How Rising Focus on Direct Lithium Extraction Will Impact Standard Lithium (TSXV:SLI) Investors

- Standard Lithium has recently drawn widespread attention for its use of Direct Lithium Extraction technology at its U.S.-based projects, which are aimed at producing lithium for the electric vehicle supply chain.

- This surge in interest highlights how technology-led lithium producers with U.S. assets may increasingly align with policy efforts to diversify supply away from China, while still facing substantial funding and execution risks.

- We’ll now examine how growing focus on Standard Lithium’s Direct Lithium Extraction technology shapes its broader investment narrative and risk profile.

Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Standard Lithium's Investment Narrative?

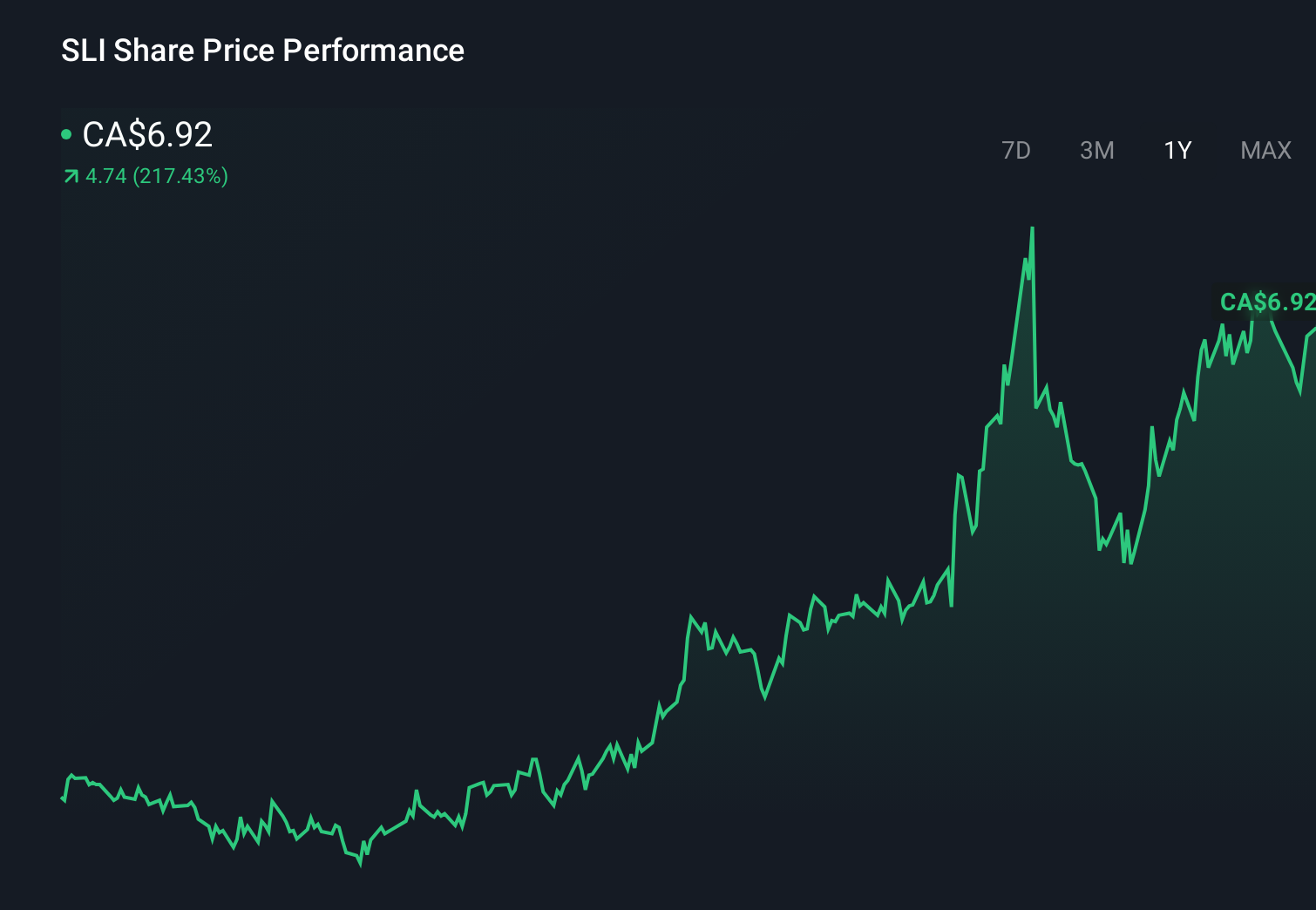

To own Standard Lithium today, you have to believe that its Direct Lithium Extraction can move from promising pilot concept to commercially viable plants in the U.S., supported by policy backing and partners like Equinor. The recent viral attention around its technology reinforces that core thesis and helps explain the very large 1‑year share price gain, but it does not remove the fundamentals: zero revenue, continuing losses and heavy future capital needs. In the near term, key catalysts still revolve around advancing the SW Arkansas project toward final investment decisions, securing additional non‑dilutive funding on top of the US$225,000,000 DOE grant, and proving DLE costs and recoveries at scale. The new buzz may temporarily ease financing conditions, yet it also raises expectations and amplifies the execution risk already embedded in the story.

However, investors should be aware that further funding could still meaningfully dilute existing shareholders. Our comprehensive valuation report raises the possibility that Standard Lithium is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 7 other fair value estimates on Standard Lithium - why the stock might be worth as much as CA$6.33!

Build Your Own Standard Lithium Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Standard Lithium research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Standard Lithium research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Standard Lithium's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal