Not Many Are Piling Into Ever Reach Group (Holdings) Company Limited (HKG:3616) Stock Yet As It Plummets 27%

Ever Reach Group (Holdings) Company Limited (HKG:3616) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

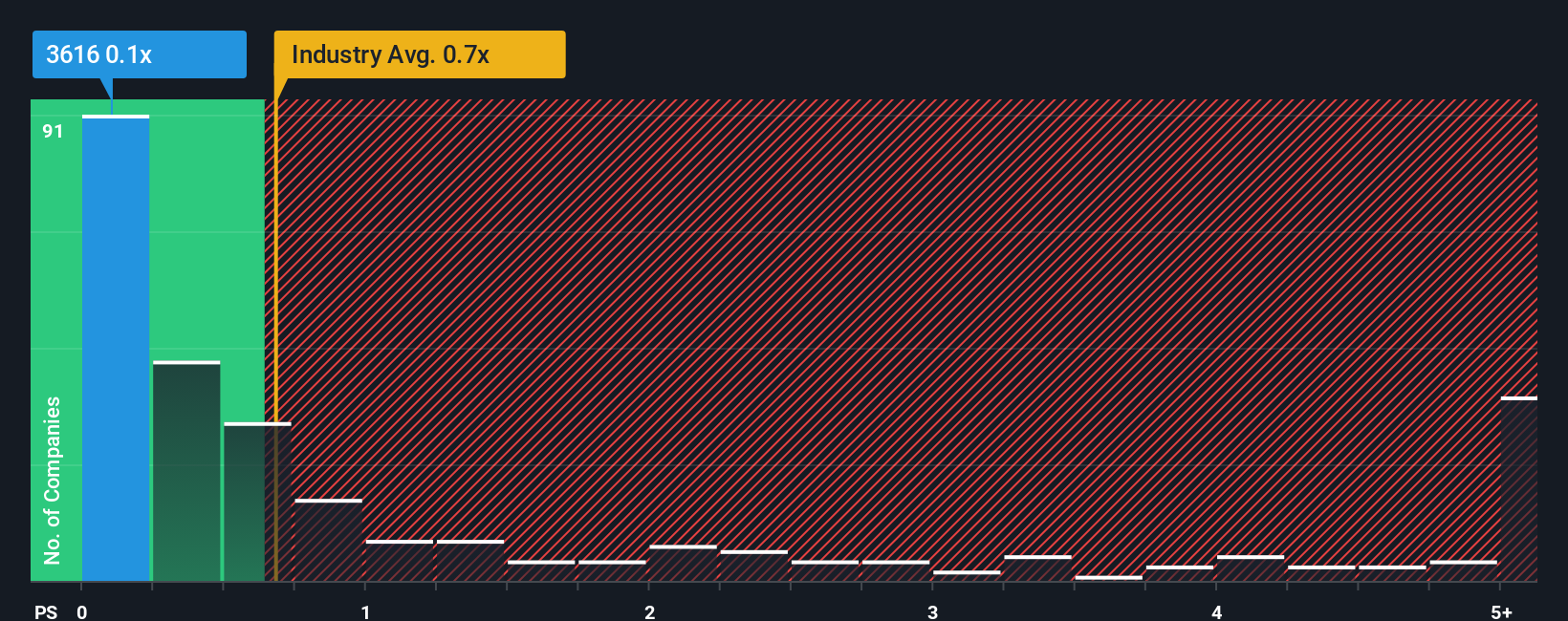

Since its price has dipped substantially, Ever Reach Group (Holdings)'s price-to-sales (or "P/S") ratio of 0.1x might make it look like a buy right now compared to the Real Estate industry in Hong Kong, where around half of the companies have P/S ratios above 0.7x and even P/S above 3x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Ever Reach Group (Holdings)

What Does Ever Reach Group (Holdings)'s Recent Performance Look Like?

For example, consider that Ever Reach Group (Holdings)'s financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Ever Reach Group (Holdings) will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Ever Reach Group (Holdings)'s earnings, revenue and cash flow.How Is Ever Reach Group (Holdings)'s Revenue Growth Trending?

Ever Reach Group (Holdings)'s P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 15% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 5.3% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in consideration, we find it intriguing that Ever Reach Group (Holdings)'s P/S falls short of its industry peers. It may be that most investors are not convinced the company can maintain recent growth rates.

The Final Word

Ever Reach Group (Holdings)'s P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Ever Reach Group (Holdings) currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Ever Reach Group (Holdings) (3 shouldn't be ignored!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Ever Reach Group (Holdings), explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal