Kuehne + Nagel International AG's (VTX:KNIN) Business Is Trailing The Market But Its Shares Aren't

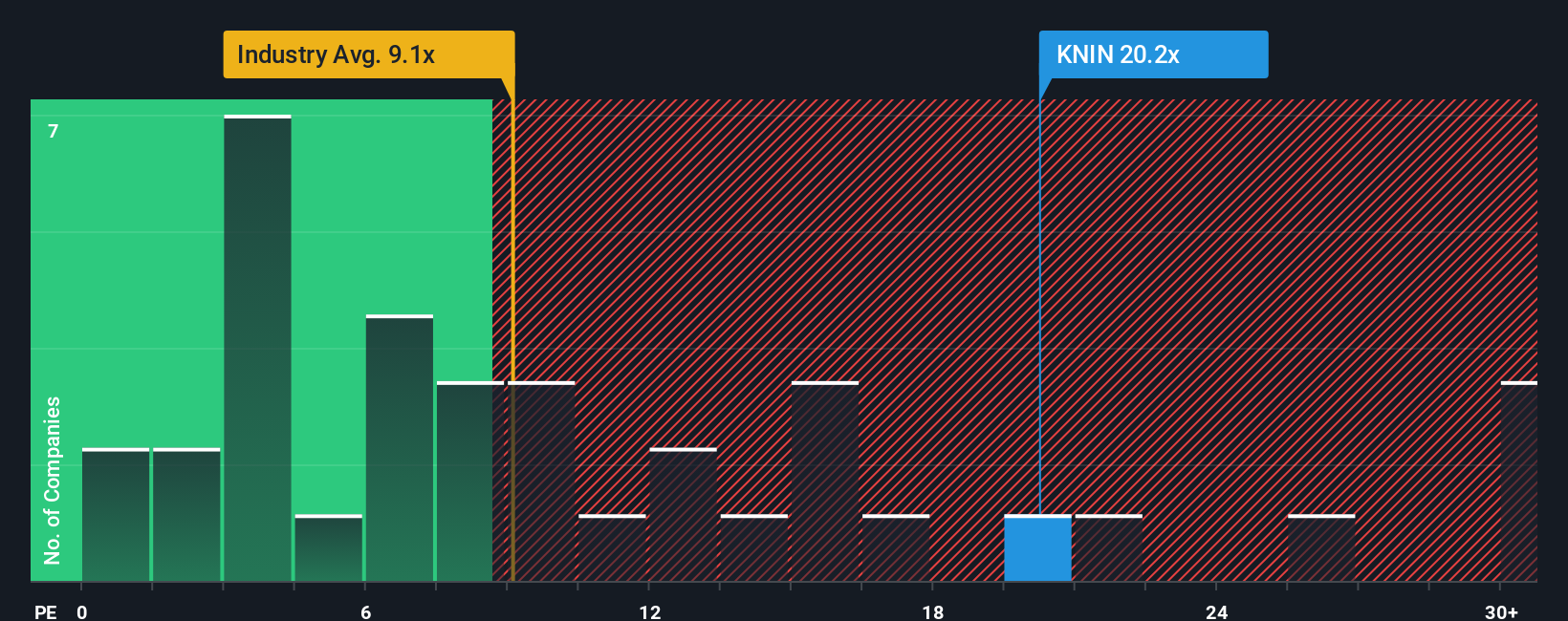

It's not a stretch to say that Kuehne + Nagel International AG's (VTX:KNIN) price-to-earnings (or "P/E") ratio of 20.2x right now seems quite "middle-of-the-road" compared to the market in Switzerland, where the median P/E ratio is around 21x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

While the market has experienced earnings growth lately, Kuehne + Nagel International's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Kuehne + Nagel International

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Kuehne + Nagel International's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 65% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the twelve analysts covering the company suggest earnings should grow by 5.3% each year over the next three years. With the market predicted to deliver 11% growth per year, the company is positioned for a weaker earnings result.

With this information, we find it interesting that Kuehne + Nagel International is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

What We Can Learn From Kuehne + Nagel International's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Kuehne + Nagel International currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 1 warning sign for Kuehne + Nagel International you should be aware of.

Of course, you might also be able to find a better stock than Kuehne + Nagel International. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal