Houlihan Lokey (HLI) Valuation Check After Recent Share Price Stability And Earnings Premium

What Houlihan Lokey’s recent performance means for investors

Houlihan Lokey (HLI) shares have been relatively steady, with a 1 day return of 3.6% and a move of about 1.6% over the past month, after a small decline across the past 3 months.

For investors tracking longer periods, the stock shows an 8.4% 1 year total return and a much larger gain over 3 and 5 years. This may prompt a closer look at how current pricing lines up with recent fundamentals.

See our latest analysis for Houlihan Lokey.

The recent 3.55% 1 day share price return, alongside an 8.38% 1 year total shareholder return and strong multi year gains, points to momentum that has cooled in the short term but remains firmly positive over longer horizons as investors reassess growth potential and risks around the current US$182.6 share price.

If Houlihan Lokey has you thinking about where else capital might work hard, it could be a good moment to scan fast growing stocks with high insider ownership for other under the radar ideas.

With Houlihan Lokey trading at about US$182.60 and sitting below the average analyst price target, together with recent revenue and net income growth, you have to ask: is this a genuine opportunity or is potential future growth already reflected in the share price?

Most Popular Narrative Narrative: 13.4% Undervalued

Compared with Houlihan Lokey’s last close at US$182.60, the most followed narrative points to a higher fair value of about US$210.86, built on specific revenue, margin and valuation assumptions.

Increasing global corporate complexity and cross-border transactions are driving ongoing demand for independent advisory expertise, as evidenced by resilient revenues and continued international hiring and expansion initiatives. These factors are expected to support sustained top-line revenue growth.

Want to see what kind of revenue climb, margin profile and future earnings multiple are baked into that price? The full narrative lays out the numbers and how they add up.

Result: Fair Value of $210.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are clear watchpoints, including Houlihan Lokey’s reliance on U.S. driven M&A trends and its high cost base, which could pressure margins if deal activity softens.

Find out about the key risks to this Houlihan Lokey narrative.

Another View: What Earnings Ratios Are Signalling

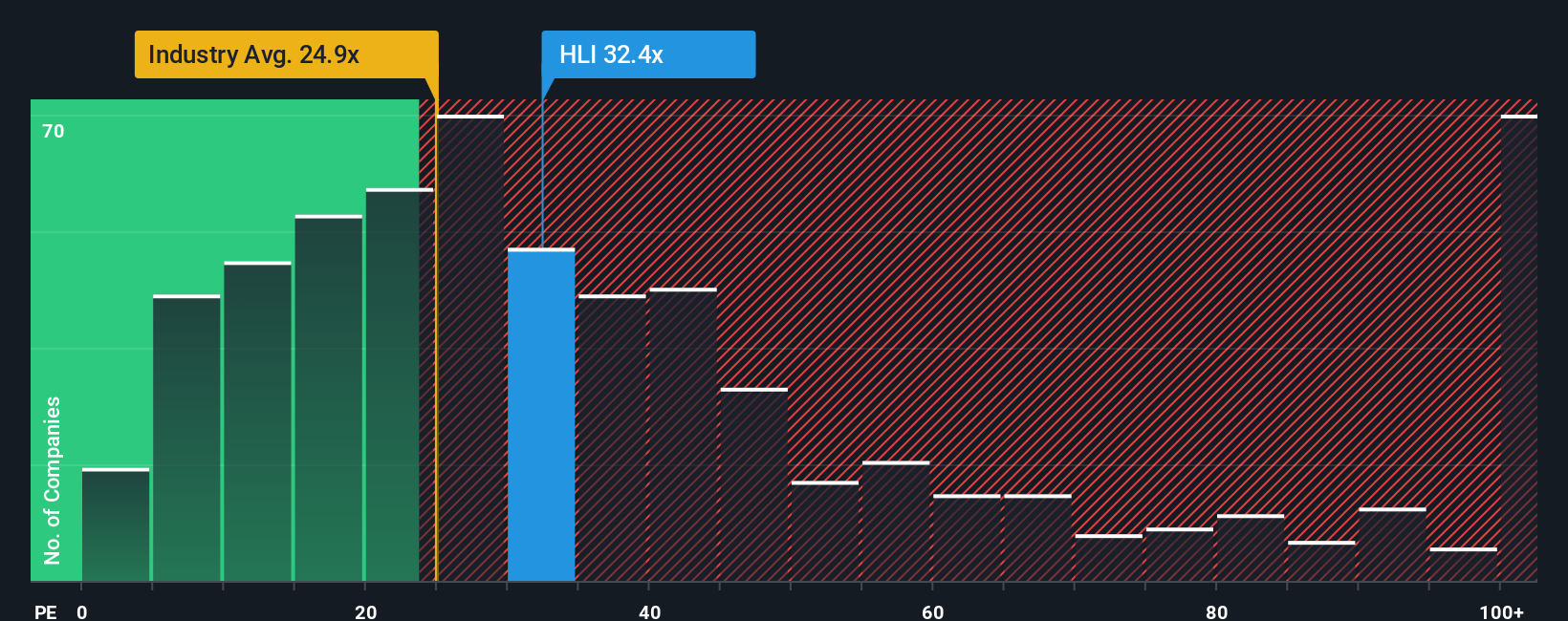

That 13.4% “undervalued” narrative sits in clear tension with how the market is currently pricing Houlihan Lokey on earnings. At about 30x P/E versus a fair ratio of 16.2x and Capital Markets peers at 19.6x and 25.6x, the shares look expensive on this yardstick. For you, that raises a simple question: are you comfortable paying a premium today for forecast growth that is not expected to outpace the wider US market?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Houlihan Lokey Narrative

If you see the data differently or prefer to work through the assumptions yourself, you can build a custom view of Houlihan Lokey in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Houlihan Lokey.

Looking for more investment ideas?

If Houlihan Lokey has sparked your interest, do not stop here. Broaden your watchlist now so you do not miss other compelling opportunities.

- Target potential mispricing by checking out these 877 undervalued stocks based on cash flows that may offer more attractive entry points.

- Ride breakthroughs in machine learning and automation with these 25 AI penny stocks shaping how data and computing power are used across industries.

- Tap into high yield opportunities through these 14 dividend stocks with yields > 3% that focus on stronger income profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal