Investors Appear Satisfied With Taihan Fiber Optics Co., Ltd's (KOSDAQ:010170) Prospects As Shares Rocket 41%

Despite an already strong run, Taihan Fiber Optics Co., Ltd (KOSDAQ:010170) shares have been powering on, with a gain of 41% in the last thirty days. The last month tops off a massive increase of 285% in the last year.

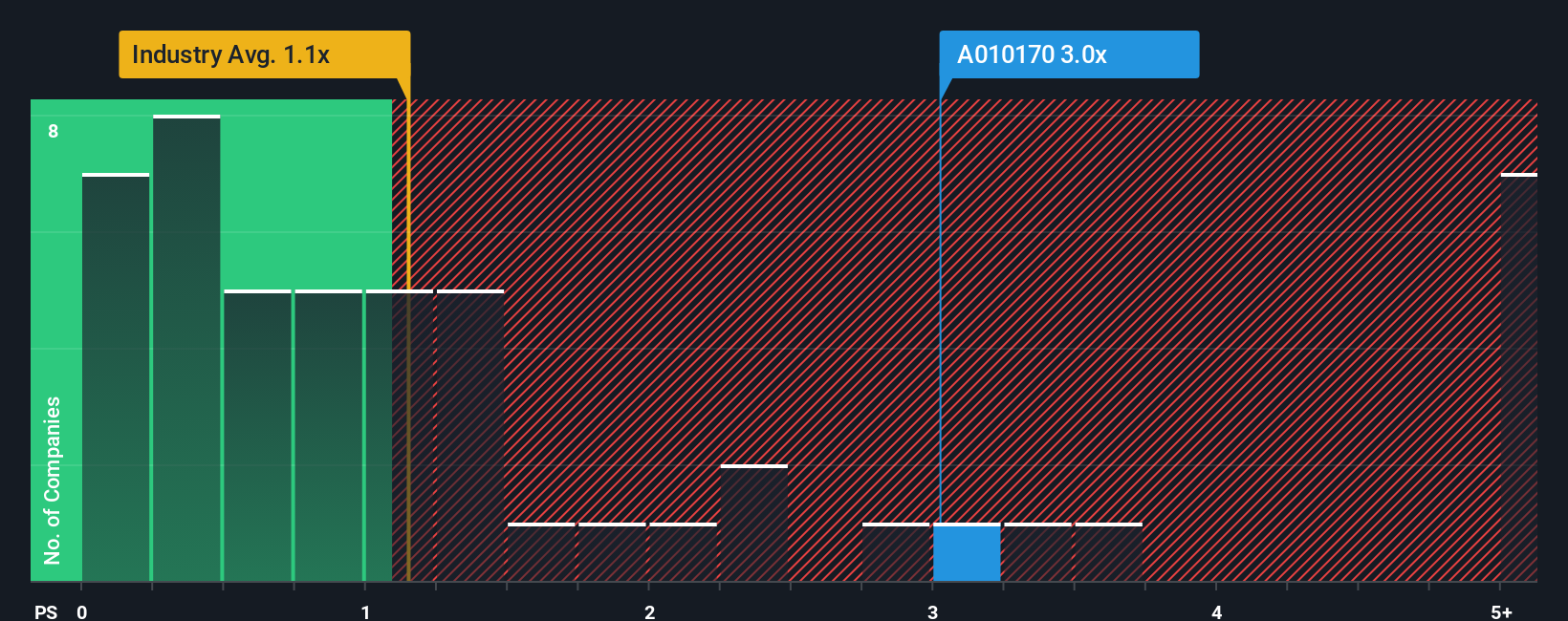

After such a large jump in price, you could be forgiven for thinking Taihan Fiber Optics is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3x, considering almost half the companies in Korea's Communications industry have P/S ratios below 1.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Taihan Fiber Optics

What Does Taihan Fiber Optics' P/S Mean For Shareholders?

Taihan Fiber Optics hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Taihan Fiber Optics.Is There Enough Revenue Growth Forecasted For Taihan Fiber Optics?

The only time you'd be truly comfortable seeing a P/S as high as Taihan Fiber Optics' is when the company's growth is on track to outshine the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.8%. This means it has also seen a slide in revenue over the longer-term as revenue is down 18% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 68% over the next year. With the industry only predicted to deliver 51%, the company is positioned for a stronger revenue result.

With this information, we can see why Taihan Fiber Optics is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Taihan Fiber Optics' P/S Mean For Investors?

The large bounce in Taihan Fiber Optics' shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Taihan Fiber Optics maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Communications industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for Taihan Fiber Optics that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal