Assessing Snowflake (SNOW) Valuation After Contract Wins And Sustained Billings Growth

Snowflake stock reaction to contract momentum and billings growth

Recent reports on Snowflake (SNOW) securing new contracts and maintaining billings growth are in focus for investors, especially as the company points to potential revenue expansion and possible market share gains over the next year.

See our latest analysis for Snowflake.

At a share price of $224.36, Snowflake’s recent 1 day share price return of 3.53% and 1 year total shareholder return of 41.25% indicate that momentum has been rebuilding after weaker 3 month share price performance of negative 10.33%, as investors react to contract wins and billings trends.

If Snowflake’s recent contract traction has caught your eye, this could be a moment to size up other high growth tech and AI names through high growth tech and AI stocks.

With Snowflake trading at $224.36, a value score of 1, and a discount of 26% to the average analyst price target, you have to ask yourself: is this genuine mispricing, or is the market already accounting for future growth?

Most Popular Narrative: 20.4% Undervalued

With Snowflake last closing at $224.36 against a narrative fair value of about $281.73, the story leans toward underpricing, which hinges heavily on how future earnings power is framed.

“In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $7.8 billion, earnings will come to $497.5 million, and it would be trading on a PE ratio of 224.7x, assuming you use a discount rate of 8.8%.”

Curious what kind of revenue build, margin shift, and rich future P/E need to line up to support that fair value? The full narrative spells out the growth curve, profitability swing, and valuation multiple that have to come together for Snowflake to match those expectations.

Result: Fair Value of $281.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative can be knocked off course if AI products fail to translate into meaningful revenue, or if heavyweight cloud competitors squeeze margins and limit customer expansion.

Find out about the key risks to this Snowflake narrative.

Another Angle On Valuation

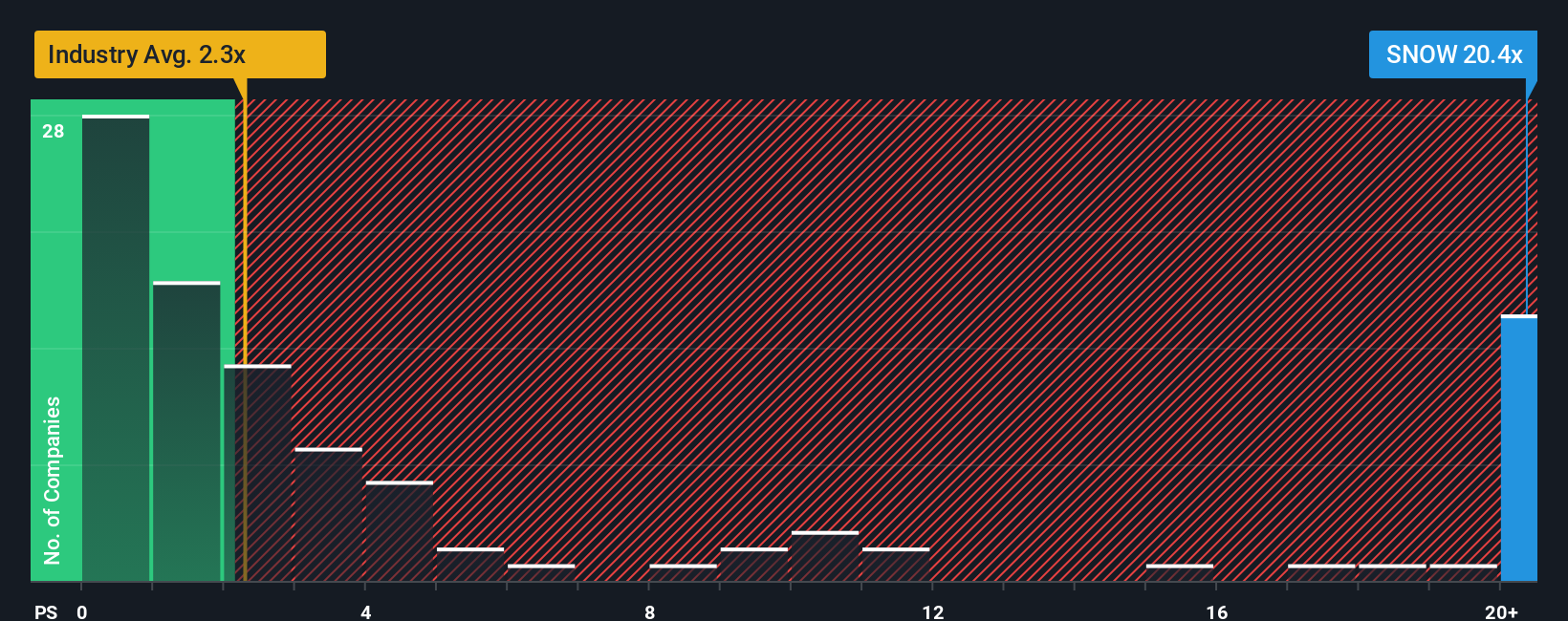

Those fair value narratives suggest upside, but the current P/S ratio of 17.5x tells a different story. It is far above the US IT industry average of 2.2x and also above Snowflake’s own fair ratio of 13x. This points to meaningful valuation risk if sentiment cools. Which signal do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Snowflake Narrative

If the assumptions here do not quite fit how you see Snowflake, you can stress test the numbers yourself and build a custom view in minutes, Do it your way.

A great starting point for your Snowflake research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Snowflake is only one piece of your watchlist, now is a good time to widen the net and pressure test your thinking against other types of opportunities.

- Spot potential bargains early by scanning these 877 undervalued stocks based on cash flows that line up with strong cash flow expectations and more reasonable pricing.

- Ride powerful technology trends by zeroing in on these 25 AI penny stocks that are geared toward artificial intelligence driven products and services.

- Stack potential income ideas by reviewing these 14 dividend stocks with yields > 3% that currently offer yields above 3% and may suit a more income focused approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal