ASX Penny Stocks To Watch In January 2026

The Australian share market is experiencing a shift towards gains, buoyed by advances in major U.S. indexes and rising Brent crude prices following geopolitical developments. In this context, penny stocks—often seen as relics of past market eras—continue to offer intriguing possibilities for investors due to their affordability and potential for growth when backed by strong financials. As we explore the landscape of ASX penny stocks, we'll highlight those that stand out for their financial strength and potential long-term success.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.425 | A$121.8M | ✅ 4 ⚠️ 4 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.85 | A$52.93M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.03 | A$465.68M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.07 | A$226.76M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$39.99M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.19 | A$3.64B | ✅ 4 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.755 | A$361.21M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.27 | A$1.39B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.865 | A$124.5M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.33 | A$129.42M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 416 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Brisbane Broncos (ASX:BBL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Brisbane Broncos Limited, with a market cap of A$159.81 million, is engaged in the management and operation of the Brisbane Broncos Rugby League Football teams in Australia.

Operations: The company generates revenue of A$65.79 million from its sports management and entertainment segment.

Market Cap: A$159.81M

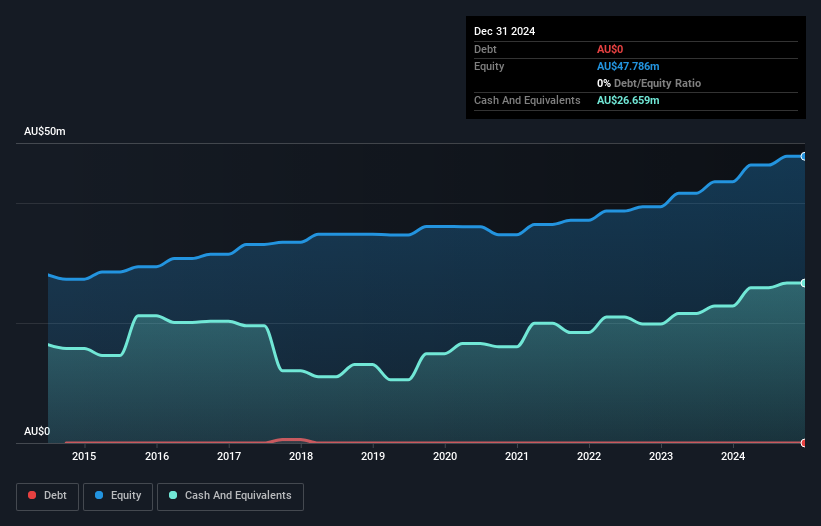

Brisbane Broncos Limited, with a market cap of A$159.81 million, presents a stable investment opportunity in the penny stock realm. The company has demonstrated significant earnings growth over the past five years at 36.3% annually, although recent growth of 21.2% lags behind industry averages. Its financial health is robust with no debt and short-term assets comfortably covering liabilities. The Price-To-Earnings ratio (21.4x) aligns closely with the Australian market average, suggesting fair valuation. Despite lower-than-desired Return on Equity at 14.4%, its experienced management and board bolster confidence in operational stability and strategic direction moving forward.

- Get an in-depth perspective on Brisbane Broncos' performance by reading our balance sheet health report here.

- Evaluate Brisbane Broncos' historical performance by accessing our past performance report.

OM Holdings (ASX:OMH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: OM Holdings Limited is an investment holding company involved in the global mining, smelting, trading, and marketing of manganese ores and ferroalloys, with a market capitalization of A$210.19 million.

Operations: The company's revenue is primarily generated from its Marketing and Trading segment, which accounts for $680.80 million, followed by the Smelting segment contributing $498.11 million.

Market Cap: A$210.19M

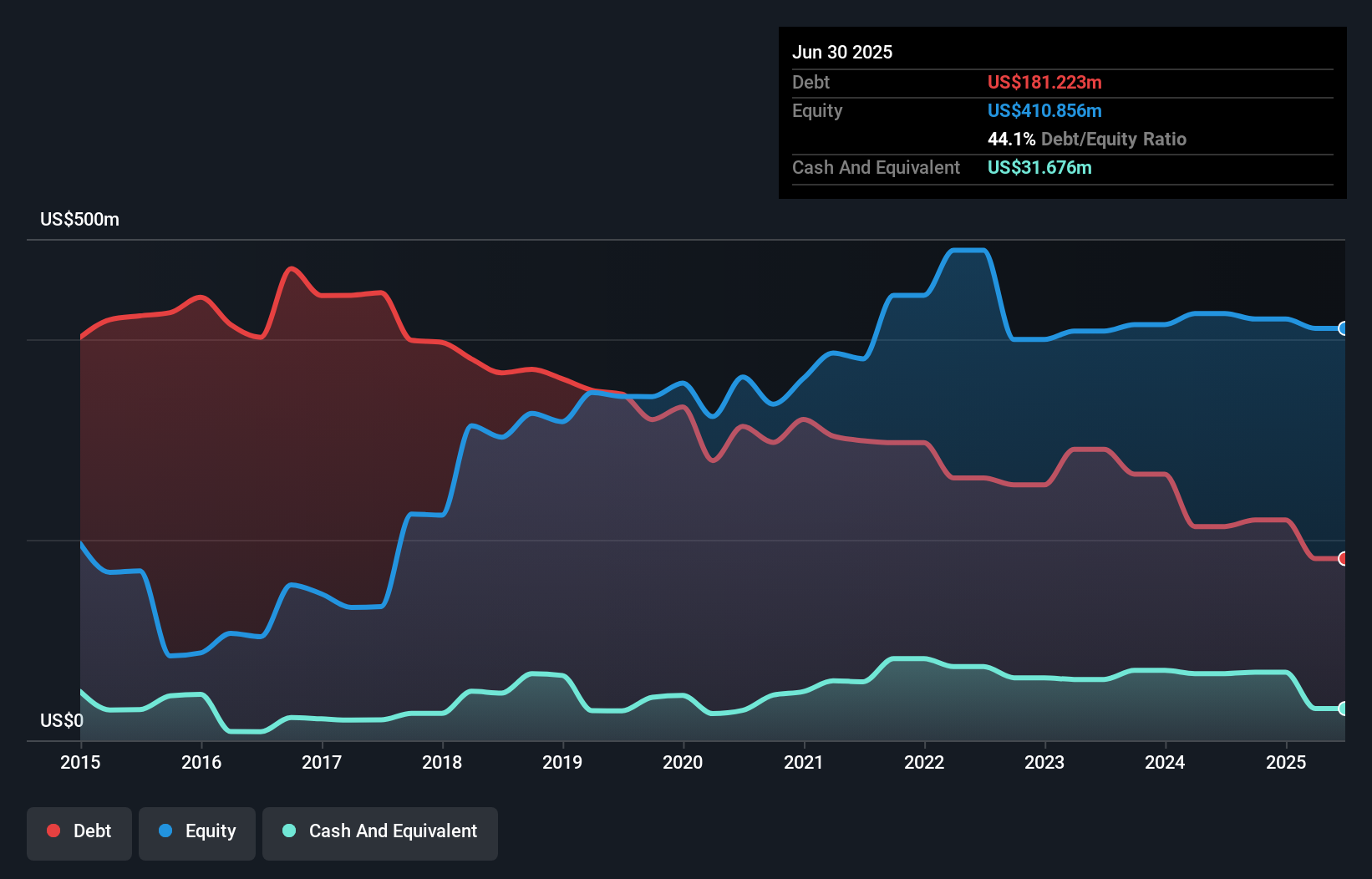

OM Holdings Limited, with a market cap of A$210.19 million, operates in the mining and smelting sector but is currently unprofitable with a negative Return on Equity of -3.11%. Despite this, the company's financial structure shows resilience; its short-term assets of $392.0M exceed both short-term ($346.3M) and long-term liabilities ($138.5M). The debt situation has improved over time, reducing from 86.4% to 44.1% in five years, while operating cash flow adequately covers debt obligations at 26.7%. Although earnings are forecasted to grow significantly at 101% annually, past losses have increased by 14.2% per year over five years.

- Jump into the full analysis health report here for a deeper understanding of OM Holdings.

- Gain insights into OM Holdings' future direction by reviewing our growth report.

Sovereign Metals (ASX:SVM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sovereign Metals Limited, along with its subsidiaries, focuses on the exploration and development of mineral resource projects in Malawi and has a market cap of A$375.22 million.

Operations: No revenue segments have been reported for this company.

Market Cap: A$375.22M

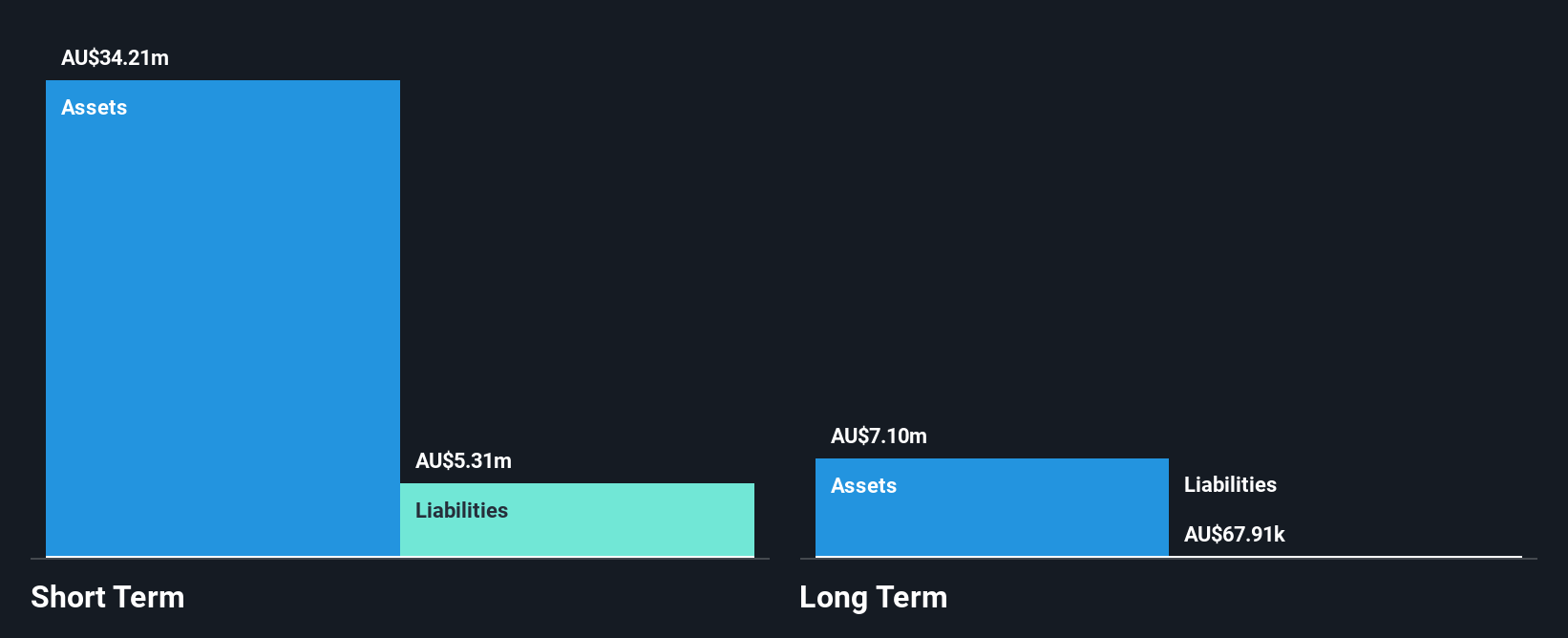

Sovereign Metals, with a market cap of A$375.22 million, is pre-revenue and unprofitable, showing a negative Return on Equity of -73.01%. Despite this, the company maintains financial stability with short-term assets (A$56.4M) surpassing both short-term (A$7.9M) and long-term liabilities (A$43.1K). The company is debt-free and has not diluted shareholders recently. A strategic collaboration with the International Finance Corporation aims to advance its Kasiya Rutile-Graphite Project in Malawi, aligning it with global sustainability standards alongside Rio Tinto's involvement—highlighting potential future growth avenues despite current challenges.

- Unlock comprehensive insights into our analysis of Sovereign Metals stock in this financial health report.

- Examine Sovereign Metals' earnings growth report to understand how analysts expect it to perform.

Next Steps

- Gain an insight into the universe of 416 ASX Penny Stocks by clicking here.

- Seeking Other Investments? Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal