Asian Growth Stocks With High Insider Ownership

As Asian markets navigate a complex landscape of geopolitical tensions and economic shifts, investors are increasingly focusing on growth stocks with strong insider ownership as potential opportunities. Such companies often signal confidence from those who know the business best, aligning with current market conditions where strategic internal investment can be a key indicator of robust prospects.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Modetour Network (KOSDAQ:A080160) | 12.8% | 41.8% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Here we highlight a subset of our preferred stocks from the screener.

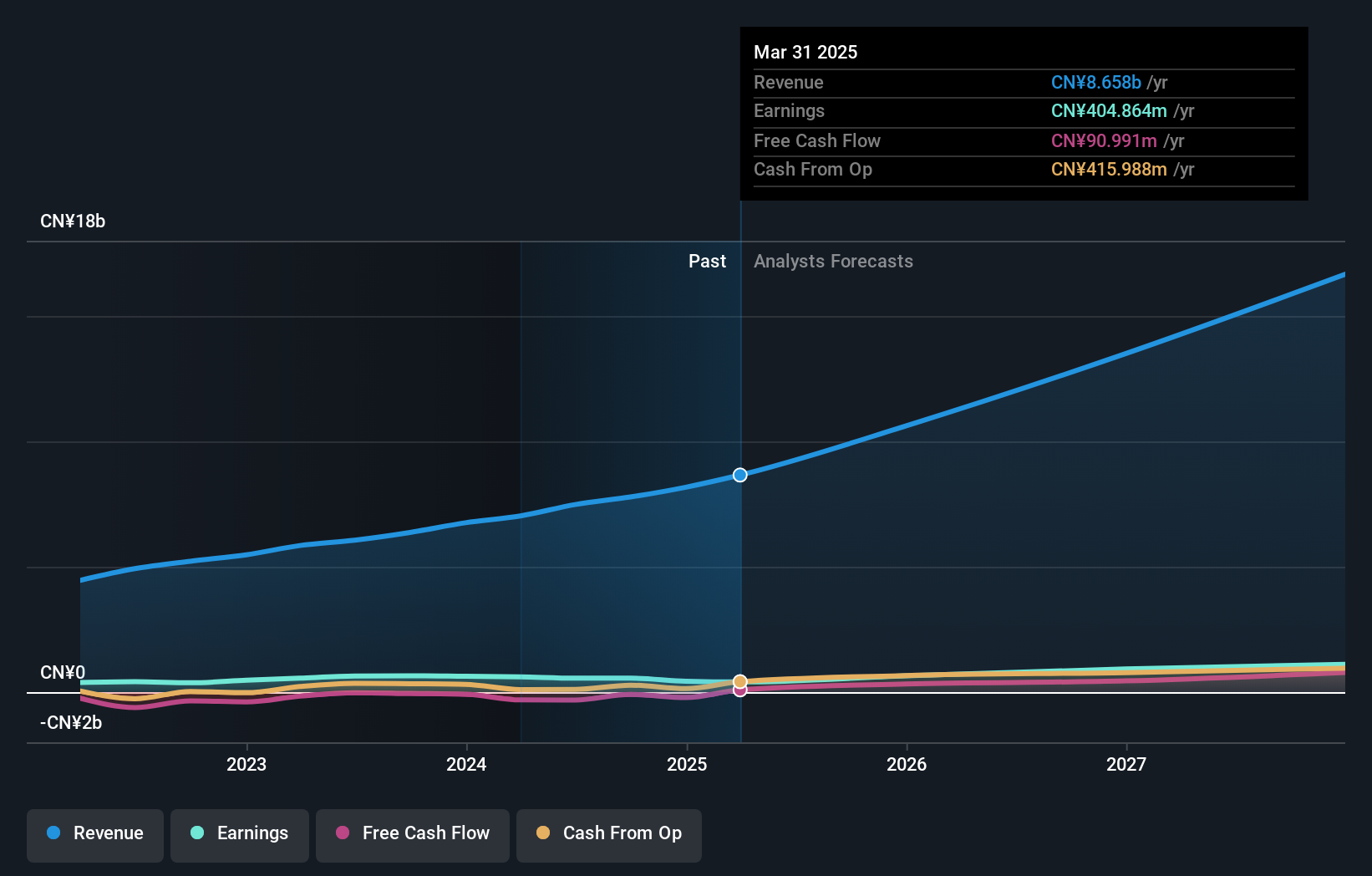

Cambricon Technologies (SHSE:688256)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cambricon Technologies Corporation Limited is engaged in the research, development, design, and sale of core chips for cloud servers, edge computing, and terminal equipment in China with a market cap of approximately CN¥586.14 billion.

Operations: Cambricon Technologies generates revenue through the sale of core chips for cloud servers, edge computing, and terminal equipment in China.

Insider Ownership: 28.3%

Revenue Growth Forecast: 48.4% p.a.

Cambricon Technologies has demonstrated remarkable growth, reporting CNY 4.61 billion in revenue for the first nine months of 2025, a substantial increase from the previous year. The company achieved profitability with a net income of CNY 1.60 billion compared to a loss last year. Despite high share price volatility, its earnings are forecast to grow significantly at over 51% annually, outpacing market averages. Analysts expect further stock price increases and robust revenue growth above 48% per annum.

- Dive into the specifics of Cambricon Technologies here with our thorough growth forecast report.

- Our valuation report here indicates Cambricon Technologies may be overvalued.

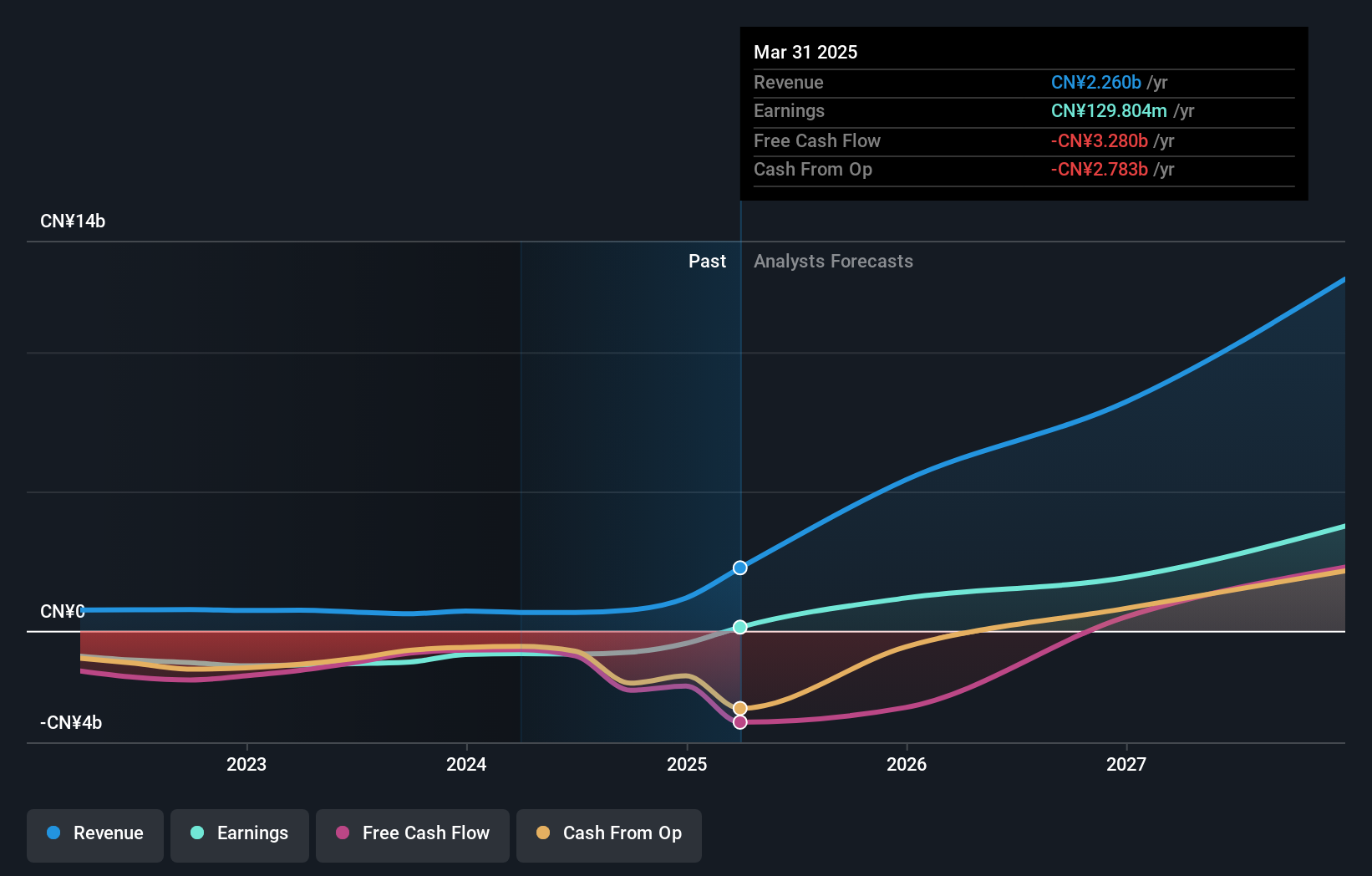

Shenzhen Megmeet Electrical (SZSE:002851)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Megmeet Electrical Co., LTD is an electrical automation company in China with a market cap of CN¥49.79 billion.

Operations: The company generates revenue from various segments, including CN¥2.34 billion from industrial automation, CN¥1.56 billion from smart home appliances, and CN¥1.02 billion from medical equipment.

Insider Ownership: 33.1%

Revenue Growth Forecast: 25.8% p.a.

Shenzhen Megmeet Electrical shows significant growth potential with earnings forecasted to rise 61.51% annually, outpacing the Chinese market's average. Despite a volatile share price and reduced profit margins, revenue is expected to grow 25.8% per year, exceeding market trends. Recent executive changes and amendments to company bylaws reflect strategic shifts aimed at enhancing governance and operational efficiency. However, net income for the first nine months of 2025 declined to CNY 212.62 million from CNY 411.15 million a year ago.

- Take a closer look at Shenzhen Megmeet Electrical's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Shenzhen Megmeet Electrical's share price might be too optimistic.

Grand Process Technology (TPEX:3131)

Simply Wall St Growth Rating: ★★★★★★

Overview: Grand Process Technology Corporation manufactures and sells semiconductor equipment in Taiwan, with a market cap of NT$51.57 billion.

Operations: The company's revenue segments include NT$3.39 billion from the Equipment Manufacturing Segment, NT$1.01 billion from the Equipment Sales Agent Department, NT$1.27 billion from the Chemical Raw Materials Manufacturing Department, and NT$61.61 million from the Software Sales Department.

Insider Ownership: 12.5%

Revenue Growth Forecast: 26.1% p.a.

Grand Process Technology demonstrates robust growth potential, with revenue and earnings forecasted to rise 26.1% and 35.1% annually, surpassing Taiwan's market averages. Recent earnings show significant improvement, with Q3 sales reaching TWD 1.49 billion from TWD 991.69 million year-on-year and net income increasing to TWD 303.95 million from TWD 216.82 million a year ago. Despite high share price volatility, no substantial insider trading activity has been reported in the past three months.

- Get an in-depth perspective on Grand Process Technology's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Grand Process Technology implies its share price may be too high.

Make It Happen

- Investigate our full lineup of 634 Fast Growing Asian Companies With High Insider Ownership right here.

- Searching for a Fresh Perspective? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal