Assessing GXO Logistics (GXO) Valuation After Digit’s 100,000 Task Robotics Milestone

GXO Logistics (GXO) is drawing fresh attention after Agility Robotics’ humanoid robot Digit completed more than 100,000 logistics tasks at the company’s Flowery Branch facility, underscoring GXO’s push into automation within its warehouse operations.

See our latest analysis for GXO Logistics.

The recent automation milestone comes as investor interest in GXO has picked up, with a 1-month share price return of 3.35% and a 1-year total shareholder return of 21.37% from a base of US$54.30. This points to steady but measured momentum.

If this kind of warehouse robotics story has your attention, it could be a good moment to widen your search and check out high growth tech and AI stocks as potential next candidates.

With GXO shares at US$54.30, a value score of 1 and a market price sitting below analyst and intrinsic estimates, investors may question whether there is still upside potential or if future growth is already fully reflected in the current price.

Most Popular Narrative: 15.1% Undervalued

With GXO last closing at US$54.30 versus a narrative fair value of US$63.94, the current price sits below the valuation that analysts are working with.

• Enhanced deployment of automation, AI, and proprietary software (with recent launches like GXO IQ) is rapidly improving warehouse productivity, reducing labor costs, and increasing operational efficiency. This is beginning to drive margin expansion and should positively impact net earnings and EBITDA margins.

Want to see why this valuation leans on more than just robots in one warehouse? Earnings, margins, and future contract economics all sit at the core of this story. Curious which assumptions really move the fair value needle here, and how they tie back to long term profitability expectations? The full narrative lays out those building blocks in plain numbers.

Result: Fair Value of $63.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on smooth Wincanton integration and management transition, as well as GXO actually realizing the expected benefits from heavy automation and software investment.

Find out about the key risks to this GXO Logistics narrative.

Another View: Rich Valuation On Earnings

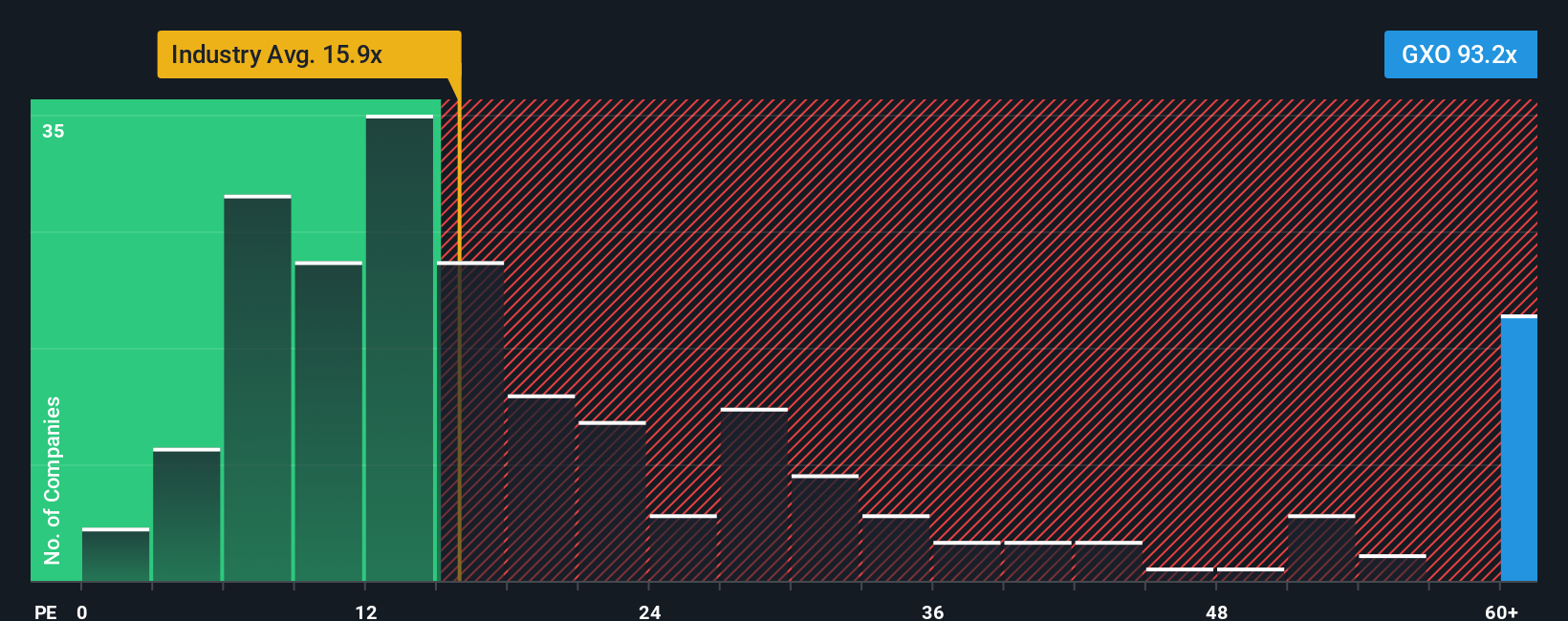

That 15.1% discount to fair value tells one story, but the earnings multiple tells another. At a P/E of 69.9x versus 23.7x for peers and 15.9x for the global logistics industry, GXO trades at a hefty premium to both its sector and the fair ratio of 42.1x.

In plain terms, the market is already pricing in a lot of future execution, which raises the risk that even small disappointments in earnings or margins could hit the share price harder than you might expect. The question is whether you are comfortable paying this kind of premium for the growth narrative in front of you.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GXO Logistics Narrative

If you see the numbers differently or prefer to weigh the assumptions yourself, you can build a custom view in just a few minutes with Do it your way.

A great starting point for your GXO Logistics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If GXO has sharpened your curiosity, do not stop here. Use the Simply Wall St Screener to spot more stocks that fit the way you like to invest.

- Zero in on potential hidden value by checking companies that appear mispriced on cash flow metrics through these 876 undervalued stocks based on cash flows before the rest of the market pays attention.

- Explore opportunities in automation and software by scanning these 25 AI penny stocks for businesses tied to real-world adoption of AI in logistics, healthcare, and other sectors.

- Tap into income ideas by reviewing these 14 dividend stocks with yields > 3% that may offer higher yields, supported by fundamental data you can scrutinize in minutes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal