Ferrari (BIT:RACE) Valuation Check After Recent Pullback And Premium P/E Multiple

Why Ferrari stock is getting a closer look today

Ferrari (BIT:RACE) is back on many watchlists after a recent pullback, with the share price at €321.40 and negative moves over the month and past 3 months drawing fresh attention from value focused investors.

See our latest analysis for Ferrari.

While Ferrari’s share price is at €321.40 after a recent 90 day share price return of a 23.68% decline, the 3 year total shareholder return of 52.00% and 5 year total shareholder return of 84.77% show that longer term holders have still seen sizeable gains. This suggests recent weakness reflects changing sentiment around growth potential and risk rather than a simple one way story.

If Ferrari’s pullback has you reassessing the auto space, it could be a good moment to compare it with other premium brands and scale players using our screener for auto manufacturers.

With Ferrari growing revenue at 6.21% and net income at 7.58% annually, yet seeing a 21.25% 1-year total return decline, you have to ask: Is the pullback an opening, or is future growth already priced in?

Most Popular Narrative: 20.5% Undervalued

Ferrari’s most followed narrative points to a fair value of €404.24 per share against the last close of €321.40, framing the current pullback as a valuation gap based on projected earnings power and capital returns.

The ramp-up of high-margin, recurring revenue streams from brand sponsorships, lifestyle, and personalization, fueled by lifestyle activities, racing events, and growing global brand desirability, will further enhance margin accretion, drive resilient long-term earnings, and reduce reliance on car sales volume alone.

Curious how modest revenue growth, higher margins and a richer earnings multiple all fit together. The valuation hinges on a bold long term profit profile. Want to see exactly how those assumptions are stacked and discounted.

Result: Fair Value of €404.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story meets some real friction if electrification costs stay high or if luxury demand softens, which could put Ferrari’s margins and pricing power under pressure.

Find out about the key risks to this Ferrari narrative.

Another view on Ferrari’s valuation

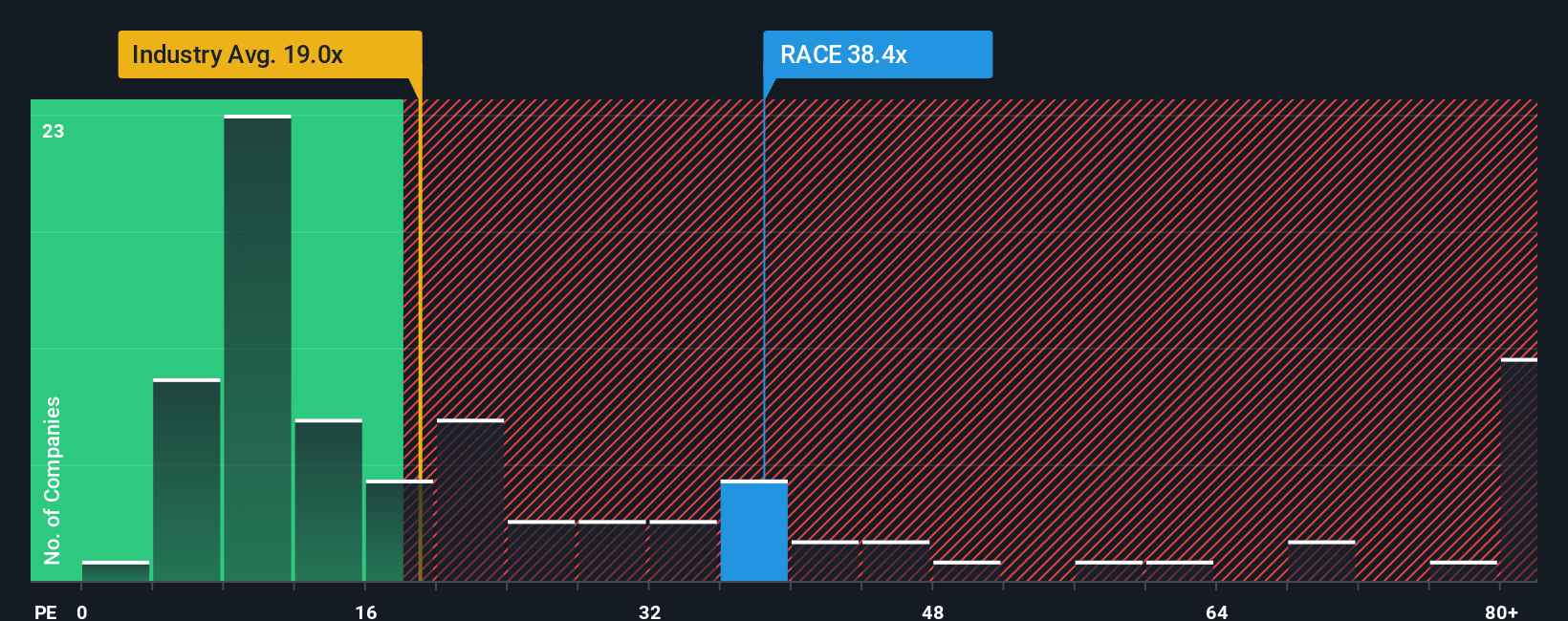

The popular narrative paints Ferrari as 20.5% undervalued at a fair value of €404.24 per share, but the current P/E of 35.6x tells a tougher story. That figure sits well above the global Auto industry at 18.5x, the peer average at 17.8x, and an estimated fair ratio of 19.6x.

Put simply, the market is already paying almost double what peers and the fair ratio suggest. That kind of gap can work out if the growth and profitability narrative plays out cleanly. However, if it does not, how quickly could sentiment swing back toward something closer to that 19.6x fair ratio?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ferrari Narrative

If you are not on board with this view or simply prefer to weigh the numbers yourself, you can shape a fresh thesis in minutes: Do it your way.

A great starting point for your Ferrari research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Ferrari has you thinking harder about where to put your money to work next, do not stop here. Broaden your watchlist before the next opportunity moves on.

- Target potential mispricing by scanning these 876 undervalued stocks based on cash flows that may offer stronger fundamentals than their current market prices suggest.

- Spot early movers in artificial intelligence with these 25 AI penny stocks that tie real business models to AI driven products and services.

- Tap into the growth of digital assets through these 79 cryptocurrency and blockchain stocks focused on companies building payment rails, exchanges, and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal