Under the turbulent geographical situation, emerging market currencies bucked the trend and stabilized, and the safe-haven appeal of the US dollar weakened

The Zhitong Finance App learned that although America's forcible control of Venezuelan President Nicolas Maduro raised market concerns about geopolitical risks, emerging market currencies remained stable on Monday, while the US dollar weakened. The MSCI Emerging Markets Currency Index rebounded after falling for a while in the intraday period and finally settled at a flat level; currencies such as the Colombian peso and the Brazilian real rose, breaking away from the weak trend in the early morning.

Juan Perez, senior head of trading at Monex USA, said: “Emerging market currencies have returned to the upward trend established last year. America's actions in Venezuela this time will not necessarily translate into strong upward momentum for the US dollar. The dollar's appeal as a safe-haven asset is waning.” After the latest data showed the biggest contraction in US manufacturing activity since 2024 last month, the US dollar lost its previous gains due to the situation in Venezuela last weekend, and a weakening trend followed.

America's actions in Venezuela are impacting the financial market through multiple channels. As the tension between US President Trump and Colombian President Gustavo Petro (Gustavo Petro) intensified after Maduro was forcibly controlled, Colombia's dollar debt once fell to the worst performing ranks in emerging markets. The Colombian peso fell 1.9% for a while, then recovered its losses.

Venezuelan bonds rebounded sharply on Monday, bringing benefits to hedge funds and other investors who previously bought these bonds at extremely low prices. The price of the defaulted bonds of the government and its state-owned oil company PDVSA rose to about 40 cents per dollar.

Elsewhere, governments and companies in emerging economies are taking advantage of the beginning of the year to speed up debt issuance in global capital markets. Mexico is issuing bonds maturing 2034, 2038, and 2056. Chile, on the other hand, sells bonds denominated in dollars and euros at the same time. Saudi Arabia has also joined this wave of debt issuance to finance large-scale diversified projects to move its economy away from oil dependency.

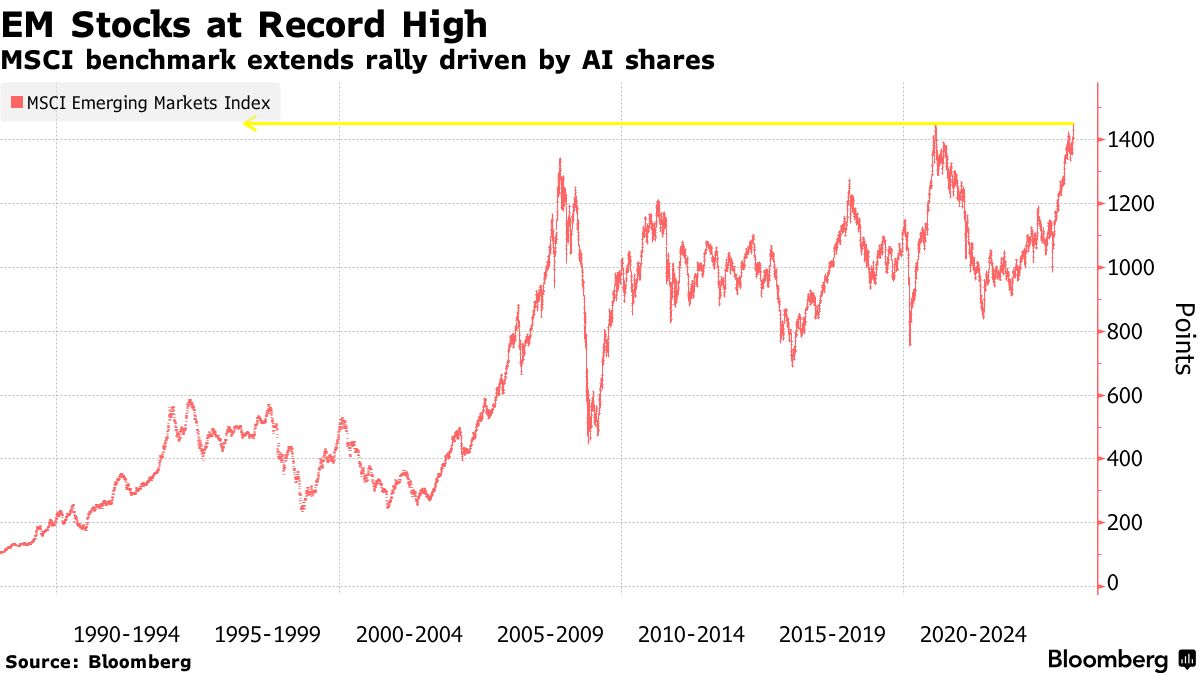

The MSCI Emerging Markets Index rose 1.6% on Monday to close at an all-time high. TSMC contributed nearly half of the index's increase after Goldman Sachs raised the target prices for this Apple and Nvidia supplier. Other individual stocks with the highest gains include Samsung Electronics, SK Hynix, and Alibaba Group Holdings Ltd.

Optimistic expectations about the future of artificial intelligence for Asian companies, as well as market expectations that China will introduce further stimulus policies, have also boosted capital inflows, and asset managers increasingly believe that the allocation of this asset class is insufficient.

Charu Chanana, chief investment strategist at Saxo Bank, said, “Emerging markets may still be supported in the short term, but they are more likely to show a slow upward trend with greater selectivity and greater volatility rather than a linear rise. On the positive side, the momentum of the Asian tech and AI supply chain is expected to continue to drive the index higher, especially as global risk appetite remains steady.”

Traders are currently looking for a new catalyst to drive the next round of gains. The upcoming US economic data and key corporate earnings reports will provide clues to judge the health of the market. Meanwhile, uncertainty about the prospects for interest rate cuts planned by the Federal Reserve, the resurgence of geopolitical tension after the US raids on Venezuela, and upcoming elections in many Latin American countries have all made some investors remain cautious.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal