Axsome Therapeutics (AXSM) Valuation Check After FDA Priority Review For AXS 05 In Alzheimer’s Agitation

Axsome’s latest FDA decision reshapes the near term setup

The latest spike in interest around Axsome Therapeutics (AXSM) stems from the FDA accepting and granting priority review to the company’s supplemental application for AXS-05 in Alzheimer’s disease agitation, which sharply tightens the regulatory decision timeline.

See our latest analysis for Axsome Therapeutics.

Axsome’s recent FDA milestones on AXS-05 and AXS-12, along with insider share sales late in 2025, have coincided with a 44.46% 90 day share price return and a 104.69% 1 year total shareholder return, suggesting momentum has been building.

If Axsome’s regulatory progress has caught your attention, this could be a good moment to scan other potential ideas across healthcare stocks and see what stands out for you.

With Axsome now trading around US$171.49 after a 1 year total return of 104.69%, investors face a key question: is this still an underappreciated CNS story, or has the market already priced in the next leg of growth?

Most Popular Narrative Narrative: 5.6% Undervalued

With Axsome’s fair value in the narrative set at US$181.59 against a last close of US$171.49, the story leans toward upside potential and leans heavily on late stage CNS assets to justify it.

The company is advancing multiple late-stage clinical programs (AXS-05, AXS-12, AXS-14, and several solriamfetol indications), which positions Axsome to benefit from the aging population and rising prevalence of CNS disorders, potentially resulting in a diversified revenue base, higher earnings, and reduced risk of overreliance on a single product.

Want to see how a fast growing top line, a swing from losses to profits, and a higher future multiple all tie together? The full narrative explains how revenue, margin expansion, and earnings forecasts link back to that fair value and what has to go right for the math to hold.

Result: Fair Value of $181.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story can change quickly if Auvelity or Sunosi underperform commercially, or if high spending and ongoing net losses strain Axsome’s cash position.

Find out about the key risks to this Axsome Therapeutics narrative.

Another way to look at Axsome’s valuation

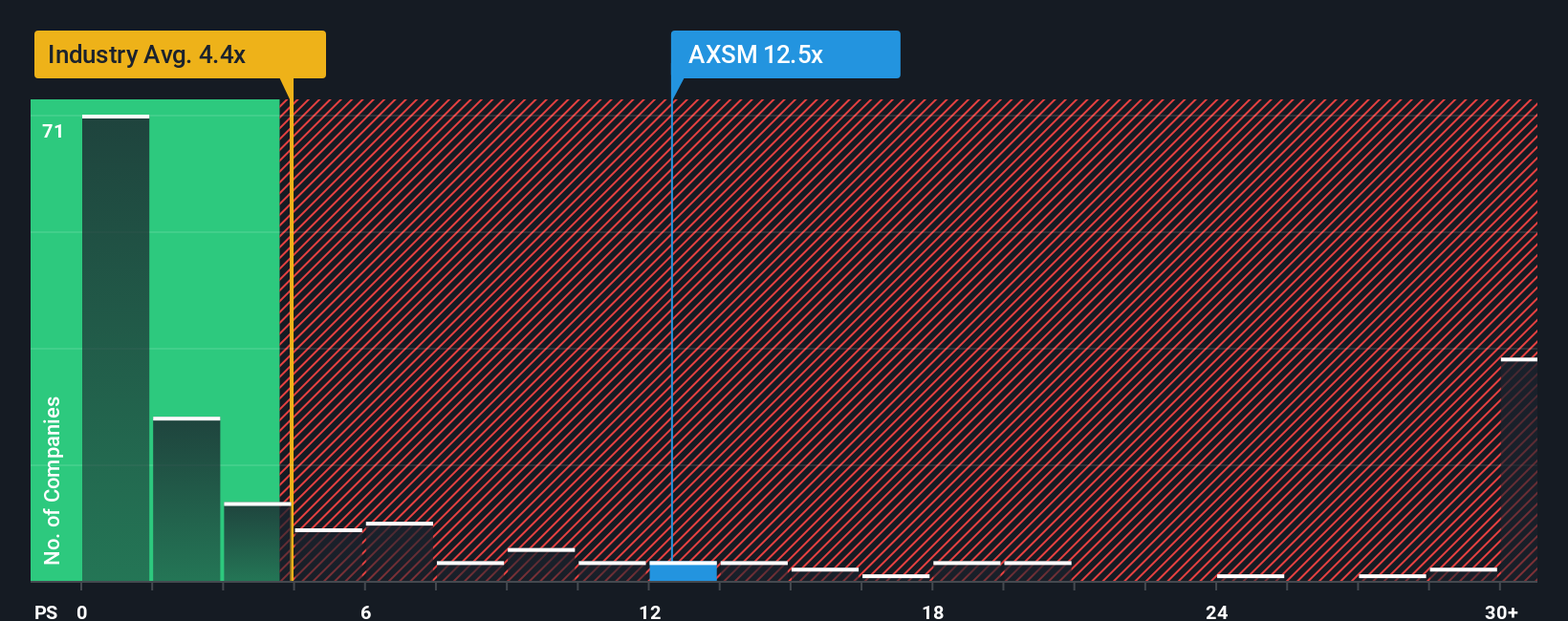

The narrative fair value of US$181.59 presents Axsome as modestly undervalued, but the P/S ratio tells a tougher story. At 15.4x sales versus 4.5x for the US pharmaceuticals group and 8.8x for peers, the stock is clearly priced richer, even though that is below a 17.3x fair ratio. Is the premium a cushion or a risk if expectations cool?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Axsome Therapeutics Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a custom Axsome view in minutes, starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Axsome Therapeutics.

Looking for more investment ideas?

If Axsome is only one piece of your watchlist, now is the time to widen your search with focused screeners that surface clear, data driven stock ideas.

- Spot potential underpriced names early by tracking these 877 undervalued stocks based on cash flows that line up with the kind of risk and reward profile you care about.

- Explore AI opportunities more intentionally by scanning these 25 AI penny stocks that are already building real use cases rather than just talking about them.

- Adjust your income mix by filtering for these 14 dividend stocks with yields > 3% that can help anchor your portfolio with cash distributions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal