Exploring 3 Undiscovered Gems In Asia With Promising Potential

As global markets navigate a complex landscape of economic shifts, Asia's small-cap stocks are capturing attention amid mixed performances across major indices. With China's manufacturing sector showing signs of recovery and South Korea's export-driven growth, the region presents intriguing opportunities for investors seeking potential in lesser-known companies. Identifying promising stocks often involves looking at those with strong fundamentals and resilience in dynamic market conditions, making them stand out as potential undiscovered gems in Asia.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ubiquoss Holdings | 0.27% | 1.42% | -5.51% | ★★★★★★ |

| Woori Technology Investment | NA | 8.42% | -4.10% | ★★★★★★ |

| Namuga | 14.15% | -4.88% | 23.32% | ★★★★★★ |

| ITE Tech | NA | 4.26% | 6.18% | ★★★★★★ |

| Shangri-La Hotel | NA | 33.29% | 66.13% | ★★★★★★ |

| Wan Hwa Enterprise | NA | 9.74% | 13.35% | ★★★★★★ |

| Zhejiang Chinastars New Materials Group | 42.04% | 1.78% | 6.47% | ★★★★★☆ |

| Ligitek ElectronicsLtd | 42.94% | -6.26% | -26.95% | ★★★★★☆ |

| Hangzhou Zhengqiang | 19.76% | 7.83% | 16.32% | ★★★★★☆ |

| Nippon Care Supply | 12.39% | 10.40% | 1.75% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Shaanxi Tourism Culture Industry HoldingLtd (SHSE:603402)

Simply Wall St Value Rating: ★★★★★★

Overview: Shaanxi Tourism Culture Industry Holding Co., Ltd focuses on tourism operations and has a market capitalization of CN¥6.22 billion.

Operations: The company generates revenue primarily from tourism and performing arts, contributing CN¥664.62 million, followed by tourism ropeway operations at CN¥367.28 million. Additional income streams include tourism catering and passenger roads, with revenues of CN¥42.70 million and CN¥41.39 million respectively.

Shaanxi Tourism, a small player in the hospitality sector, recently raised CNY 1.56 billion through an IPO with shares priced at CNY 80.44 each. Its price-to-earnings ratio of 14.7x is notably lower than the Chinese market average of 44.7x, suggesting potential value for investors seeking bargains in this space. Despite a challenging year with earnings growth at -12.7%, the company has managed to reduce its debt-to-equity ratio from 20.4% to 13.2% over five years and maintains high-quality past earnings with interest payments well-covered by EBIT at an impressive 895x coverage level.

Cofoe Medical TechnologyLtd (SZSE:301087)

Simply Wall St Value Rating: ★★★★★★

Overview: Cofoe Medical Technology Co., Ltd. manufactures and sells professional household medical devices in China, with a market cap of CN¥10.08 billion.

Operations: Cofoe Medical Technology Co., Ltd. generates revenue primarily from the sale of household medical devices in China. The company's net profit margin has shown notable fluctuations, reflecting changes in operational efficiency and cost management.

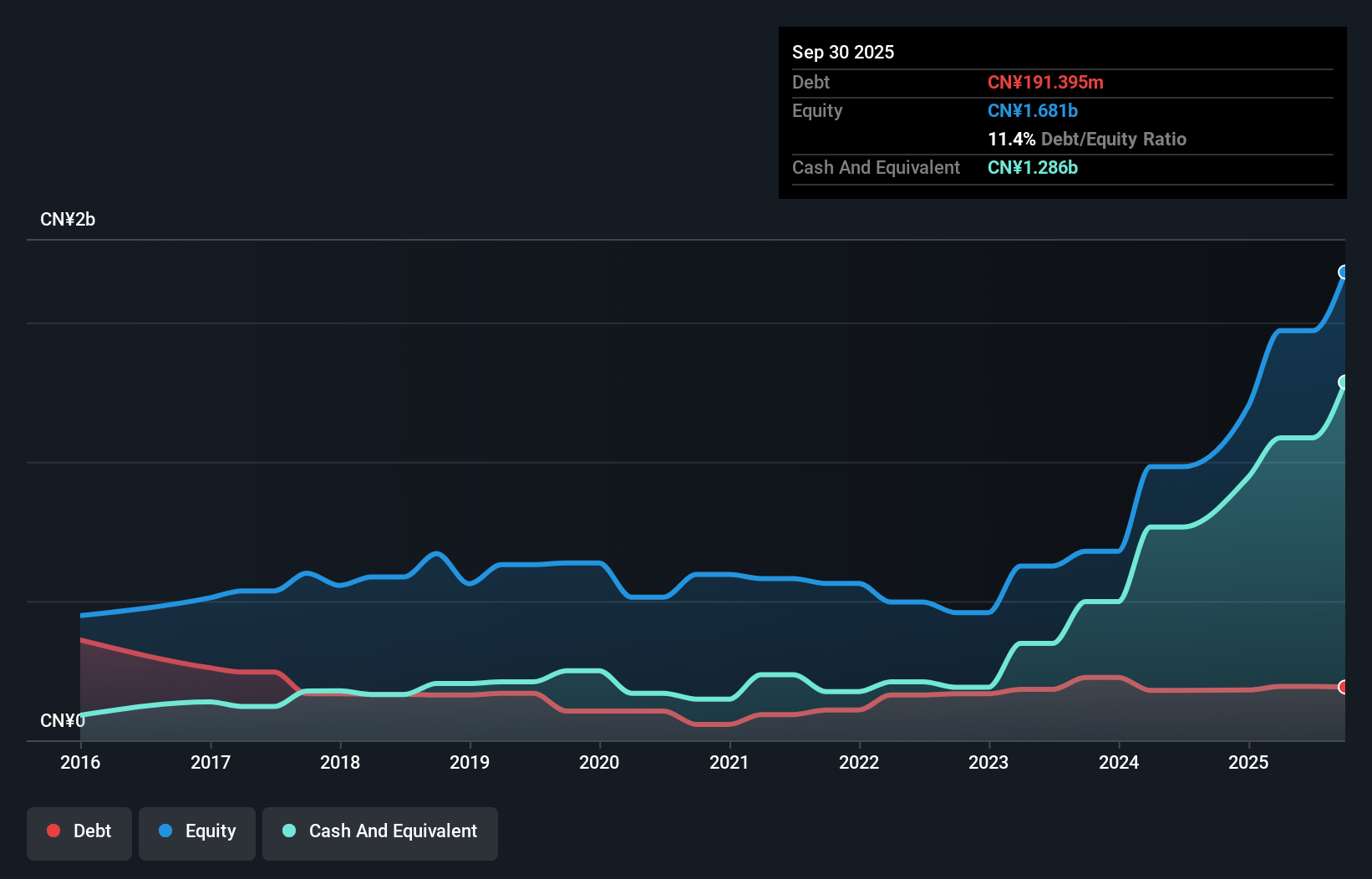

Cofoe Medical Technology seems to be an intriguing player in the medical equipment sector, trading at 70.9% below its estimated fair value. Over the past year, earnings have grown by 21.1%, outpacing the industry average of 0.6%. Despite a historical decline of 8.8% in earnings over five years, recent figures show improvement with net income reaching CNY 260 million for nine months ending September 2025. The company holds more cash than total debt and has reduced its debt-to-equity ratio from 25.8% to 15.7% over five years, suggesting a solid financial footing moving forward.

ICkey (Shanghai) Internet and TechnologyLtd (SZSE:301563)

Simply Wall St Value Rating: ★★★★★☆

Overview: ICkey (Shanghai) Internet and Technology Co., Ltd. operates in the electronics wholesale industry and has a market capitalization of approximately CN¥11.97 billion.

Operations: ICkey generates revenue primarily through its electronics wholesale segment, which recorded CN¥2.58 billion. The company's financial performance is highlighted by a gross profit margin of 45%.

ICkey, a dynamic player in the tech scene, has shown impressive earnings growth of 12% over the past year, outpacing the broader electronics industry. Its debt to equity ratio has risen from 8.2% to 11.1% over five years, yet it holds more cash than total debt, reflecting strong financial health. The company’s interest payments are comfortably covered by EBIT at an impressive 85 times coverage. Recent board changes and amendments to its articles of association suggest a strategic shift that might influence future directions positively or otherwise as they adapt to market demands and governance standards.

- Dive into the specifics of ICkey (Shanghai) Internet and TechnologyLtd here with our thorough health report.

Learn about ICkey (Shanghai) Internet and TechnologyLtd's historical performance.

Seize The Opportunity

- Unlock more gems! Our Asian Undiscovered Gems With Strong Fundamentals screener has unearthed 2490 more companies for you to explore.Click here to unveil our expertly curated list of 2493 Asian Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal