Investors Still Aren't Entirely Convinced By Petro-king Oilfield Services Limited's (HKG:2178) Revenues Despite 44% Price Jump

Petro-king Oilfield Services Limited (HKG:2178) shares have had a really impressive month, gaining 44% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 5.9% isn't as attractive.

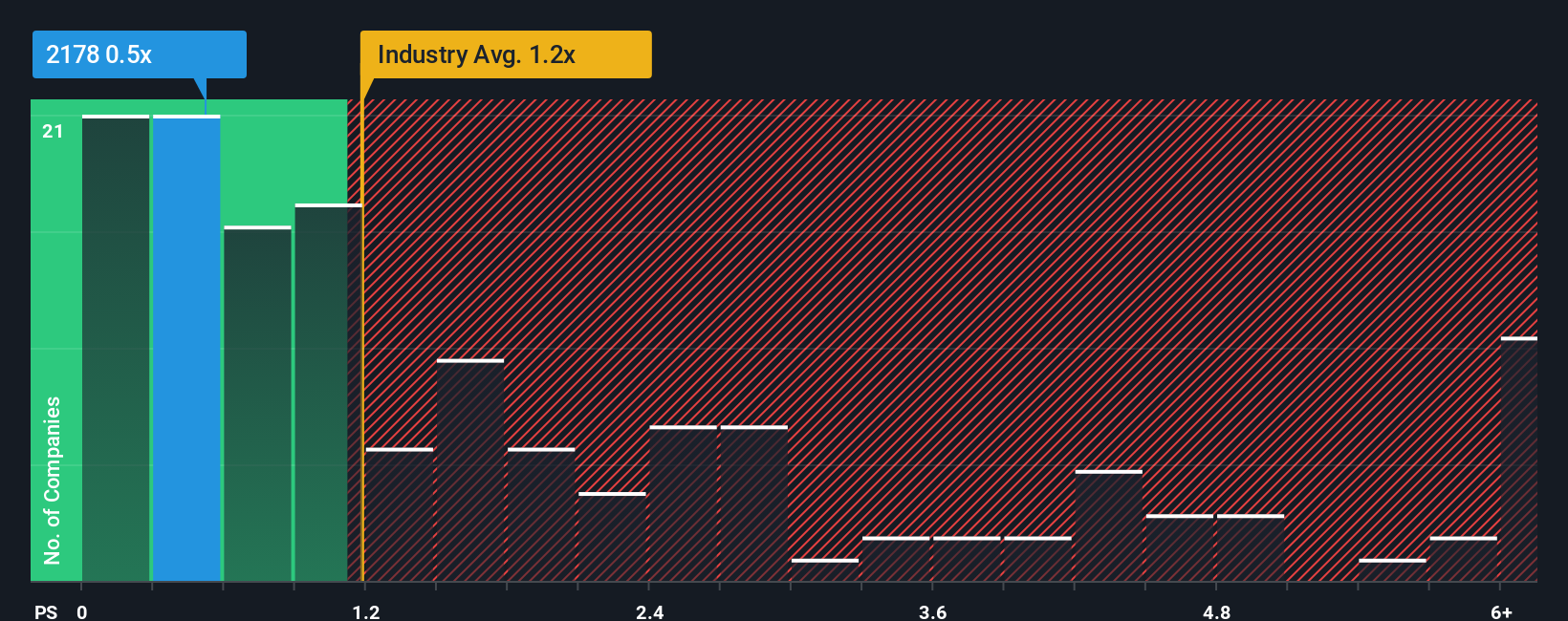

In spite of the firm bounce in price, there still wouldn't be many who think Petro-king Oilfield Services' price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S in Hong Kong's Energy Services industry is similar at about 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Petro-king Oilfield Services

How Has Petro-king Oilfield Services Performed Recently?

As an illustration, revenue has deteriorated at Petro-king Oilfield Services over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Petro-king Oilfield Services will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Petro-king Oilfield Services?

Petro-king Oilfield Services' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 37%. Even so, admirably revenue has lifted 49% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is only predicted to deliver 7.9% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's curious that Petro-king Oilfield Services' P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Petro-king Oilfield Services' P/S

Petro-king Oilfield Services' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Petro-king Oilfield Services currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

Having said that, be aware Petro-king Oilfield Services is showing 2 warning signs in our investment analysis, and 1 of those can't be ignored.

If you're unsure about the strength of Petro-king Oilfield Services' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal