Wind: In 2025, the total financing of the Hong Kong stock equity financing market reached HK$612.2 billion, with a growth rate of 250.91%

The Zhitong Finance App learned that on January 6, Wind released the 2025 Hong Kong Stock Underwriting Ranking. The deep restoration of liquidity in the secondary market and the significant recovery in risk appetite have provided an ideal “issuance window” for the primary equity financing market, and Hong Kong stock equity financing has shown an explosive growth trend. According to statistics, in 2025, the total amount raised in the Hong Kong equity financing market reached HK$612.2 billion, which is a marked double of HK$174.5 billion in the same period last year. The growth rate reached 250.91%, achieving a shift in scale. This surge is due to the return of large Chinese securities companies and the normalization of special technology companies (18C). It not only reshaped Hong Kong's position as a global IPO capital raising center, but also completed the core transformation from a “valuation depression” to an “asset pricing hub” in the context of increased pricing power for capital going south.

In 2025, the strong recovery of the Hong Kong stock secondary market provided an excellent “launch window” for primary equity financing. The Hang Seng Composite Index rose 30.98% throughout the year. It is worth noting that the market style showed obvious “two-wheel drive” characteristics: on the one hand, the Hang Seng Financial Index led by a leapfrog of 39.26%, reflecting the role of weighted sectors under improved macro-liquidity; on the other hand, the Hang Seng Technology Index and the Sustainable Development Enterprise Index rose 23.45% and 31.36% respectively, showing that capital highly appreciates the long-term value of new productivity and ESG. At the same time, the outstanding performance of the Hang Seng Hong Kong Stock Connect Small and Medium Cap Index (+30.93%) has also activated financing channels for small and medium market capitalization companies. The market has not only doubled in terms of “volume”, but also achieved multi-level “structural” development.

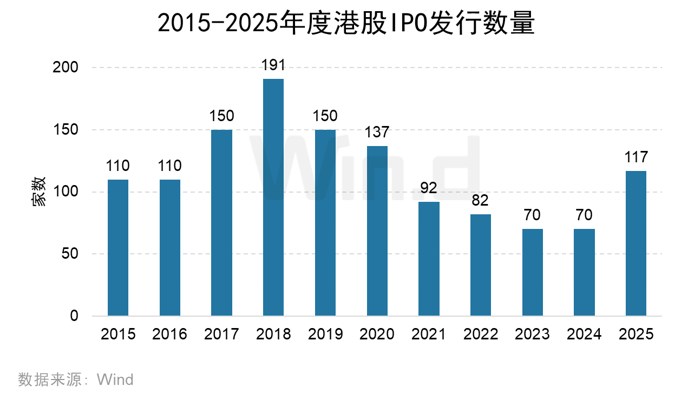

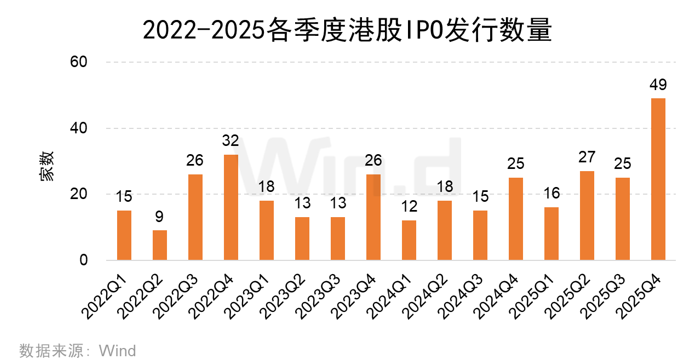

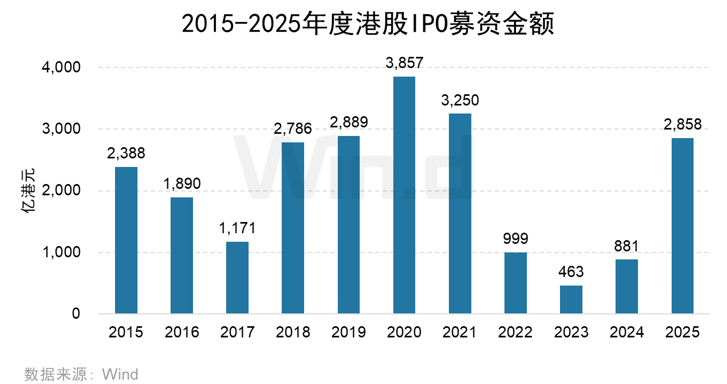

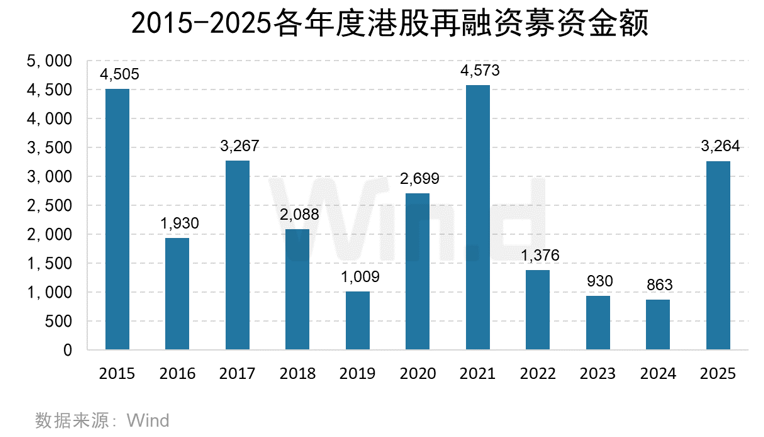

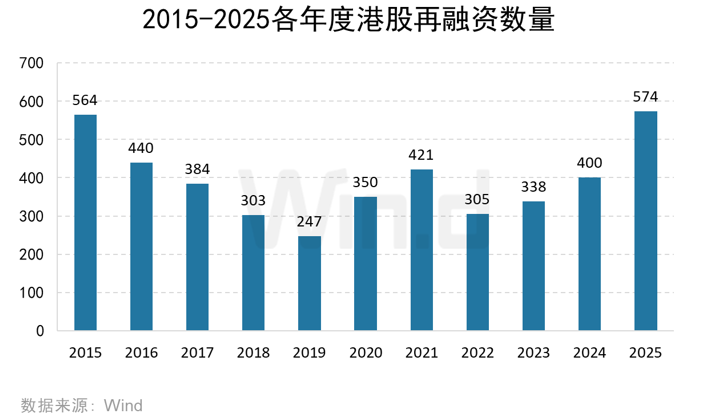

From the perspective of project types, in the IPO market, 117 companies were listed on the main board in 2025, an increase of 67.14% over 70 companies in the same period last year; in 2025, the total amount raised by Hong Kong stock IPOs was HK$285.8 billion, a sharp increase of 224.24% from HK$88.1 billion last year. At the same time, the refinancing market is also showing high popularity. In 2025, the total amount raised by Hong Kong stock refinancing was HK$326.4 billion, a sharp increase of 278.15% over HK$86.3 billion last year. The number of refinancing projects was 574, an increase of 43.50% compared to 400 last year.

Looking at the IPO underwriting sponsorship dimension, CICC topped the list with a sponsorship scale of HK$51,652 billion, with 42 underwriters; CITIC Securities (Hong Kong) ranked second with a sponsor size of HK$46.029 billion, with 33 underwriters; and Morgan Stanley ranked third with a sponsorship scale of HK$25.827 billion, with 12 underwriters. In terms of refinancing and underwriting, Goldman Sachs ranked first with a refinancing underwriting scale of HK$32.244 billion, with 8 underwriting cases; CICC ranked second with an underwriting scale of HK$24.967 billion, with 13 underwriting cases; and Morgan Stanley ranked third with an underwriting scale of HK$23.175 billion, with 15 underwriting cases.

Overview of the Hong Kong Stock Equity Financing Market

1.1 Trends in the size of equity financing

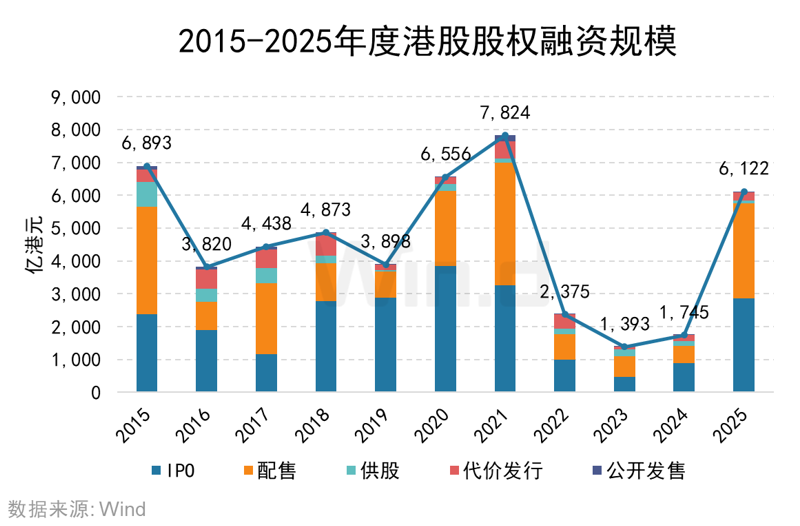

The total amount of equity financing in the primary market of Hong Kong stocks in 2025 reached HK$612.2 billion, which is a marked double of HK$174.5 billion in the same period last year, with an increase of 250.91%. Among them, the IPO financing scale was HK$285.8 billion, up 224.24% from last year; the scale of placement financing increased particularly significantly, raising a total of HK$289.6 billion, an increase of 438.66% over last year; the scale of trade-off financing was HK$26.9 billion, up 41.33% from last year; and the total public offering scale was HK$2.3 billion, a significant increase compared with less than HK$200 million last year. The share offering volume decreased compared to last year. The total amount of share financing in 2025 was HK$7.6 billion, down 43.33% from last year.

1.2 Distribution of financing methods

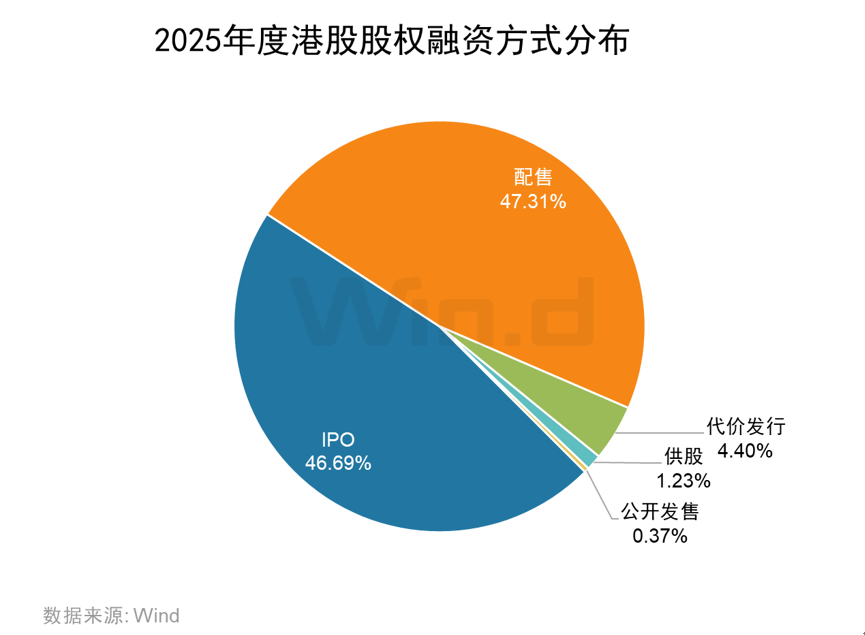

In terms of specific financing methods, the amount of capital raised in the 2025 IPO was HK$285.812 billion, accounting for 46.69% of the total capital raised; the amount raised by placement was HK$289.619 billion, accounting for 47.31%; the amount raised from the trade-off was HK$26.919 billion, accounting for 4.40%; and the amount of capital raised from the stock offering and public offering was HK$7.552 billion and HK$2,277 billion respectively, accounting for 1.23% and 0.37% respectively.

1.3 Distribution of financing entities by industry

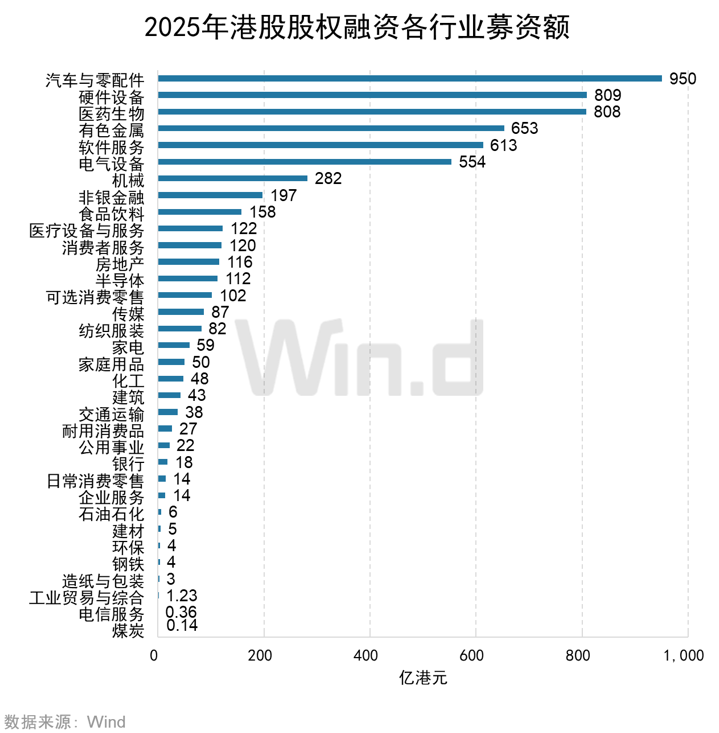

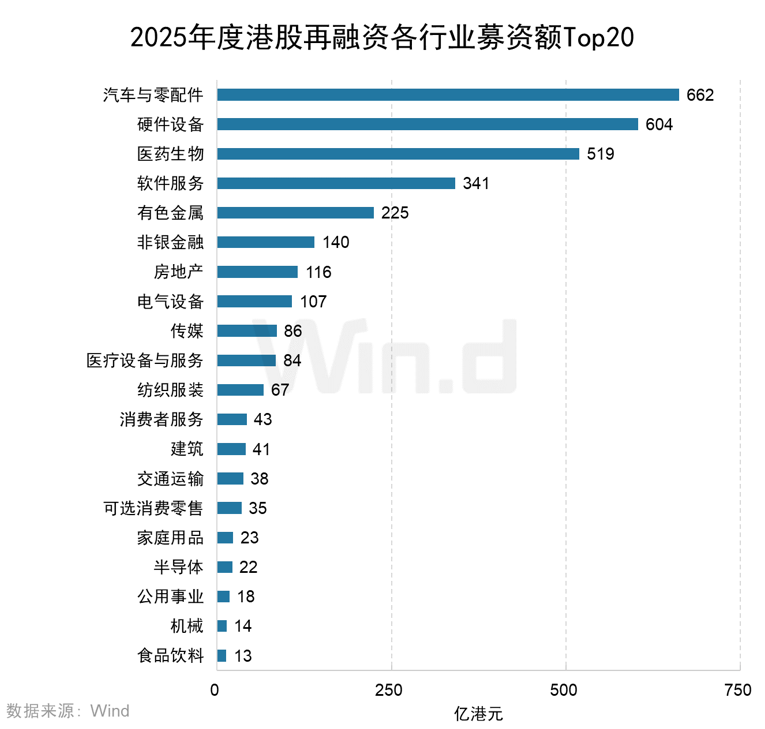

Looking at the amount of financing from various industries, automobiles and spare parts, hardware equipment, and pharmaceutics were the top three industries, raising capital amounts of HK$95 billion, HK$80.9 billion, and HK$80.8 billion respectively.

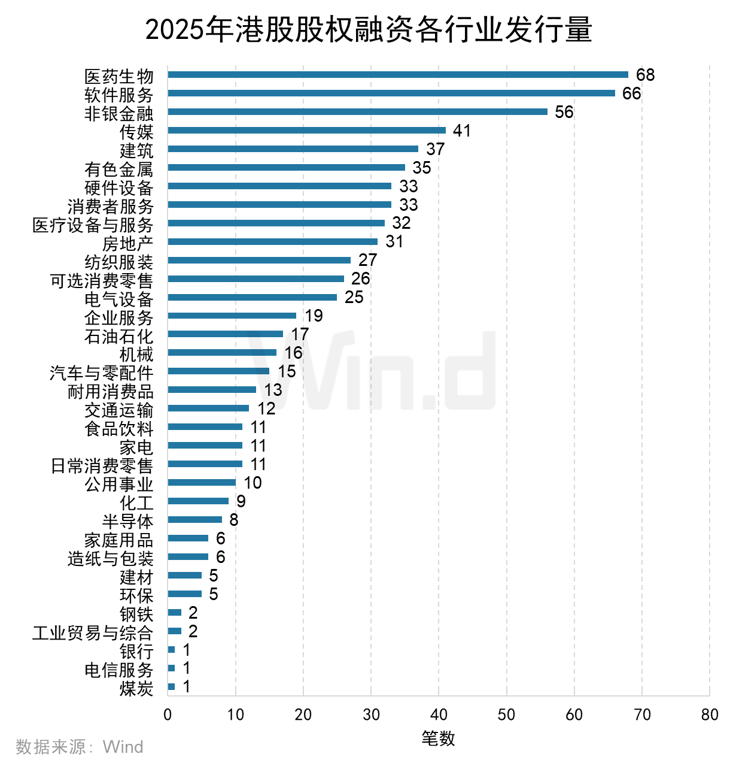

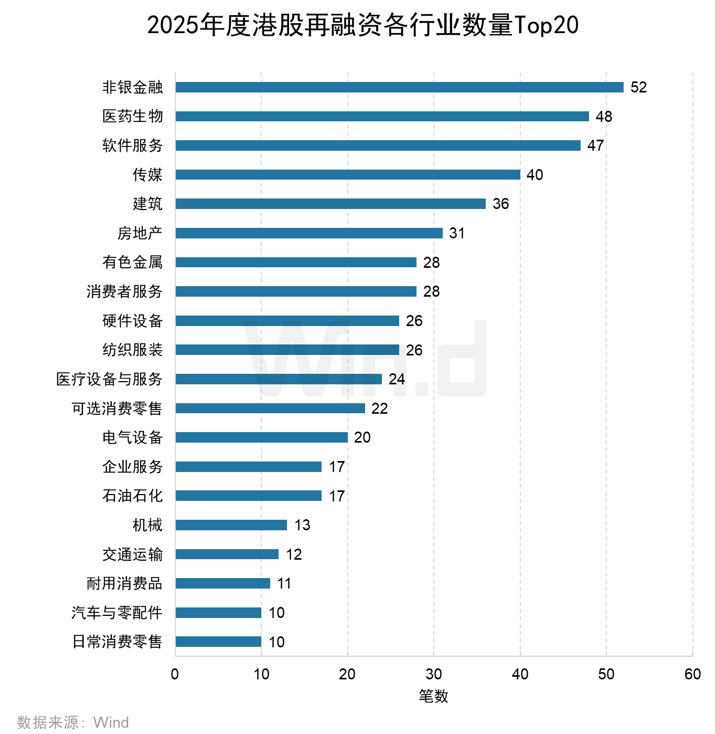

Judging from the number of financing incidents in various industries, the pharmaceutical biology industry ranked first with 68 orders distributed, the software service industry ranked second with 66 orders issued, and the non-banking financial industry ranked third with 56 units.

starters

2.1 Trends in the number of IPOs issued

In 2025, the number of Hong Kong stock IPOs issued was 117, an increase of 67.14% over 70 in the same period last year.

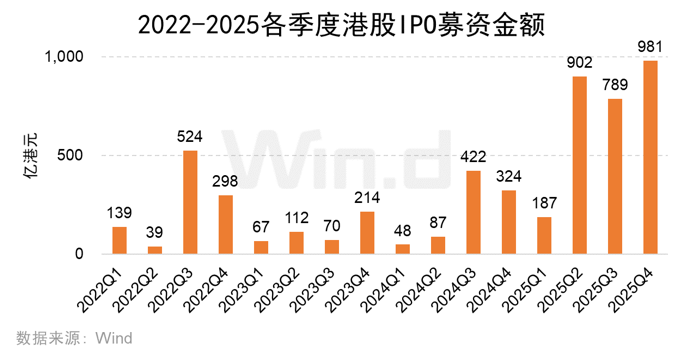

2.2 Trends in the size of IPO financing

In 2025, the total amount raised in Hong Kong stock IPOs was HK$285.8 billion, a sharp increase of 224.24% from HK$88.1 billion last year.

2.3 Distribution of IPO listing sectors

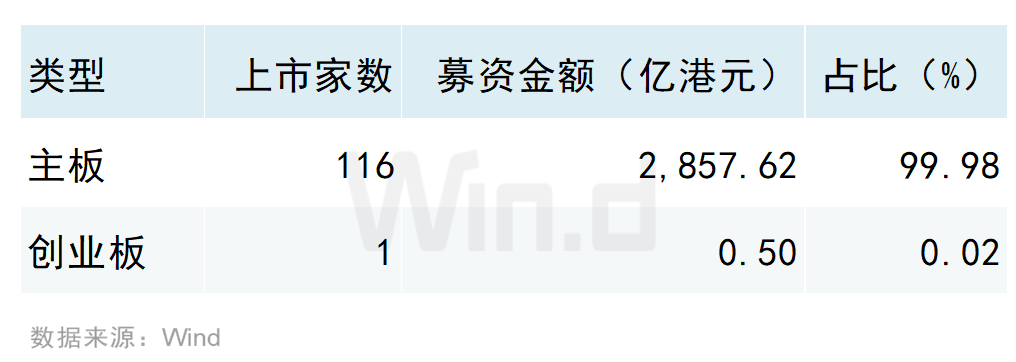

Looking at the IPO listing sector, in 2025, a total of 116 companies were successfully listed on the Hong Kong Main Board, and 1 company was on the GEM.

2.4 Distribution of major IPOs by industry

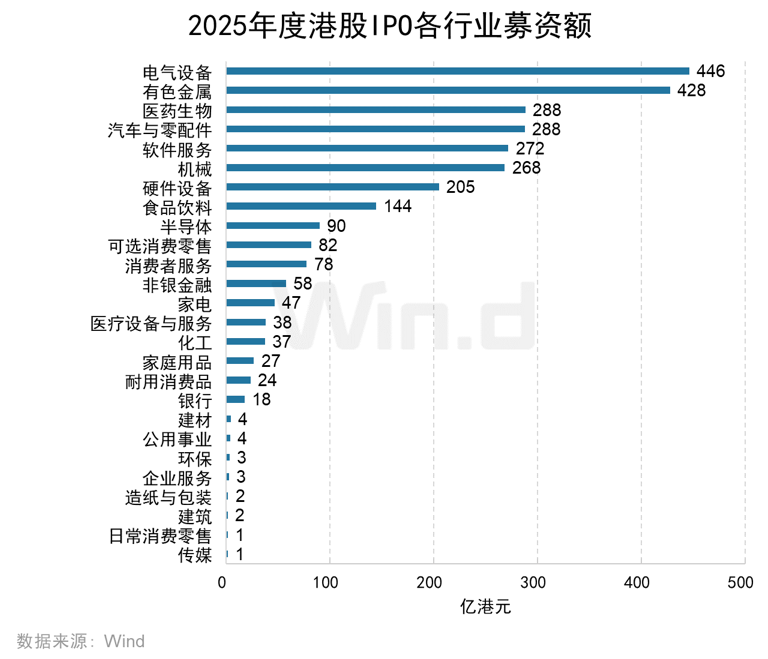

Looking at the amount of IPOs raised in various industries, the industry with the highest amount of capital raised by Hong Kong stock IPOs in 2025 was electrical equipment, with a total capital raised of HK$44.6 billion; followed by the non-ferrous metals industry, which raised HK$42.8 billion; the pharmaceutical, biological, and automotive and spare parts industries were basically the same, ranking third, with a capital raised of HK$28.8 billion.

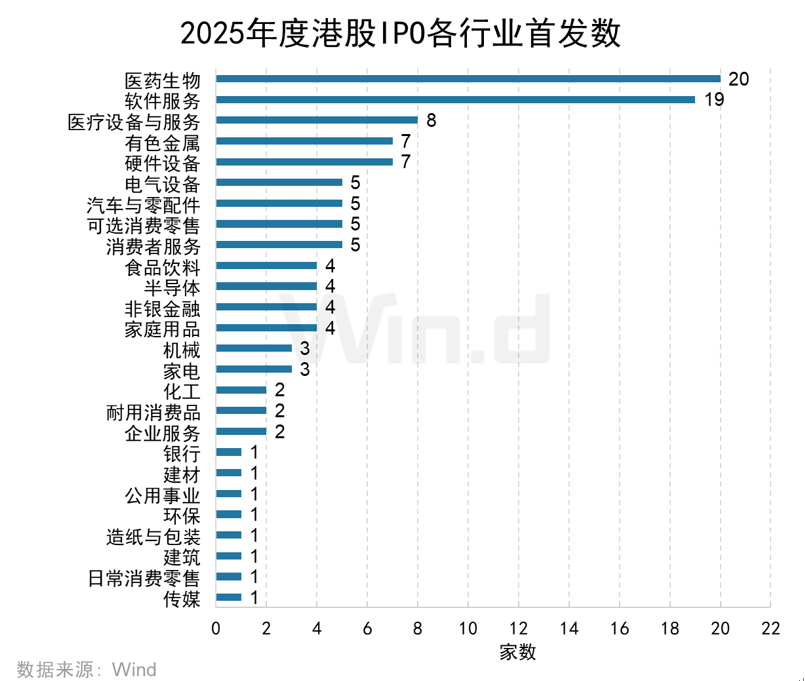

Judging from the number of IPOs issued in various industries, the pharmaceutical biology industry had 20 IPOs, ranking first; followed by the software service industry, which ranked second with 19 IPOs.

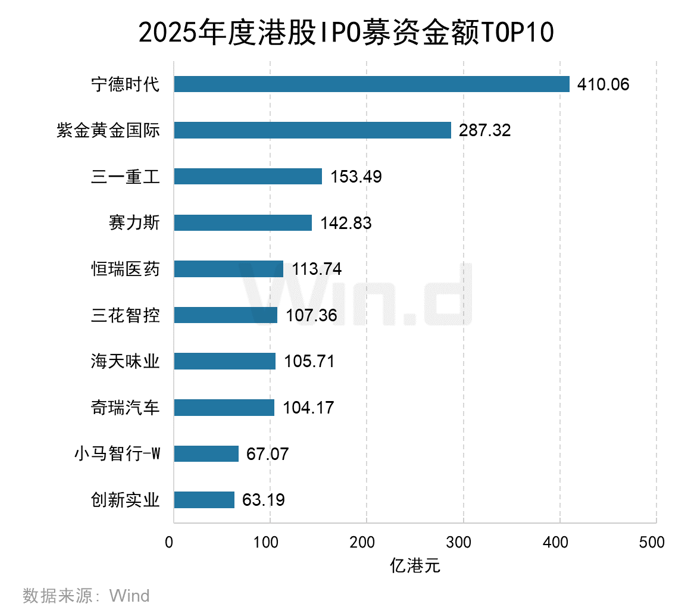

2.5 Top 10 IPO Financing Amounts

In 2025, the company with the highest amount of capital raised in a Hong Kong stock IPO was Ningde Times, with an amount of HK$41,06 billion; Zijin Gold International and Sany Heavy Industries ranked second and third with a raised amount of HK$28.732 billion and HK$15.349 billion respectively. The top ten IPOs raised a total of HK$155.495 billion, accounting for 54.40% of the total amount of Hong Kong stock IPOs raised in 2025.

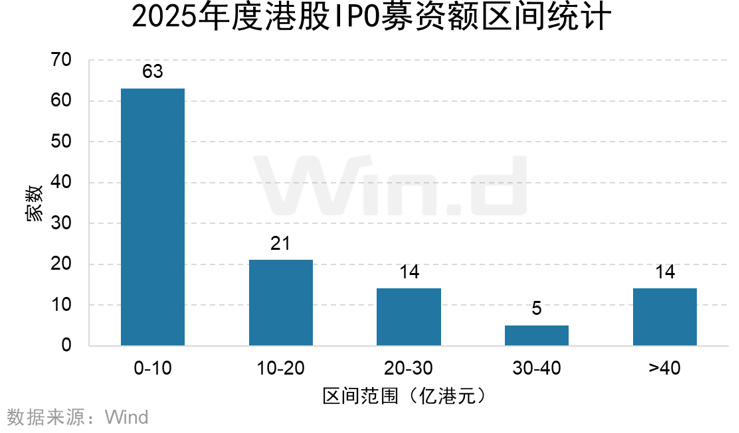

2.6 IPO financing range statistics

In 2025, the number of Hong Kong stock IPOs with financing amounts below HK$1 billion was the highest, reaching 63 companies, accounting for 53.85% of the total number of IPOs; followed by the amount raised in the HK$1-2 billion range, with 21 companies, accounting for 17.95% of the total number of IPOs.

refinancing

3.1 Trends in additional financing

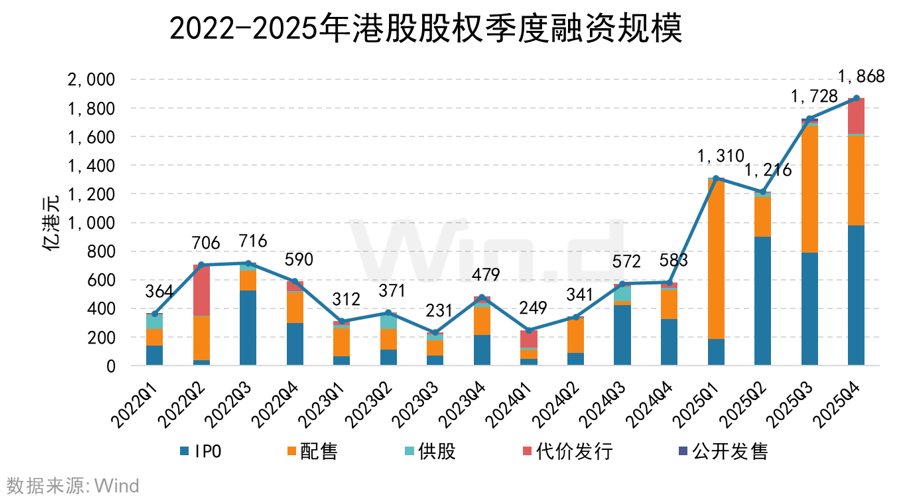

In 2025, the total amount raised in refinancing of Hong Kong stocks was HK$326.4 billion, up 278.15% from HK$86.3 billion last year. The number of refinancing projects was 574, an increase of 43.50% compared to 400 last year.

3.2 Distribution of major refinancing industries

Looking at the amount of refinancing in various industries, the industry with the highest amount of refinancing was the automobile and spare parts industry, with an amount of HK$66.2 billion, mainly from the sale of BYD shares, with a financing scale of HK$43.5 billion; the hardware equipment industry ranked second with a raised amount of HK$60.4 billion, mainly from Xiaomi Group-W's placement, with a financing scale of HK$42.6 billion; and the pharmaceutical and biological industry ranked third with a financing amount of HK$51.9 billion.

Judging from the number of refinancing projects in various industries, the number of refinancing projects in the non-bank financial industry was 52, ranking first; the pharmaceutical and biological industry ranked second with 48; and software services ranked third with 47.

3.3 Top 10 refinancing project financing

The company with the highest amount raised in refinancing was BYD shares, which raised HK$43.509 billion, accounting for 13.33% of the total refinancing scale in 2025; Xiaomi Group-W ranked second with a capital raised of HK$42.6 billion; and China Hongqiao ranked third with a capital raised of HK$11.68 billion.

institutions

4.1 IPO Sponsorship Size Ranking

CICC topped the list with a sponsorship scale of HK$51,652 billion, with 42 underwriters; CITIC Securities (Hong Kong) ranked second with a sponsor size of HK$46.029 billion, with 33 underwriters; and Morgan Stanley ranked third with a sponsorship scale of HK$25.827 billion, with 12 underwriters.

4.2 Ranking of the number of IPO sponsors

As a sponsor, CICC participated in 42 IPOs, topping the list; CITIC Securities (Hong Kong) sponsored 33 IPOs, ranking second; and Huatai Financial Holdings sponsored 21 IPOs, ranking third in number.

4.3 List of IPOs Global Coordinators

As a global coordinator, CICC participated in 52 IPOs, ranking first in the global coordinator list; CITIC Securities (Hong Kong) participated in 46 IPOs, ranking second; and CMB International ranked third with participation in 32 IPOs.

4.4 Ranking of IPO bookkeepers

As a bookkeeper, Agricultural Bank International participated in 54 IPOs, ranking first; CMB International participated in 53 IPOs, ranking second; and CICC participated in 51 IPOs, ranking third.

4.5 IPO underwriting scale ranking

In terms of IPO underwriting amount, CICC topped the IPO underwriting list with an underwriting amount of HK$53,837 billion, with 53 underwriters; CITIC Securities (Hong Kong) ranked second with an underwriting amount of HK$48.252 billion, with 50 underwriters; and Morgan Stanley ranked third with an underwriting amount of HK$27.522 billion.

4.6 Ranking of the number of IPO underwriters

Judging from the number of IPO underwriters, CICC topped the list with 53 IPO underwriters; Futu Securities ranked second with 52 IPO underwriters; and Agricultural Bank International and CMB International tied for third with 51 IPO underwriters.

4.7 Ranking of refinancing underwriting scale

In the Hong Kong stock refinancing market in 2025, Goldman Sachs ranked first with a refinancing underwriting scale of HK$32.244 billion, with 8 underwriting cases; CICC ranked second with an underwriting scale of HK$24.967 billion, with 13 underwriting cases; and Morgan Stanley ranked third with an underwriting scale of HK$23.175 billion, with 15 underwriting cases.

4.8 Ranking of the number of refinancing underwriters

Cathay Pacific Junan (Hong Kong) participated in 30 refinancing cases as an underwriter, ranking first; CITIC Securities (Hong Kong) participated in 23 refinancing cases, ranking second; and Morgan Stanley participated in 15 refinancing cases, ranking third.

Distribution intermediaries

5.1 IPO Auditor Rankings

EY participated in 41 IPOs, ranking first in the auditors' rankings; KPMG participated in 25 IPOs, ranking second; Deloitte participated in 23 IPOs, ranking third.

5.2 Ranking of IPO lawyers

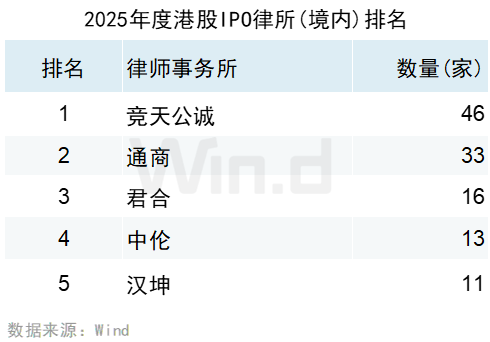

In terms of IPO lawyers (domestic business), Jingtian Gongcheng Law Firm participated in 46 IPOs, ranking first; Commerce Law Firm participated in 33 IPOs, ranking second; and Junhe Law Firm participated in 16 IPOs, ranking third.

In terms of IPO lawyers (overseas business), Gao Weishen's firm participated in 23 IPOs, ranking first; David and Hawking Lovell participated in 17 and 16 IPOs respectively, ranking second and third.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal