Freshpet (FRPT) Valuation Check After Recent Share Pullback And Mixed Return Track Record

Freshpet snapshot after recent share performance

Freshpet (FRPT) has drawn investor attention after a recent pullback, with the stock showing a 1 day return of a 1.28% decline and a 4.58% decline over the past week.

Over the past month, Freshpet has recorded a 3.06% decline, while the past 3 months show a 13.77% gain. This has prompted some investors to reassess how the current price of US$60.15 lines up with the business fundamentals.

See our latest analysis for Freshpet.

Looking beyond the recent pullback, Freshpet’s 1 year total shareholder return of 58.72% decline contrasts with a 14.29% gain over 3 years. This suggests short term momentum has faded while longer term holders have still seen positive returns overall.

If Freshpet’s recent swings have you reassessing your watchlist, this could be a good moment to broaden your search and check out healthcare stocks as a different corner of the market.

So with Freshpet trading at US$60.15 after a 1 year total shareholder return decline of 58.72% and an indicated 18% discount to analyst price targets, is this a reset that opens a buying opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 14.9% Undervalued

Against Freshpet’s last close of US$60.15, the most followed narrative points to a fair value of about US$70.67, implying a valuation gap that hinges on future earnings quality and cash generation.

Operational improvements and implementation of new production technologies at Ennis and other facilities have driven higher yields, quality, and throughput, leading to a significant reduction in CapEx ($100 million less over 2025-26) and enhanced gross/EBITDA margins, setting the business up for improving net earnings and cash generation.

Want to understand why a pet food manufacturer commands a premium valuation? This narrative leans heavily on future margin expansion, revenue compounding and a richer earnings multiple. Curious which profit assumptions and discount rate sit behind that fair value number? The full story joins those pieces together.

Result: Fair Value of $70.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case can crack if pet owners remain reluctant to trade up to premium food or if bigger rivals squeeze Freshpet’s pricing power and margins.

Find out about the key risks to this Freshpet narrative.

Another View: Richer Valuation On Earnings

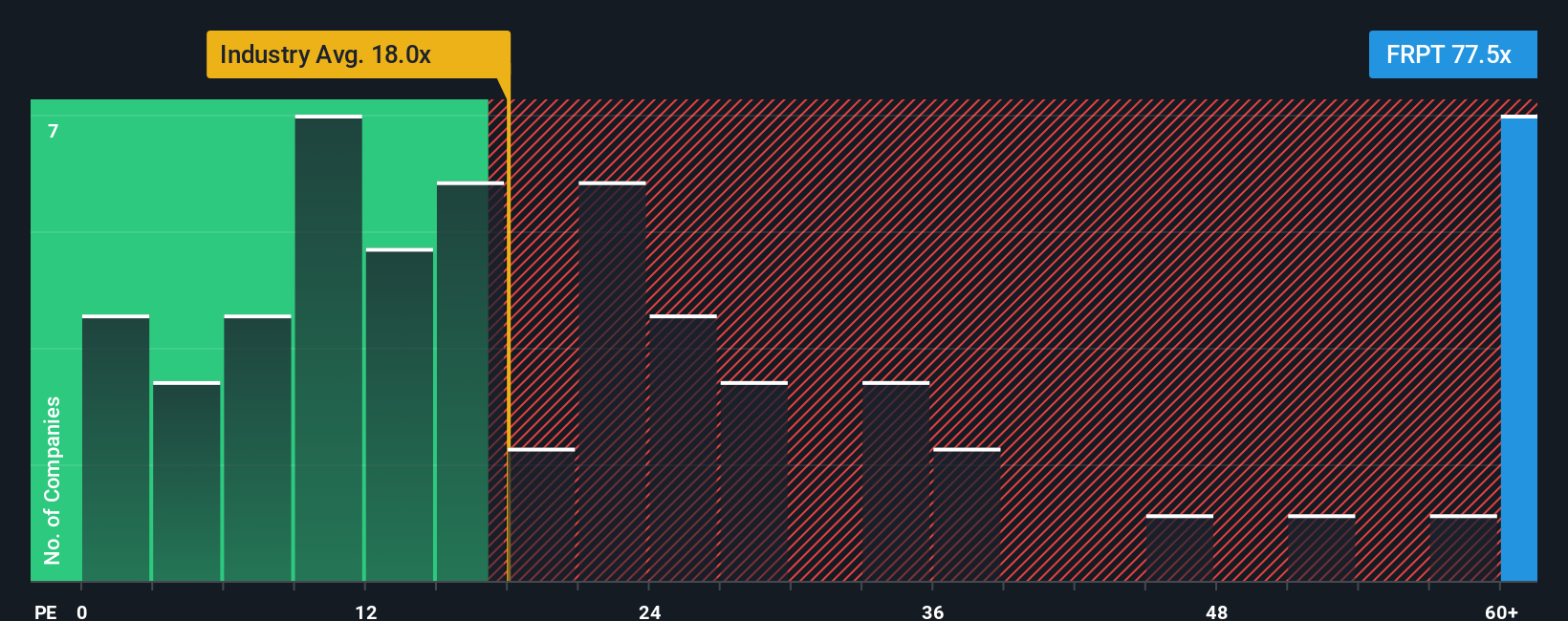

That 14.9% undervalued fair value of about US$70.67 sits awkwardly next to Freshpet’s P/E of 23.8x, which is higher than the US Food industry at 19.5x, peers at 16.1x, and our fair ratio of 15.8x. If the market leans toward that fair ratio, today’s price could imply more valuation risk than upside. Which story do you think holds up better?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Freshpet Narrative

If you see the numbers differently or simply prefer to test your own assumptions, you can build a custom Freshpet view in just a few minutes, starting with Do it your way.

A great starting point for your Freshpet research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Freshpet has you thinking more broadly about where to put your next dollar, it is worth lining up a few fresh ideas before the market shifts again.

- Jump on growth stories early by checking out these 3564 penny stocks with strong financials that pair smaller market values with stronger fundamentals.

- Harness the potential of machine learning and automation through these 25 AI penny stocks that are tied to real business models, not just hype.

- Zero in on value focused opportunities by screening for these 875 undervalued stocks based on cash flows where prices may sit below their estimated cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal