3 European Dividend Stocks Yielding Up To 5.1%

As the European market continues to show strength, with the STOXX Europe 600 Index reaching new highs and an annual price return of nearly 17% in 2025, investors are increasingly drawn to dividend stocks as a means of generating steady income. In this robust economic environment, selecting dividend stocks that offer attractive yields can be a strategic way to capitalize on market gains while benefiting from regular income streams.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.10% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.44% | ★★★★★☆ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.73% | ★★★★★★ |

| Holcim (SWX:HOLN) | 3.97% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.77% | ★★★★★★ |

| Evolution (OM:EVO) | 4.88% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.01% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 10.26% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.17% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.21% | ★★★★★★ |

Click here to see the full list of 191 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

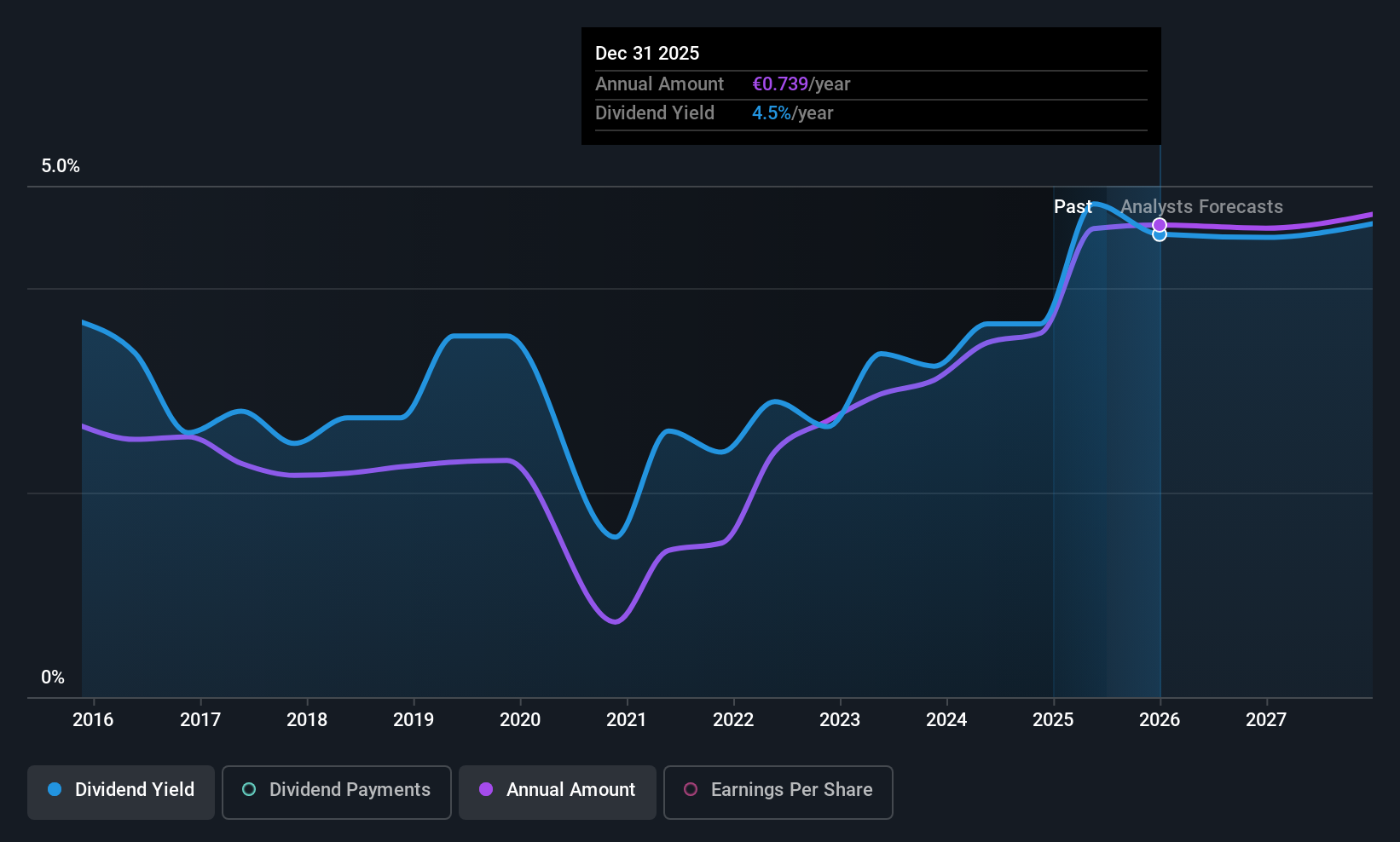

Tenaris (BIT:TEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tenaris S.A. manufactures and supplies steel pipe products and related services for the energy industry and other industrial applications across various regions, with a market cap of €17.49 billion.

Operations: Tenaris generates its revenue primarily from its Tubes segment, which accounted for $11.26 billion.

Dividend Yield: 4.1%

Tenaris offers a mixed dividend profile, with a recent interim dividend of $0.29 per share and a payout ratio of 45.6% indicating coverage by earnings. The company's dividends are also supported by cash flows, with a cash payout ratio of 51.6%. However, the dividend yield is lower than the top quartile in Italy, and historical payments have been volatile with annual drops over 20%. Recent buybacks totaling $588 million may enhance shareholder value alongside dividends.

- Take a closer look at Tenaris' potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Tenaris shares in the market.

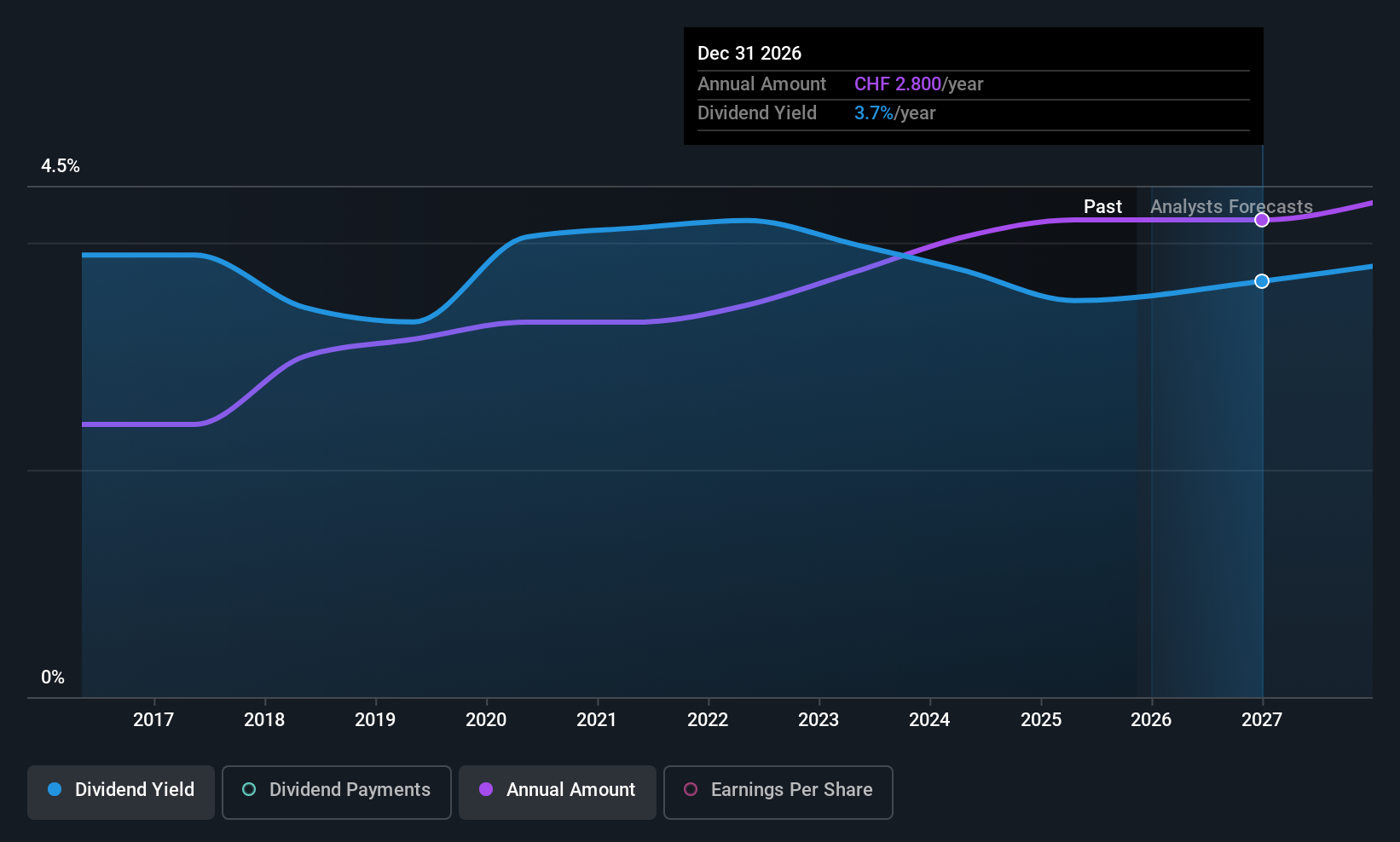

Liechtensteinische Landesbank (SWX:LLBN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Liechtensteinische Landesbank Aktiengesellschaft offers banking products and services across Liechtenstein, Switzerland, Germany, and Austria with a market cap of CHF2.65 billion.

Operations: Liechtensteinische Landesbank's revenue segments include Retail & Corporate Banking at CHF306.49 million and International Wealth Management at CHF250.77 million, along with a contribution from the Corporate Center amounting to CHF38.33 million.

Dividend Yield: 3.2%

Liechtensteinische Landesbank provides a cautious dividend outlook with a payout ratio of 50.8%, indicating dividends are covered by earnings, though historical volatility raises concerns about reliability. The bank's dividends have grown over the past decade, yet remain low compared to top Swiss dividend payers. Recent executive changes and strong financial metrics, such as a CHF 2.3 billion equity capital and an Aa2 Moody’s rating, highlight its solid foundation amidst strategic leadership transitions.

- Click here and access our complete dividend analysis report to understand the dynamics of Liechtensteinische Landesbank.

- Upon reviewing our latest valuation report, Liechtensteinische Landesbank's share price might be too pessimistic.

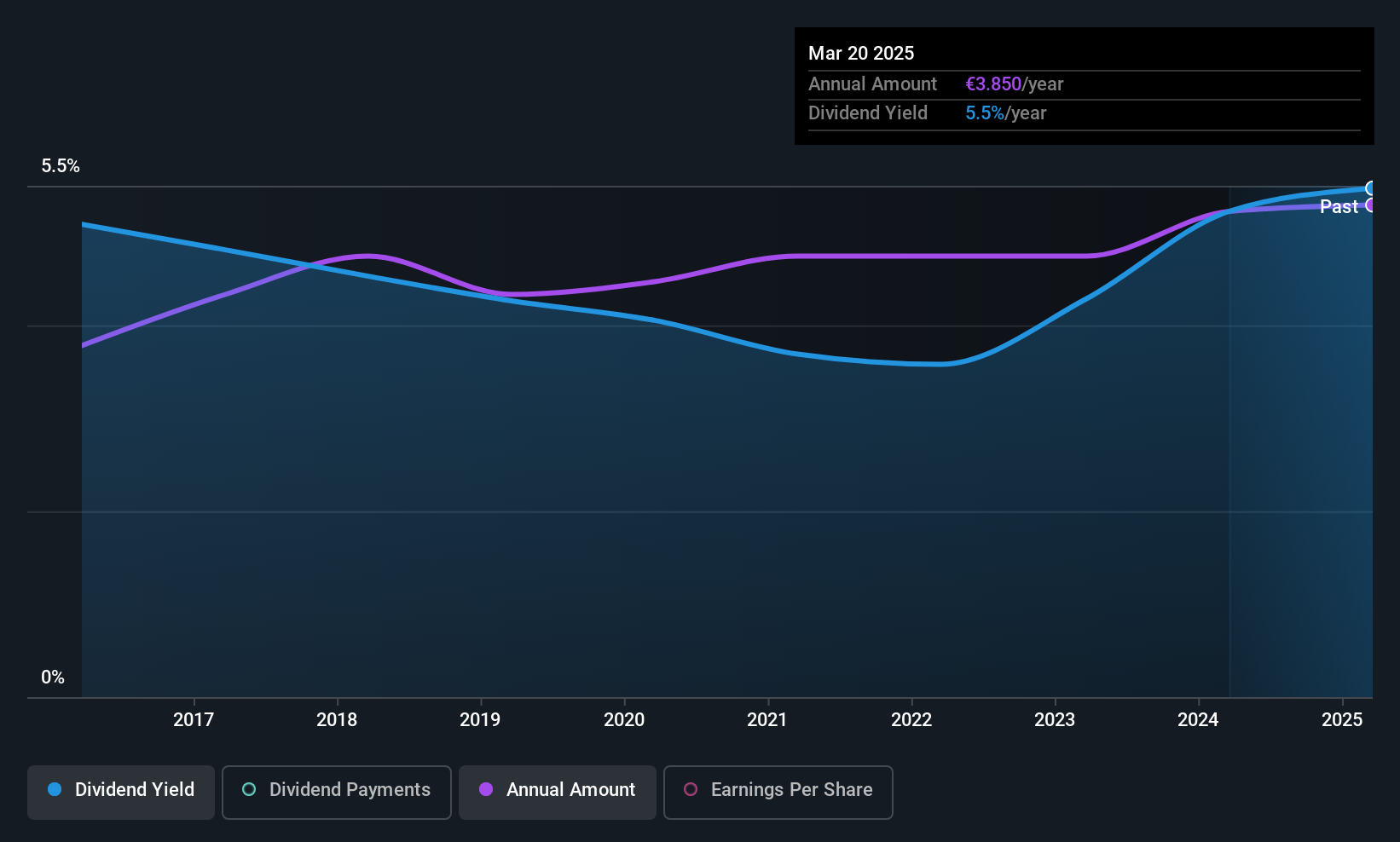

Burgenland Holding (WBAG:BHD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Burgenland Holding Aktiengesellschaft, with a market cap of €234 million, is involved in the generation and sale of electricity in Austria through its investment in Burgenland Energie AG.

Operations: Burgenland Holding's revenue is primarily derived from its investment in Burgenland Energie AG, focusing on electricity generation and sales within Austria.

Dividend Yield: 5.2%

Burgenland Holding's dividends have been stable and growing over the past decade, positioning it in the top 25% of Austrian dividend payers with a yield of 5.19%. However, its high payout ratio (100.1%) and cash payout ratio (105.5%) indicate dividends are not well covered by earnings or cash flows. Despite trading at 24.6% below estimated fair value and modest earnings growth, its illiquid shares and minimal revenue (€0) present challenges for dividend sustainability.

- Get an in-depth perspective on Burgenland Holding's performance by reading our dividend report here.

- According our valuation report, there's an indication that Burgenland Holding's share price might be on the cheaper side.

Taking Advantage

- Click here to access our complete index of 191 Top European Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal