How Transocean (RIG) Valuation Looks After New Deepwater Mykonos And Enabler Rig Contracts

What the new rig contracts mean for Transocean (RIG)

Transocean (RIG) just announced a new contract for its Deepwater Mykonos rig with bp in Brazil and an extension for Transocean Enabler in Norway, together adding about $168 million in firm backlog.

The Mykonos contract is an estimated 302 day drilling campaign starting in the third quarter of 2026, contributing roughly $120 million in backlog, excluding any extra services, mobilization, or demobilization payments.

For Transocean Enabler, three one well options in Norway were exercised. This adds about 105 days of incremental work and around $48 million of backlog, and keeps the rig committed through September 2027.

See our latest analysis for Transocean.

These new contracts come after a series of recent rig awards that have kept Transocean in focus. The stock’s 22.54% 90 day share price return suggests momentum has picked up, even though the 3 year total shareholder return of a 19.08% decline and 5 year total shareholder return of 53.62% tell a mixed longer term story.

If you are looking beyond offshore drilling for what could be moving next, this is a good moment to scan aerospace and defense stocks as another pocket of potential ideas.

With Transocean trading at $4.24, close to an average analyst target of about $4.16 despite a 60% intrinsic discount flag and mixed multi year returns, is the market leaving upside on the table or already pricing in future growth?

Most Popular Narrative Narrative: 1.8% Overvalued

With Transocean last closing at $4.24 against a narrative fair value of about $4.17, the two are very close, yet the story behind that estimate is far more involved.

Transocean's industry-leading backlog (~$7 billion) with major E&P clients provides strong revenue visibility and cash flow stability, enabling efficient conversion of backlog into revenue and supporting rapid deleveraging, which will positively impact net debt levels and interest expense.

Want to see what sits underneath that backlog headline? The narrative builds in a sharp earnings swing, richer margins, and a premium future earnings multiple. It is worth examining how those moving parts combine into a fair value sitting just below today’s price.

Result: Fair Value of $4.17 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could change quickly if offshore dayrates soften or if Transocean’s heavy debt load makes refinancing more difficult and squeezes future earnings.

Find out about the key risks to this Transocean narrative.

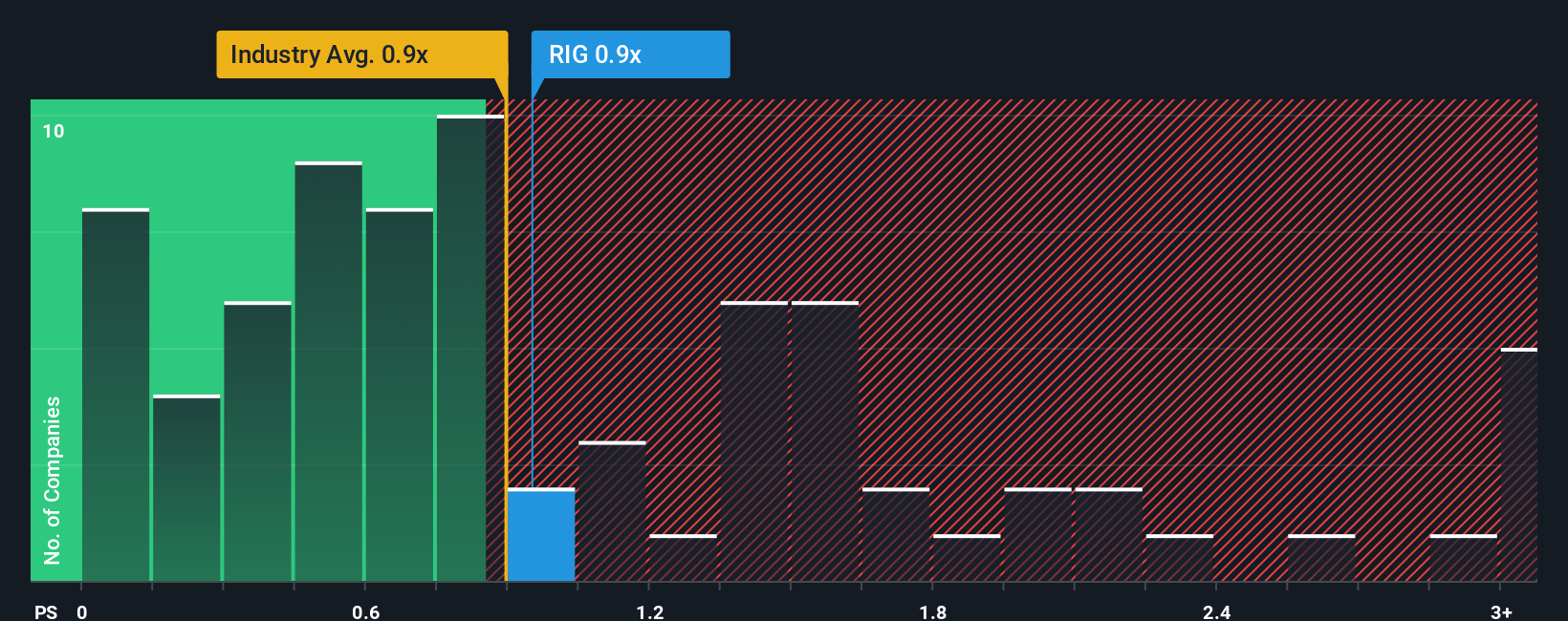

Another View: Market Ratios Tell a Different Story

While the narrative model flags Transocean as about 1.8% overvalued around $4.24, the market ratios tell a more mixed story. The current P/S of 1.2x sits slightly above the US Energy Services average of 1.1x and above an estimated fair ratio of 1x.

That gap suggests the market is paying a bit extra for Transocean compared with the sector and with where the fair ratio indicates it could trade. This raises a simple question for you: is that premium a cushion of confidence or a source of downside risk if expectations cool?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Transocean Narrative

If you look at the numbers and come to a different conclusion, or simply prefer your own process, you can build a custom view in minutes with Do it your way.

A great starting point for your Transocean research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Transocean has your attention, do not stop there; broaden your watchlist now so you are not the one hearing about the next idea after it moves.

- Spot potential value opportunities early by scanning these 876 undervalued stocks based on cash flows that may be pricing in more cautious expectations than their cash flows suggest.

- Tap into growth themes by checking out these 25 AI penny stocks that are tied to real business models rather than just hype.

- Strengthen your income watchlist by reviewing these 14 dividend stocks with yields > 3% that offer yields above 3% and might complement more volatile holdings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal