Assessing Seadrill (NYSE:SDRL) Valuation After Recent Share Price Momentum And Mixed Return Profile

Why Seadrill Is On Investors’ Radar Today

Seadrill (NYSE:SDRL) has caught investor attention after recent share price moves, with the stock last closing at $34.95. That has some investors revisiting its offshore drilling profile and recent financial metrics.

See our latest analysis for Seadrill.

The recent 1-month share price return of 9.22% and 3-month share price return of 9.63%, compared with a 1-year total shareholder return decline of 7.59% and a 3-year total shareholder return of 5.56%, suggest that short-term momentum has picked up while longer-term results remain mixed.

If Seadrill’s move has you thinking about where else capital might work hard for you, this could be a good moment to check out aerospace and defense stocks.

With Seadrill trading at $34.95, showing a mixed return profile and sitting below an average analyst price target of $41.86, is the market overlooking value here or already pricing in the company’s future growth potential?

Most Popular Narrative: 19.7% Undervalued

The most followed narrative sees Seadrill’s fair value at US$43.50 against the last close of US$34.95. This frames a sizeable valuation gap for investors to weigh.

Deepwater project investment is projected to surge, with Wood Mackenzie forecasting a massive rise in offshore FIDs over the next 2-3 years, which supports a bullish outlook for Seadrill's backlog, earnings, and overall cash flow durability.

Curious how a mid single digit revenue trajectory supports a higher price tag? The narrative leans heavily on profit margins and earnings power. The exact hurdles are in the details.

According to this widely followed view, Seadrill’s future value is built around moderate top line growth, a sizeable uplift in profit margins and a lower earnings multiple than many peers currently carry. Those assumptions are brought back to today using a discount rate of 8.13%, which is the hurdle rate used to translate expected future cash generation into a present fair value estimate of US$43.50.

Result: Fair Value of $43.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story can quickly change if softer utilization and day rates persist, or if further legal and regulatory setbacks disrupt cash flow and contract visibility.

Find out about the key risks to this Seadrill narrative.

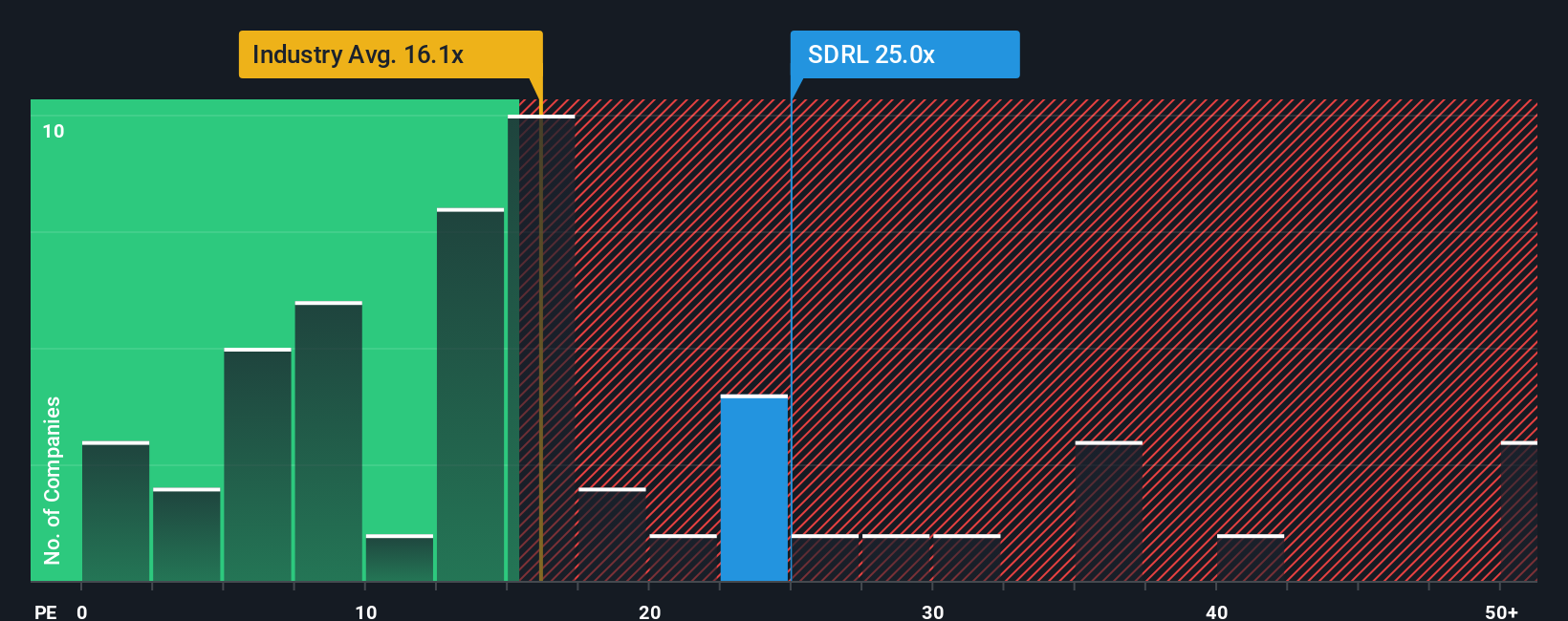

Another View: What The P/E Ratio Is Saying

The popular fair value narrative paints Seadrill as undervalued, but the current P/E of 64.1x tells a different story. That is much higher than the US Energy Services industry at 18.7x, the peer average at 12.7x, and even the fair ratio estimate of 53.8x.

This gap suggests investors are already paying a premium for future earnings, which raises the risk that any setback in delivery on forecasts could hit the share price hard. The question for you is whether that premium feels like a cushion or a warning sign.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Seadrill Narrative

If you see the numbers differently or want to weigh the assumptions yourself, you can build your own view in just a few minutes: Do it your way.

A great starting point for your Seadrill research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking For More Investment Ideas?

If Seadrill has your attention, do not stop there. Widening your search across sectors and styles can help you spot opportunities you might otherwise miss.

- Spot potential early movers in smaller companies by checking out these 3564 penny stocks with strong financials that pair low share prices with stronger fundamentals.

- Target the intersection of technology and medicine with these 29 healthcare AI stocks that focus on companies applying AI to real world healthcare problems.

- Zero in on income focused opportunities through these 14 dividend stocks with yields > 3% that feature yields above 3% and help you compare payout profiles side by side.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal