A Look At Semtech (SMTC) Valuation After Recent Share Price Weakness And Long Term Returns

Without a specific news headline driving attention today, Semtech (SMTC) still gives investors a lot to consider, including its recent share performance and its role in semiconductors and IoT connectivity.

See our latest analysis for Semtech.

After a softer recent patch, with a 30 day share price return of 6.62% decline and year to date share price return of 1.22% decline, Semtech’s 1 year total shareholder return of 14.11% and 3 year total shareholder return of about 14x suggest that longer term momentum has been stronger than the latest pullback implies.

If Semtech’s mix of semiconductors and IoT connectivity has caught your eye, it could be a good moment to widen your watchlist with high growth tech and AI stocks.

So with Semtech sharing a mix of recent share price weakness, a 14.11% 1 year return, and analysts’ price target sitting above the current US$74.34 level, is there still a buying opportunity here, or is future growth already priced in?

Most Popular Narrative: 9.3% Undervalued

With Semtech last closing at US$74.34 against a narrative fair value of US$82, the story centers on whether future growth can justify that gap.

Accelerating demand from hyperscale data centers and AI infrastructure is driving robust, multi-year growth across Semtech's high-margin data center business, supported by design wins in advanced optical (FiberEdge), low-power (LPO), and active copper interconnects (CopperEdge/ACC). As data rates move from 400G to 800G and 1.6T, Semtech stands to capture significant revenue and margin expansion from new content per deployment.

Curious what kind of revenue curve and margin lift would need to play out for that valuation to hold up? The narrative leans on rapid earnings expansion, richer profitability, and a future earnings multiple usually reserved for higher growth names. Want to see exactly how those moving parts stack together to reach that fair value?

Result: Fair Value of $82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could change quickly if mix driven margin pressure persists or if integration challenges, such as the goodwill impairment, signal deeper profitability issues in the future.

Find out about the key risks to this Semtech narrative.

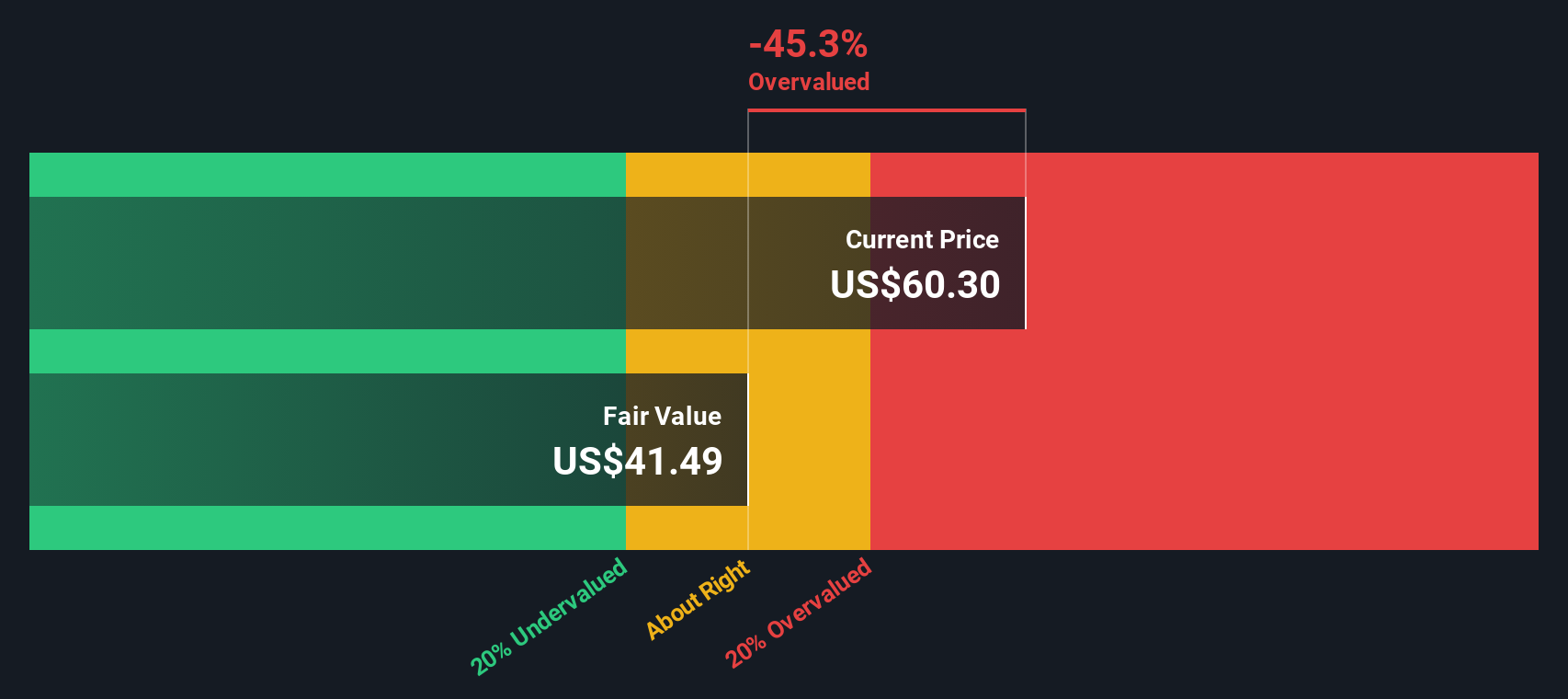

Another View: Our DCF Model Paints a Different Picture

If you lean on the SWS DCF model instead of the narrative fair value, you get a very different message. At a last close of US$74.34 versus an SWS DCF value of US$46.41, Semtech screens as overvalued. This raises a fair question: are growth expectations running ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Semtech for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Semtech Narrative

If your take on Semtech’s story is different, or you simply prefer to work from the raw numbers yourself, you can build a custom narrative in just a few minutes with Do it your way.

A great starting point for your Semtech research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Semtech is on your radar, do not stop there. Use the tools at your fingertips to line up your next round of ideas with confidence.

- Spot potential bargains by scanning these 877 undervalued stocks based on cash flows that may be trading below what their cash flows imply.

- Chase cutting edge growth by zeroing in on these 25 AI penny stocks positioned around artificial intelligence themes.

- Tap into income potential by reviewing these 14 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal