2 Other Promising UK Penny Stocks

The London stock market has recently faced headwinds, with the FTSE 100 and FTSE 250 indices closing lower amid weak global cues and disappointing trade data from China. In such a challenging market landscape, identifying stocks with strong financial foundations becomes crucial for investors seeking potential growth opportunities. Penny stocks, despite their somewhat outdated label, continue to hold relevance by offering access to smaller or newer companies that may provide significant value. This article explores three promising UK penny stocks that combine financial stability with the potential for long-term growth.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.66 | £16.59M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.34 | £498.41M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.91 | £154.3M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £1.12 | £16.91M | ✅ 2 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.70 | $406.93M | ✅ 4 ⚠️ 2 View Analysis > |

| Michelmersh Brick Holdings (AIM:MBH) | £0.84 | £76.16M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.518 | £183.85M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.465 | £40.08M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £186.68M | ✅ 6 ⚠️ 1 View Analysis > |

| Billington Holdings (AIM:BILN) | £3.50 | £45.69M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 294 stocks from our UK Penny Stocks screener.

We'll examine a selection from our screener results.

ITM Power (AIM:ITM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ITM Power Plc designs and manufactures proton exchange membrane (PEM) electrolysers for various international markets, with a market cap of £414.26 million.

Operations: The company's revenue comes from its Electric Equipment segment, totaling £26.04 million.

Market Cap: £414.26M

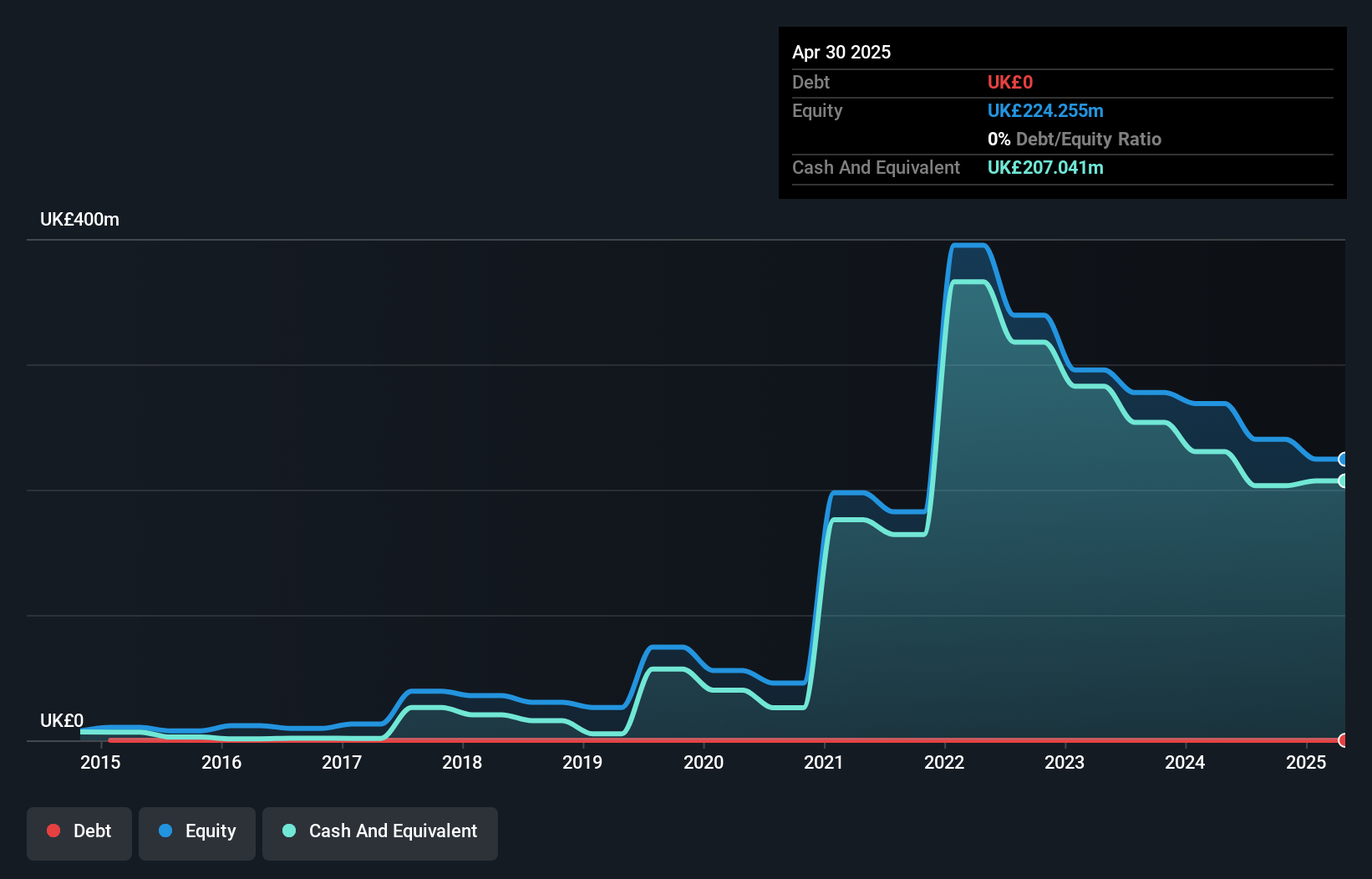

ITM Power, despite its unprofitability and volatile share price, has demonstrated resilience with significant contract wins in the green hydrogen sector. Recent projects include a collaboration with Octopus Energy to decarbonise Kimberly-Clark's operations and engineering contracts in Australia and Canada. The company is debt-free, with short-term assets significantly exceeding liabilities, providing a solid financial footing. ITM's revenue is forecasted to grow substantially, supported by innovative products like the ALPHA 50 plant. However, profitability remains elusive in the near term as losses have increased over the past five years.

- Click here and access our complete financial health analysis report to understand the dynamics of ITM Power.

- Gain insights into ITM Power's future direction by reviewing our growth report.

Auction Technology Group (LSE:ATG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Auction Technology Group plc operates online auction marketplaces across the United Kingdom, North America, and Germany with a market cap of £403.93 million.

Operations: The company's revenue is derived from two main segments: Arts and Antiques (A&A) generating $115.16 million and Industrial and Commercial (I&C) contributing $74.99 million.

Market Cap: £403.93M

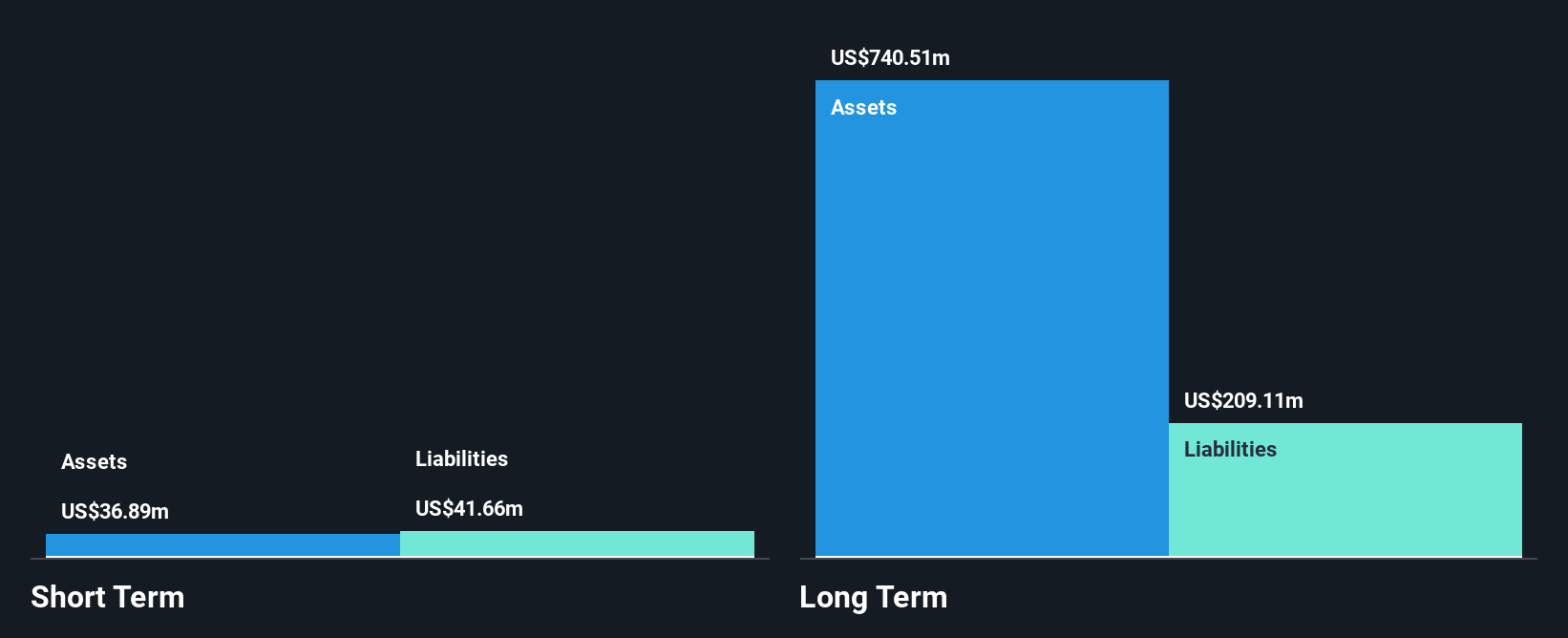

Auction Technology Group plc, with a market cap of £403.93 million, operates online auction marketplaces and is currently unprofitable, reporting a net loss of US$144.6 million for 2025. Despite the cancellation of a proposed acquisition by FitzWalter Capital Limited due to an inadequate offer price, the company maintains sufficient cash runway for over three years owing to positive free cash flow growth at 24.1% annually. While its share price has been highly volatile recently and short-term liabilities exceed assets, Auction Technology Group forecasts significant revenue growth in 2026 driven by its Arts and Antiques and Industrial segments.

- Get an in-depth perspective on Auction Technology Group's performance by reading our balance sheet health report here.

- Explore Auction Technology Group's analyst forecasts in our growth report.

QinetiQ Group (LSE:QQ.)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: QinetiQ Group plc offers science and technology solutions in the defense, security, and infrastructure sectors across the UK, US, Australia, and internationally, with a market cap of £2.42 billion.

Operations: The company generates revenue through two main segments: EMEA Services, which accounts for £1.47 billion, and Global Solutions, contributing £417 million.

Market Cap: £2.42B

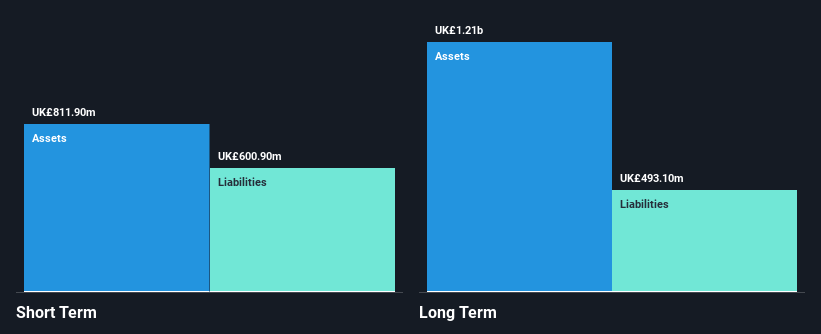

QinetiQ Group plc, with a market cap of £2.42 billion, operates in the defense and security sectors, generating substantial revenues from its EMEA Services and Global Solutions segments. Despite reporting a decline in sales to £900.4 million for the half year ending September 2025, it maintains a satisfactory net debt to equity ratio of 18.6%. Recent board changes include appointing experienced leaders Brad Feldmann and John Kavanaugh to strengthen governance under its Special Security Agreement framework. The company announced an interim dividend increase by 7%, reflecting its commitment to a progressive dividend policy despite current unprofitability challenges.

- Dive into the specifics of QinetiQ Group here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into QinetiQ Group's future.

Key Takeaways

- Take a closer look at our UK Penny Stocks list of 294 companies by clicking here.

- Want To Explore Some Alternatives? We've found 14 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal