Assessing McCormick (MKC) Valuation As Shares Show Recent Short-Term Momentum

McCormick (MKC) stock has been moving without a clear headline catalyst, which has some investors revisiting the spice and condiments maker’s fundamentals, recent returns, and how its current valuation stacks up.

See our latest analysis for McCormick.

The recent 1 month share price return of 6.29% and 90 day share price return of 2.53% suggest some momentum has returned, even as the 1 year total shareholder return of 6.87% and 3 year total shareholder return of 14.75% remain weak.

If McCormick’s moves have you rethinking your watchlist, this could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

So, with McCormick’s shares still lagging over 1, 3 and 5 years despite recent gains, and the stock trading below the average analyst price target, is there a genuine buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 12% Undervalued

With McCormick last closing at US$67.28 against a fair value estimate of US$76.17, the most followed narrative sees room between price and fundamentals.

Ongoing global expansion and success in winning new customers in high growth, health oriented categories, particularly in Asia-Pacific and through partnerships with innovative beverage and snack brands, are broadening McCormick's addressable market while diversifying revenue streams, contributing to both top-line growth and future earnings stability.

Curious what earnings profile and profit margins need to line up for that valuation gap to make sense? The narrative leans on steady growth, richer margins, and a premium P/E multiple that assumes investors keep paying up for this earnings stream.

Result: Fair Value of US$76.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that gap can close quickly if higher raw material and tariff costs further squeeze margins or if large customers and quick service restaurant volumes remain weak.

Find out about the key risks to this McCormick narrative.

Another View: Higher P/E Points To Less Of A Bargain

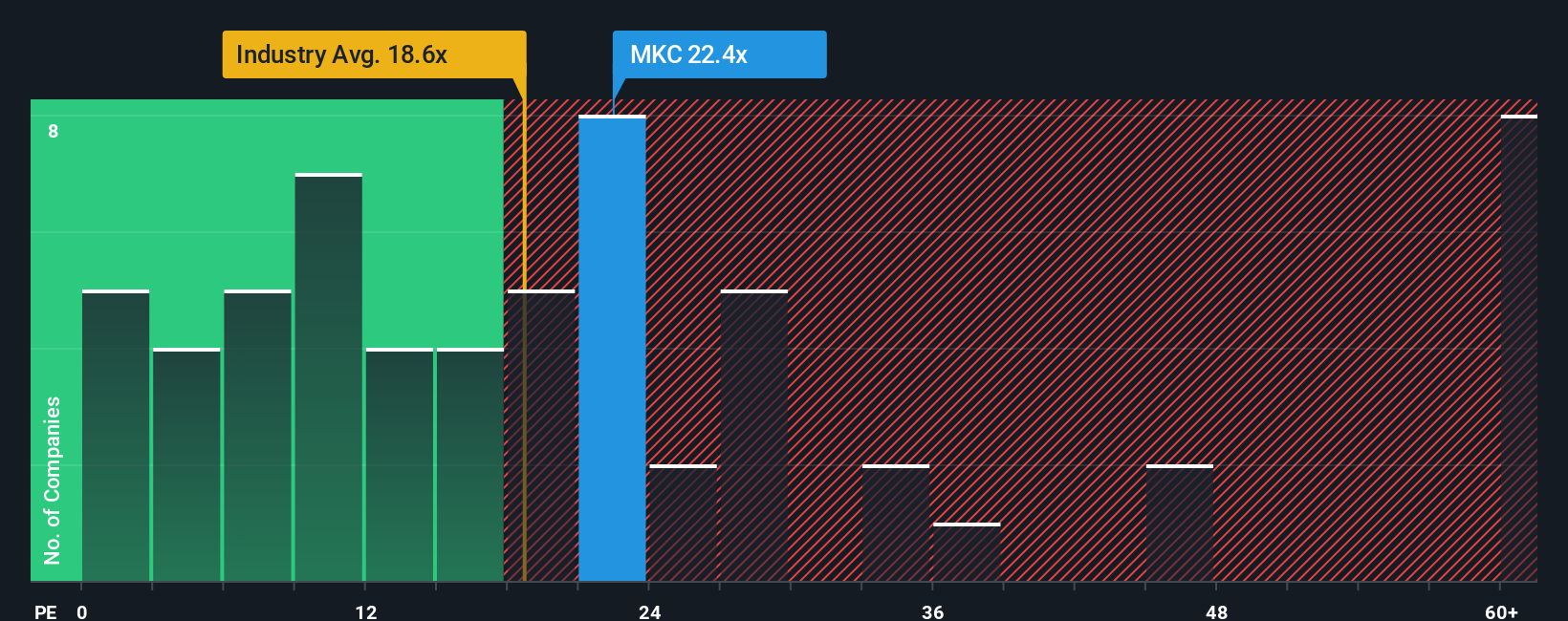

That 12% gap to fair value looks interesting, but the market is not exactly treating McCormick like a cheap stock. At a P/E of 23.2x, it trades above the US Food industry at 19.5x, the peer average at 21.9x, and the fair ratio of 18.1x that our work suggests the market could settle toward.

In practical terms, you are paying a premium price for a business whose earnings growth is expected to be solid rather than high. This raises the question: is the discount to fair value enough to justify taking on that valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own McCormick Narrative

If you see the numbers differently or prefer to weigh the forecasts yourself, you can build a personalised McCormick view in just a few minutes starting with Do it your way.

A great starting point for your McCormick research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If McCormick has you thinking more carefully about where you put your money, do not stop here. Widen your lens and compare it with other clear, data driven ideas.

- Spot potential value by reviewing these 876 undervalued stocks based on cash flows that currently trade below what their cash flows might suggest.

- Back long term income goals by scanning these 14 dividend stocks with yields > 3% offering yields above 3%.

- Get exposure to future facing themes through these 79 cryptocurrency and blockchain stocks tied to digital assets and blockchain use cases.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal