A Look At Kennedy-Wilson (KW) Valuation After Recent Gains And Conflicting Fair Value Estimates

Why Kennedy-Wilson Holdings is on investors’ radar today

Kennedy-Wilson Holdings (KW) has drawn attention after a mixed picture in its latest reported fundamentals, with annual revenue of $550.5 million alongside a net loss of $35.3 million. This has prompted closer scrutiny of its real estate focused model.

See our latest analysis for Kennedy-Wilson Holdings.

At a share price of $9.64, Kennedy-Wilson’s 90-day share price return of 22.96% contrasts with a 5-year total shareholder return decline of 28.72%, suggesting recent momentum is building after a tougher longer-term stretch.

If this mix of recovering sentiment and past volatility has you thinking about diversification, it could be a good moment to look at fast growing stocks with high insider ownership.

With a value score of 2, a recent 90 day gain of 22.96% and shares sitting just below a US$10 price target, is Kennedy Wilson still mispriced or is the market already banking on future growth?

Most Popular Narrative Narrative: 12.4% Undervalued

With Kennedy-Wilson last closing at US$9.64 versus a narrative fair value of US$11, the widely followed thesis points to upside that hinges on how its rental and fee based model plays out over time.

The company is rapidly expanding its rental housing portfolio in both the US and Europe, moving from 65% to a projected 80% of assets under management, positioning Kennedy-Wilson to benefit from persistent housing shortages and growing rental demand, which should drive future revenue growth and higher occupancy.

Curious what kind of revenue surge, margin shift and future earnings multiple are being pencilled in to back that fair value? The narrative leans on aggressive top line growth, a step change in profitability and a valuation multiple usually reserved for faster growing sectors. Want to see exactly how those moving parts stack up against today’s price?

Result: Fair Value of $11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on rental housing demand holding up and on Kennedy-Wilson not becoming too dependent on selling assets to keep debt and funding in check.

Find out about the key risks to this Kennedy-Wilson Holdings narrative.

Another take on valuation

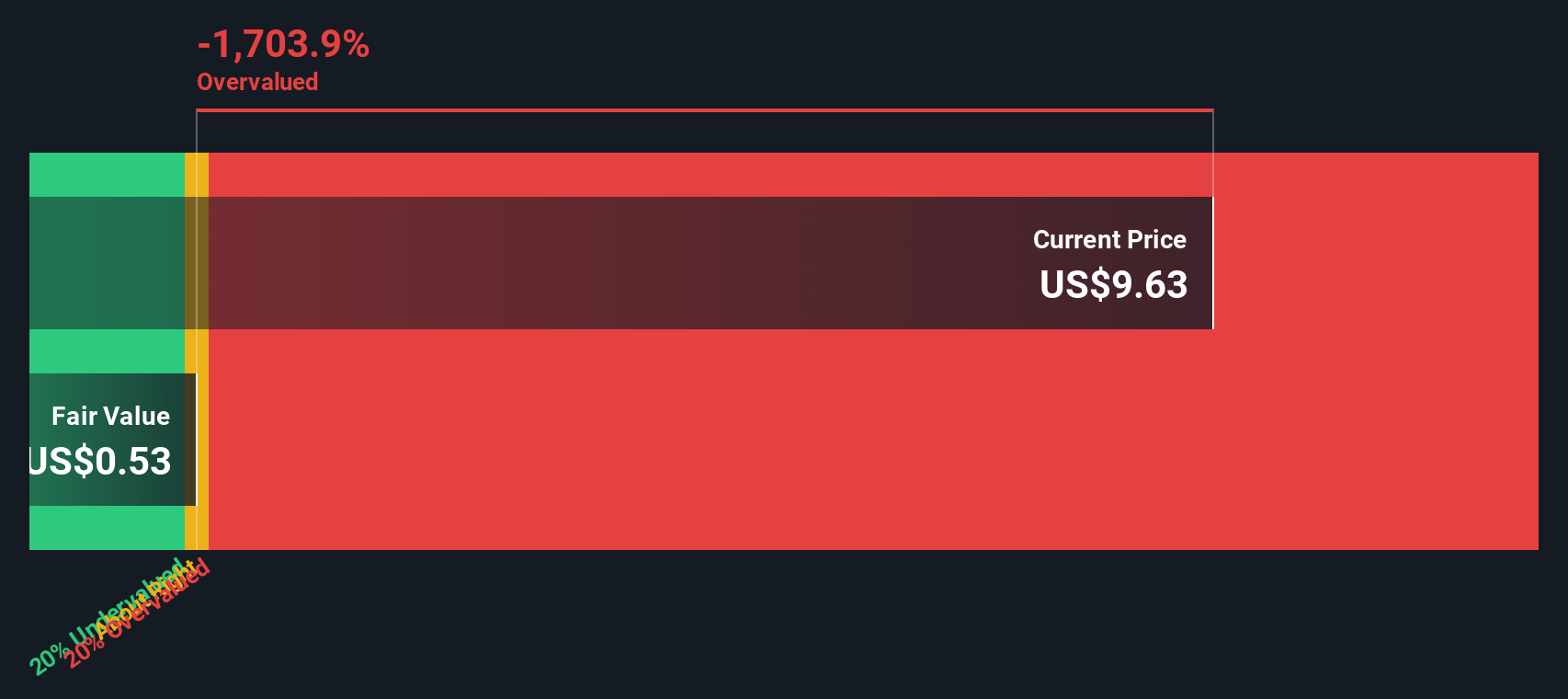

Our SWS DCF model paints a very different picture, with an estimated fair value of just US$0.53 per share versus the current US$9.64. That gap points to meaningful downside risk. It raises a simple question for you: are the narrative assumptions too optimistic, or is the model too harsh?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kennedy-Wilson Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kennedy-Wilson Holdings Narrative

If you look at the numbers and come to a different conclusion, or simply prefer to test your own assumptions, you can build a custom view in just a few minutes with Do it your way.

A great starting point for your Kennedy-Wilson Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Kennedy-Wilson has caught your attention, do not stop there. Use the Simply Wall St Screener to spot other opportunities that fit the way you like to invest.

- Target potential value opportunities by checking out these 876 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Tap into the growth story around artificial intelligence with these 25 AI penny stocks that are tied to AI trends shaping many sectors.

- Strengthen your income focus by reviewing these 14 dividend stocks with yields > 3% that offer yields above 3% for investors who care about regular cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal