Leonardo DRS (DRS) Valuation Check After Recent Share Price Volatility

Why investors may be paying closer attention to Leonardo DRS now

Leonardo DRS (DRS) has drawn interest after a mixed run in its share price, with a small gain over the past month contrasting with a roughly 22% decline over the past 3 months.

That recent pattern, along with its current value score of 3 and measured revenue and net income growth, is leading some investors to reassess how the stock fits into a diversified defense-focused portfolio.

See our latest analysis for Leonardo DRS.

At a share price of $34.78, Leonardo DRS has seen its short term momentum cool after a 22.23% 3 month share price decline. However, the 3 year total shareholder return of 177.90% points to a very strong longer term outcome, and a 6.41% 1 year total shareholder return suggests investors who held through recent volatility are still ahead overall.

If Leonardo DRS has you looking more broadly at defense names, it could be a good moment to scan aerospace and defense stocks for other companies with similar sector exposure and different risk profiles.

So with a value score of 3, annual revenue and net income growth, and a share price that sits below the average analyst target, you have to ask: is Leonardo DRS undervalued right now, or is the market already pricing in its future growth?

Most Popular Narrative: 26.5% Undervalued

With Leonardo DRS last closing at $34.78 and the most followed narrative pointing to a fair value of $47.30, the gap between price and narrative valuation is clear and sets up a very earnings focused story.

The company's strategic alignment with national priorities, including investments in naval modernization, next-generation air and missile defense (such as the Golden Dome initiative), and counter-UAS capabilities, sets the stage for premium contract awards and program expansions, benefiting both revenue and net margins over the next several years.

Global increases in digitization and modernization of military forces are benefiting DRS's proprietary solutions in network computing, electronic warfare, and electric propulsion, supporting higher average selling prices and expanded platform content, which is expected to enhance net margins and drive operational leverage.

Curious how this view gets to a higher fair value than today’s price? Earnings, margins and a future profit multiple all play a central role in that story.

Result: Fair Value of $47.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh supply constraints in key materials and the company’s reliance on large U.S. government contracts, both of which could pressure margins and revenue.

Find out about the key risks to this Leonardo DRS narrative.

Another way to look at Leonardo DRS

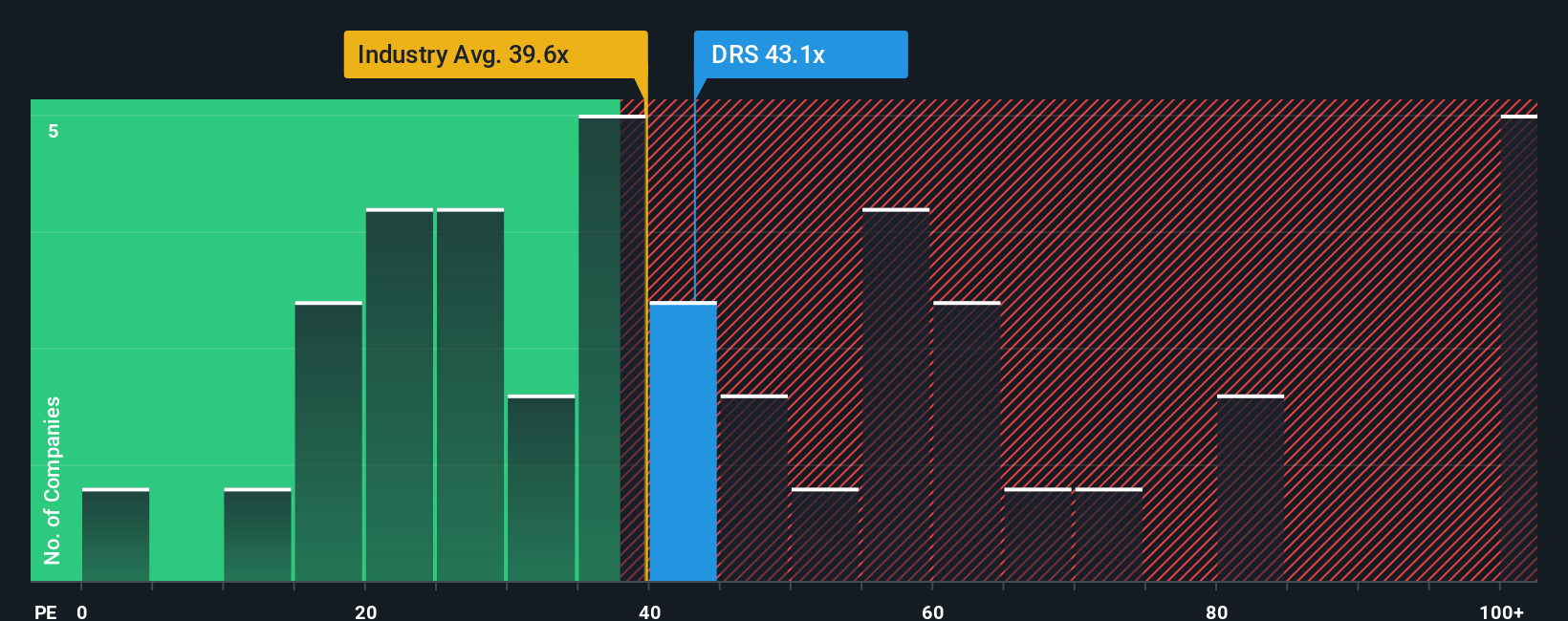

Those narratives point to a 26.5% discount to fair value, but the P/E ratio tells a more cautious story. At 34.9x, DRS trades above our fair ratio of 25.9x, even if it sits below the industry average of 39.3x and peer average of 54.3x. Is that a margin of safety or a valuation risk you are comfortable with?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Leonardo DRS Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a personal view in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Leonardo DRS.

Looking for more investment ideas?

If Leonardo DRS has sharpened your interest in defense and valuation, do not stop here. Broaden your watchlist with focused stock ideas that match your style.

- Target value opportunities by reviewing these 876 undervalued stocks based on cash flows that may offer more attractive pricing relative to their cash flows and fundamentals.

- Ride technology trends by scanning these 25 AI penny stocks that are positioned around artificial intelligence themes.

- Boost your income focus by checking out these 14 dividend stocks with yields > 3% that prioritize regular cash returns to shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal