A Look At Casella Waste Systems (CWST) Valuation After CEO Succession To Edmond “Ned” Coletta

Casella Waste Systems (CWST) shareholders are watching a rare leadership transition, as Edmond R. “Ned” Coletta steps in as Chief Executive Officer and joins the Board, becoming only the company’s second CEO.

See our latest analysis for Casella Waste Systems.

At a share price of $98.65, Casella Waste Systems has seen a 7.34% 90 day share price return, while the 1 year total shareholder return of a 6.85% decline contrasts with a 24.37% gain over three years. This suggests longer term momentum has been stronger than the recent pullback as investors weigh the CEO transition.

If this leadership change has you thinking about where else capital might work hard, it could be a good moment to check out fast growing stocks with high insider ownership.

With Casella Waste Systems trading at $98.65 after a mixed run of recent and longer term returns, the key question is whether the current price already reflects its prospects or if there is still a buying opportunity the market has not fully priced in.

Most Popular Narrative Narrative: 12.5% Undervalued

The most followed narrative sees fair value for Casella Waste Systems at about $112.70 per share versus the last close of $98.65. This frames the current price as a discount that leans heavily on execution improving over time.

Infrastructure investments such as automation in fleet (with 55 new and mostly automated trucks coming in late 2025), upgraded ERP systems, and route optimization are expected to unlock significant operational efficiencies, capturing previously delayed cost synergies in the Mid-Atlantic region, which should materially boost net margins and EBITDA starting in 2026.

Curious how a low current margin, rapid earnings ramp, and a very high future P/E assumption can still add up to that fair value? The narrative leans on compounding revenue, margin expansion, and a rich earnings multiple all at once. The exact mix of these moving parts sits behind the headline number.

Result: Fair Value of $112.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that fair value story could unravel if acquisition integration drags on, or if higher labor and capital costs keep squeezing already thin net margins.

Find out about the key risks to this Casella Waste Systems narrative.

Another Angle on Valuation: Pricing vs Peers

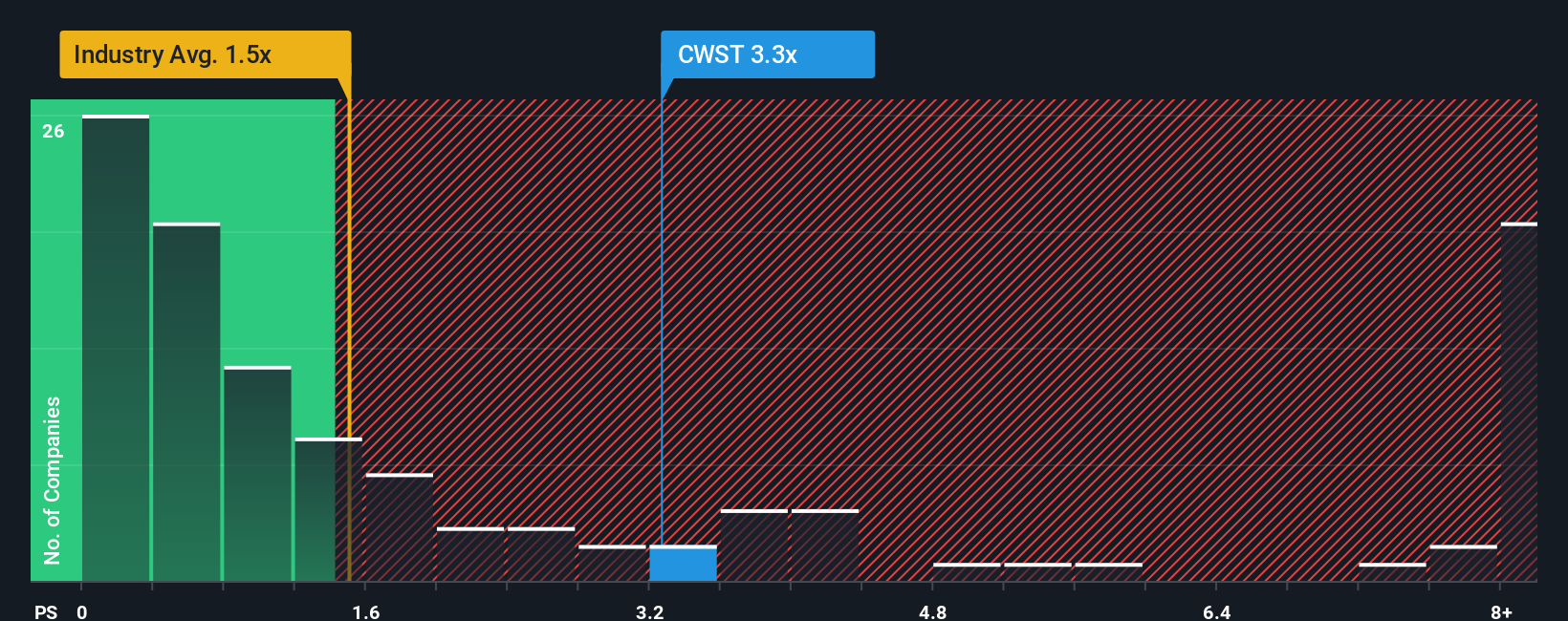

The fair value story around $112.70 leans on future earnings and margins, but the current P/S of 3.5x paints a tougher picture. That multiple sits above the US Commercial Services average at 1.2x, peers at 3x, and a fair ratio of 1.7x, which implies meaningful valuation risk if sentiment cools. With the shares already pricing in a richer sales multiple than both peers and the fair ratio, the question is whether you are comfortable paying a premium for that narrative.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Casella Waste Systems Narrative

If you see this story differently, or just like to test assumptions against the raw numbers, you can build your own view in minutes with Do it your way.

A great starting point for your Casella Waste Systems research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Casella Waste Systems has sharpened your focus, do not stop here. A few minutes with the right screeners could surface ideas that better fit your goals.

- Spot potential bargains by scanning these 875 undervalued stocks based on cash flows that currently trade at prices that do not seem to fully reflect their cash flow profiles.

- Zero in on income opportunities with these 14 dividend stocks with yields > 3% that offer yields above 3% for investors who care about regular cash returns.

- Tap into future facing themes through these 29 healthcare AI stocks that sit at the intersection of medicine, data, and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal