A Look At Sempra (SRE) Valuation As A Potential Regulatory Charge Weighs On Future Earnings

Sempra (SRE) disclosed that subsidiary San Diego Gas & Electric is seeking regulatory remedies after a Track 2 recommended decision that is expected to trigger a projected US$471 million after-tax charge to fourth quarter 2025 earnings.

See our latest analysis for Sempra.

At a share price of US$89.71, Sempra has seen a 1 day share price return of 1.61%, while its 1 year total shareholder return of 9.63% suggests momentum has been gradually building despite a 4.57% 90 day share price pullback.

If this regulatory update has you rethinking your utilities exposure, it could be a good moment to broaden your view with fast growing stocks with high insider ownership

With Sempra trading at US$89.71 and sitting at an intrinsic premium alongside a discount to analyst targets, the key question is simple: are you looking at an underappreciated utilities compounder or a business the market already fully values for future growth?

Most Popular Narrative: 10.4% Undervalued

With Sempra closing at US$89.71 against a narrative fair value of about US$100.13, the current setup centers on whether earnings power justifies that gap.

The rollout and completion of major LNG export projects (ECA Phase 1 nearing completion, Port Arthur Phase 1 advancing, and strong commercial momentum for Phase 2) positions Sempra to benefit from sustained global demand for U.S. LNG as a transition fuel, significantly increasing future cash flows and long-term revenue generation.

Curious what earnings profile backs this valuation gap? The narrative focuses on rising margins, faster revenue, and a future profit multiple that is not stretched by sector standards.

Result: Fair Value of $100.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that underpriced story can crack if Texas or California regulators tighten allowed returns, or if LNG markets soften and leave big export projects earning less than hoped.

Find out about the key risks to this Sempra narrative.

Another View on Valuation

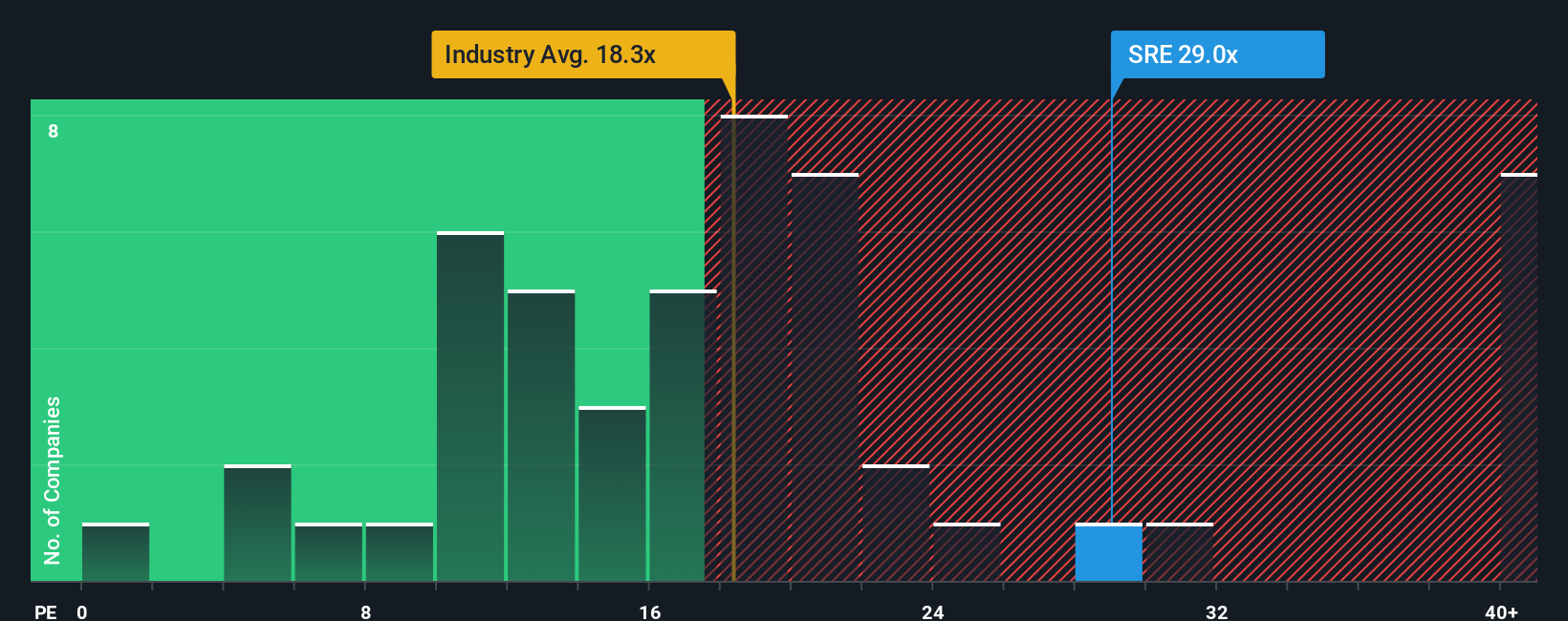

That 10.4% narrative discount paints Sempra as undervalued, but the market is asking a higher price on earnings today. The current P/E of 27.8x sits above both global Integrated Utilities at 18.2x and peers at 19.2x, even though the fair ratio is 29x.

This gap suggests investors are already paying a premium with only a small cushion to that 29x fair ratio. The key question is whether you view that as valuation risk or a price you are comfortable with for Sempra's growth profile.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sempra Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to work from your own assumptions, you can build a personalised view in just a few minutes with Do it your way

A great starting point for your Sempra research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Sempra has sharpened your thinking, do not stop here. Broaden your watchlist with focused ideas that could fit different roles in your portfolio.

- Spot potential value opportunities by scanning these 875 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Zero in on income potential with these 14 dividend stocks with yields > 3% offering yields above 3% for investors who prioritise regular payouts.

- Lean into long term themes by reviewing these 79 cryptocurrency and blockchain stocks tied to digital assets and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal