Middle East Hidden Gems Including Ayalon Insurance and 2 Promising Stocks

As Middle Eastern markets experience fluctuations due to weak oil prices and geopolitical tensions, investors are keenly observing the region's economic landscape for opportunities amid the challenges. Despite these headwinds, the growth in non-oil sectors and potential monetary easing provide a backdrop where discerning investors might find hidden gems like Ayalon Insurance and two other promising stocks that offer resilience and potential within this dynamic environment.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nofoth Food Products | NA | 21.36% | 25.28% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| MOBI Industry | 13.81% | 5.67% | 19.69% | ★★★★★★ |

| Amanat Holdings PJSC | 10.86% | 27.51% | -0.92% | ★★★★★☆ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| Ajman Bank PJSC | 53.89% | 16.11% | 18.02% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Ayalon Insurance (TASE:AYAL)

Simply Wall St Value Rating: ★★★★★☆

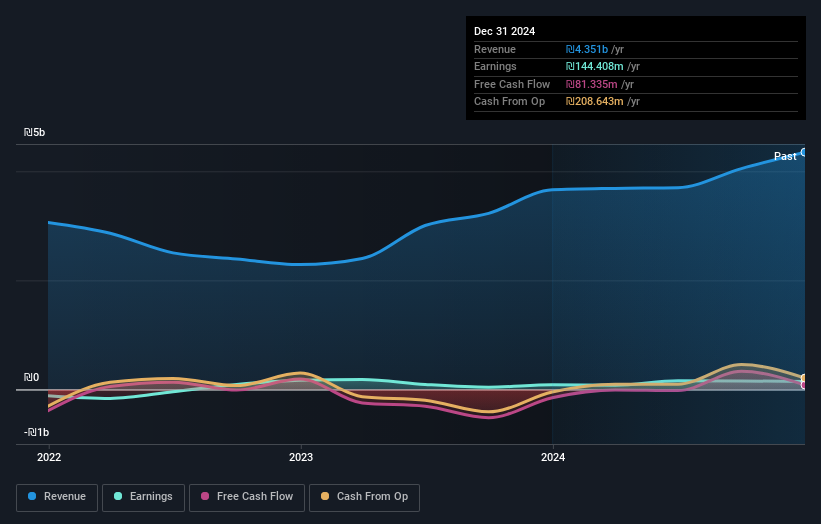

Overview: Ayalon Insurance Company Ltd, with a market cap of ₪2.55 billion, operates through its subsidiaries to offer a range of insurance products in Israel.

Operations: Ayalon generates revenue primarily from its life insurance and long-term savings segment, contributing ₪1.22 billion, and health insurance segment, which adds ₪707.66 million. The general insurance sector also plays a significant role with automobile property insurance at ₪712.74 million and compulsory vehicle insurance at ₪328.46 million.

Ayalon Insurance, with its robust financial health, stands out in the Middle Eastern market. Over the past five years, earnings have surged by 53% annually, showcasing strong growth potential. The company's debt to equity ratio has impressively decreased from 93.7% to 46.9%, and its interest payments are well covered at 6.3 times EBIT, indicating solid fiscal management. Despite a volatile share price recently, Ayalon trades at a compelling value—31% below estimated fair value—while maintaining high-quality earnings and positive free cash flow. Recent quarterly net income of ILS 118 million further underscores its profitability trajectory.

- Take a closer look at Ayalon Insurance's potential here in our health report.

Gain insights into Ayalon Insurance's past trends and performance with our Past report.

BrainsWay (TASE:BWAY)

Simply Wall St Value Rating: ★★★★★★

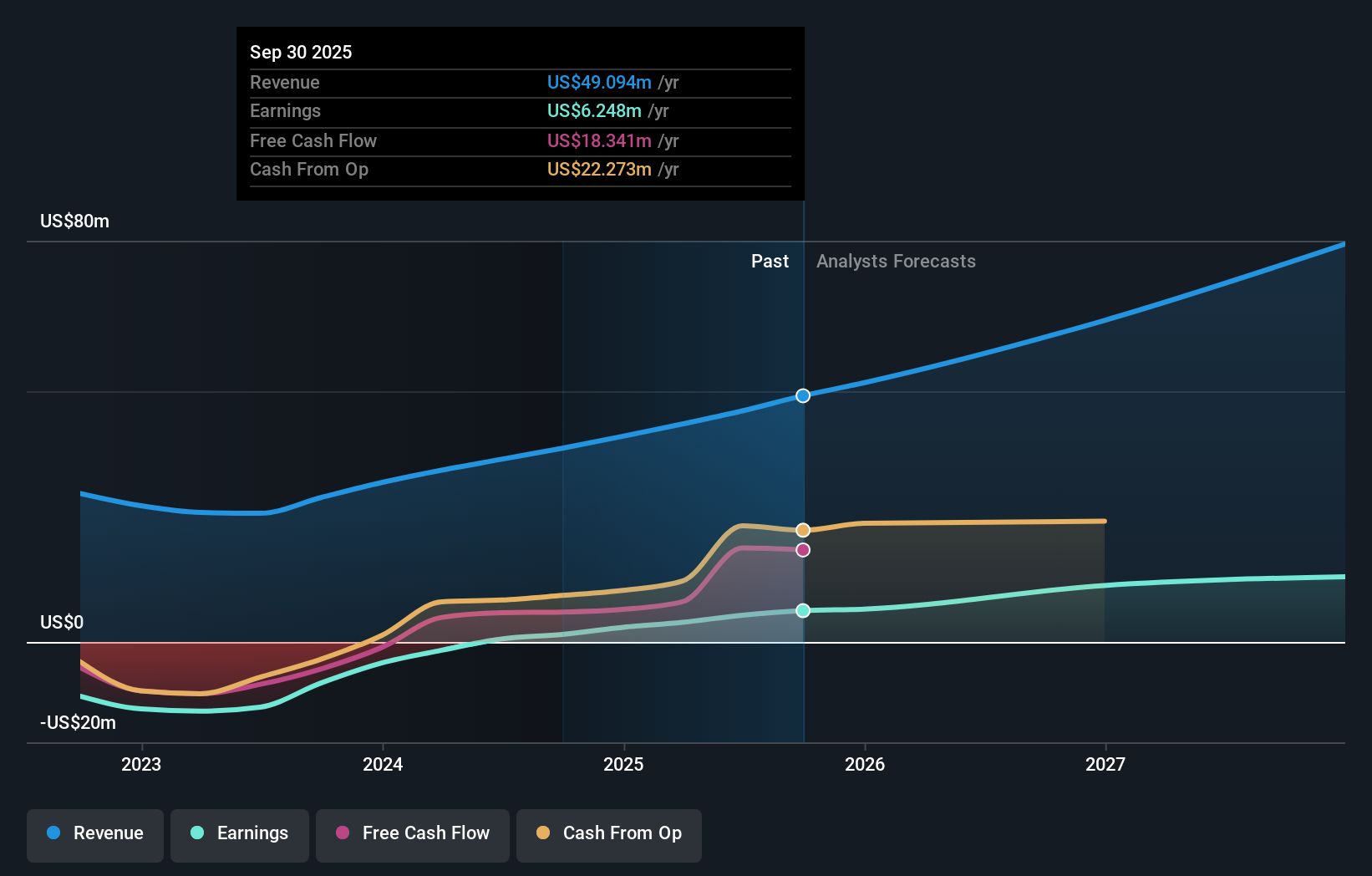

Overview: BrainsWay Ltd. specializes in developing and selling noninvasive neurostimulation treatments for mental health disorders across the United States, East Asia, and other international markets, with a market cap of ₪1.25 billion.

Operations: BrainsWay generates revenue primarily from the development and commercialization of its Deep TMS System, amounting to $49.09 million.

BrainsWay, a nimble player in the medical equipment sector, boasts impressive financial health with earnings surging 316% last year, outpacing its industry peers. The company is debt-free and trades at a significant discount of 70.9% below its estimated fair value, positioning it as an attractive opportunity for investors seeking growth potential. Recent strategic moves include launching a multicenter clinical trial using their Deep TMS 360™ system for Alcohol Use Disorder (AUD), highlighting their commitment to innovation in mental health treatment. With FDA approval expanding their reach into adolescent therapy, BrainsWay continues to solidify its pioneering role in transcranial magnetic stimulation technology.

- Unlock comprehensive insights into our analysis of BrainsWay stock in this health report.

Assess BrainsWay's past performance with our detailed historical performance reports.

Qualitau (TASE:QLTU)

Simply Wall St Value Rating: ★★★★★★

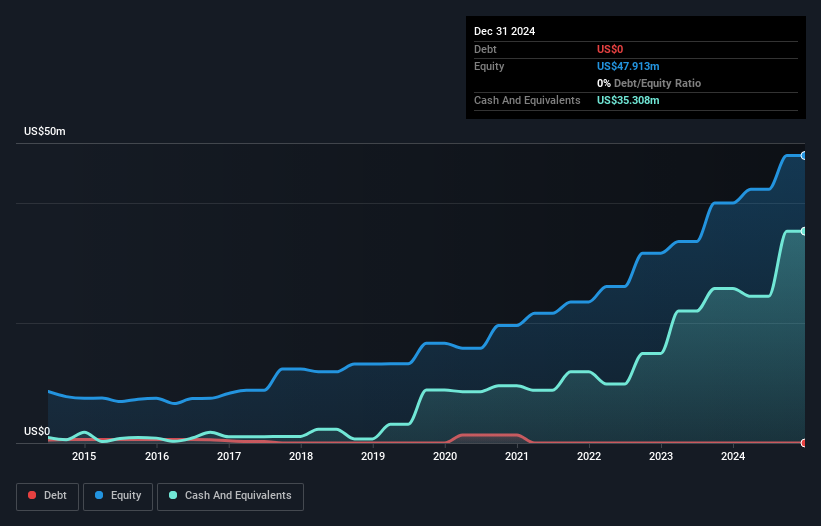

Overview: Qualitau Ltd develops, manufactures, and sells test equipment and services for the semiconductor industry targeting European and Far-Eastern markets with a market cap of ₪2.87 billion.

Operations: Qualitau generates revenue primarily from its electronic components and parts segment, amounting to $63.70 million. The company operates within the semiconductor industry, focusing on markets in Europe and the Far East.

Qualitau, a semiconductor player, has shown impressive financial health with no debt as of now, compared to a 6.8% debt-to-equity ratio five years ago. Its earnings have surged by 96.9%, significantly outpacing the industry average of 8.8%. The company reported Q3 net income at US$10.72 million, up from US$3.63 million the previous year; basic EPS rose to US$2.352 from US$0.833 in the same period last year. With a price-to-earnings ratio of 33.7x below the industry average and high-quality non-cash earnings, Qualitau seems well-positioned for continued growth in its sector.

- Click to explore a detailed breakdown of our findings in Qualitau's health report.

Evaluate Qualitau's historical performance by accessing our past performance report.

Key Takeaways

- Get an in-depth perspective on all 186 Middle Eastern Undiscovered Gems With Strong Fundamentals by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal