Granite Construction (GVA) Valuation Check As Revenue Growth And Free Cash Flow Gains Draw Investor Interest

Granite Construction (GVA) is back in focus after investors reacted to its recent revenue growth and improved free cash flow margin, developments that highlight ongoing market share gains and stronger cash generation from its infrastructure business.

See our latest analysis for Granite Construction.

The recent revenue growth and stronger free cash flow story appears to be feeding into sentiment, with Granite Construction’s 1 month share price return of 9.8% and 3 month share price return of 12.0% adding to a 1 year total shareholder return of 32.7% and a 3 year total shareholder return above 200%. This suggests momentum has been building over both shorter and longer horizons.

If you are looking beyond Granite Construction for other infrastructure exposed names, it could be a good moment to scan related sectors such as aerospace and defense stocks for fresh ideas.

So with Granite’s shares already up strongly over 1 and 3 years, revenue at US$4,236.3m and an indicated intrinsic discount of 28.2%, are you looking at an undervalued infrastructure player, or a stock where future growth is fully priced in?

Most Popular Narrative Narrative: 12.4% Undervalued

Granite Construction’s fair value in the most followed narrative sits above the recent US$118.67 close, framing the current price as a potential discount.

Increasing vertical integration in aggregates and materials supply, enhanced by automation and operational best practices, is expected to deliver higher margins and greater earnings stability by improving cost control and reducing exposure to input cost volatility.

Want to see what that margin story looks like on paper? Revenue assumptions, profit ramp, and the future earnings multiple all have to line up. Curious how those moving parts stack together to reach a higher fair value and justify that discount rate?

According to the most popular narrative, the US$135.50 fair value pulls together expectations for faster earnings growth than revenue, a step up in profit margins, and a future P/E that sits below some earlier assumptions yet still supports a premium to today’s price.

Result: Fair Value of $135.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a heavier tilt toward acquisitions and higher debt, along with any slowdown or delays in public infrastructure funding, could quickly test this margin and valuation narrative.

Find out about the key risks to this Granite Construction narrative.

Another View: What Earnings Multiples Are Saying

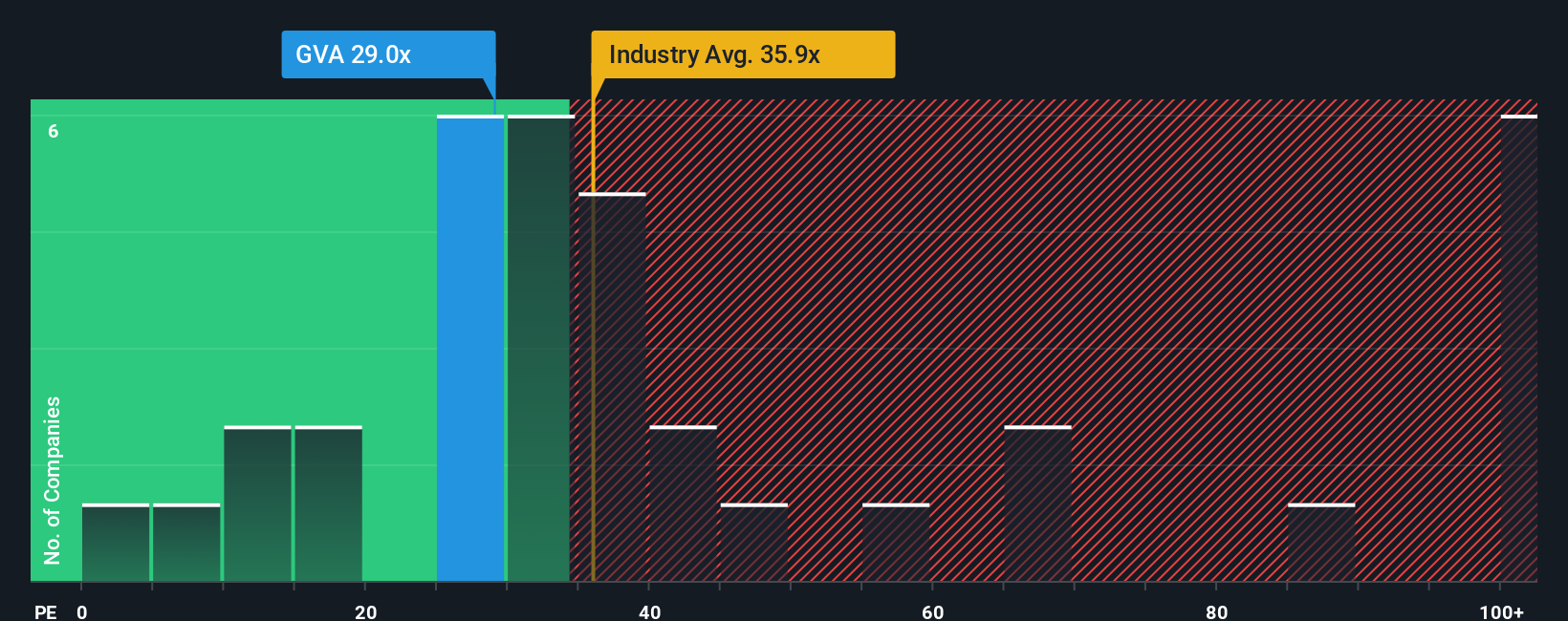

Fair value models point to Granite Construction trading at a 28.2% discount, but the earnings multiple sends a different signal. The P/E sits at 28.4x versus 22x for peers and a fair ratio of 27.3x. This combination hints at less obvious upside and some valuation risk if expectations cool.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Granite Construction Narrative

If you are not on board with this view or simply prefer to weigh the numbers yourself, you can shape a full Granite Construction story in just a few minutes, Do it your way.

A great starting point for your Granite Construction research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Granite Construction has caught your eye, do not stop there, you could be missing other opportunities that fit your style just as well or even better.

- Spot potential value ideas early by scanning these 876 undervalued stocks based on cash flows that may be trading at prices below what their cash flows suggest.

- Target income focused opportunities through these 14 dividend stocks with yields > 3% that offer yields above 3% and support a regular payout profile.

- Lean into structural tech shifts with these 25 AI penny stocks that are tied to artificial intelligence trends across multiple industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal