Mastercard (MA) Valuation Check After Mixed Near Term Share Price Moves

Mastercard (MA) is back in focus after recent share price moves, with the stock posting mixed short term returns but a positive 1 year total return. This has prompted investors to reassess its current valuation.

See our latest analysis for Mastercard.

The recent 1 day and 7 day share price declines contrast with Mastercard’s 1 month share price gain of 3.23%, while its 1 year total shareholder return of 10.63% points to momentum that has softened in the short term.

If Mastercard’s mixed near term moves have you thinking about where else growth and ownership can align, it could be a good moment to scan fast growing stocks with high insider ownership.

With Mastercard trading at $563.13 and sitting about 17% below the average analyst price target and roughly 25% below one intrinsic value estimate, you have to ask: Is this a genuine opening, or is future growth already priced in?

Most Popular Narrative: 14.3% Undervalued

Against Mastercard's last close at $563.13, the most followed narrative points to a higher fair value, built around digital and cross border payment trends.

Mastercard is benefiting from the accelerating global shift from cash to digital payments, as evidenced by strong growth in payment volumes, increased contactless and online transaction penetration, and ongoing expansion into underpenetrated verticals and regions supporting sustained revenue and earnings growth.

Curious what kind of revenue expansion, margin profile, and earnings multiples need to hold together for that valuation to work? The full narrative lays out the exact growth path behind this fair value call and how long term fee income, value added services, and capital returns are expected to carry the model.

Result: Fair Value of $657 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are pressure points you need to keep in view, including rising competition from local real time payment systems and ongoing regulatory scrutiny that could affect pricing power.

Find out about the key risks to this Mastercard narrative.

Another Take: Multiples Point To A Richer Price

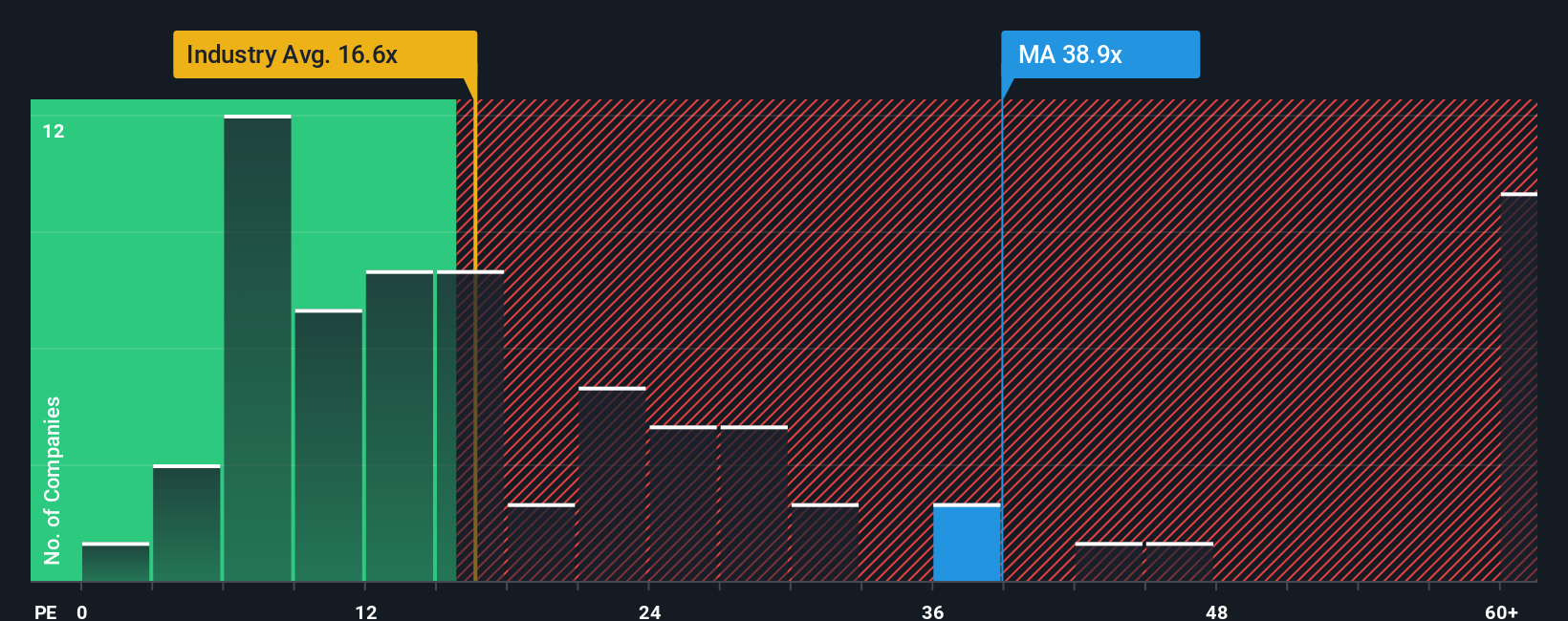

While the most followed narrative sees Mastercard as about 14.3% undervalued, the current P/E of 35.5x looks expensive compared with the US Diversified Financial industry at 13.7x, peers at 16.7x, and a fair ratio of 20.4x. If the market moves toward that fair ratio, how comfortable are you with the valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mastercard Narrative

If you see Mastercard’s story differently or prefer to test your own assumptions against the data, you can build a custom view in minutes with Do it your way.

A great starting point for your Mastercard research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready To Hunt For Your Next Idea?

If Mastercard is only one piece of your watchlist, now is the moment to widen your search so you do not miss other potential opportunities.

- Spot potential value by scanning these 876 undervalued stocks based on cash flows that align with your return expectations and risk comfort.

- Ride powerful themes by checking out these 25 AI penny stocks that sit at the intersection of technology and earnings potential.

- Boost your income focus by reviewing these 14 dividend stocks with yields > 3% offering yields above 3% that may complement a total return approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal