Assessing STAAR Surgical (STAA) Valuation As Sentiment Cools And Revenue Growth Assumptions Tighten

STAAR Surgical (STAA) has come into focus after a recent move in its share price, with the stock last closing at US$23.60 and showing mixed returns over the past year and the past 3 months.

See our latest analysis for STAAR Surgical.

The latest 1 day share price return of 2.21% comes after a weaker 30 day share price return of 7.01% decline and a 3 year total shareholder return of 63.94% decline, suggesting momentum has been fading rather than building recently.

If STAAR Surgical has you reassessing opportunities in eye care and medical technology, it could be a good moment to scan a wider set of healthcare stocks.

With STAAR Surgical trading at US$23.60 alongside an implied 38.63% intrinsic discount and a price target of US$26.56, investors now face a key question: is there real value on the table or is the market already pricing in future growth?

Most Popular Narrative: 11.2% Undervalued

With STAAR Surgical last closing at US$23.60 against a narrative fair value of US$26.56, the current share price sits below what this widely followed view considers reasonable.

The analysts have a consensus price target of $24.625 for STAAR Surgical based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $28.0, and the most bearish reporting a price target of just $16.0.

Curious what kind of revenue curve and margin shift could support that higher fair value, even with such a wide earnings range on the table? The narrative leans on a sharp swing from loss making to profitable, paired with a rich future earnings multiple that many investors usually associate with faster growing sectors. Want to see exactly how those growth and profitability assumptions stack up year by year and how they feed into that valuation gap?

Result: Fair Value of $26.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear pressure points, including weaker refractive procedure assumptions and ongoing uncertainty around China distribution and inventory, which could undercut this underpriced story.

Find out about the key risks to this STAAR Surgical narrative.

Another View: Rich Sales Multiple Raises Questions

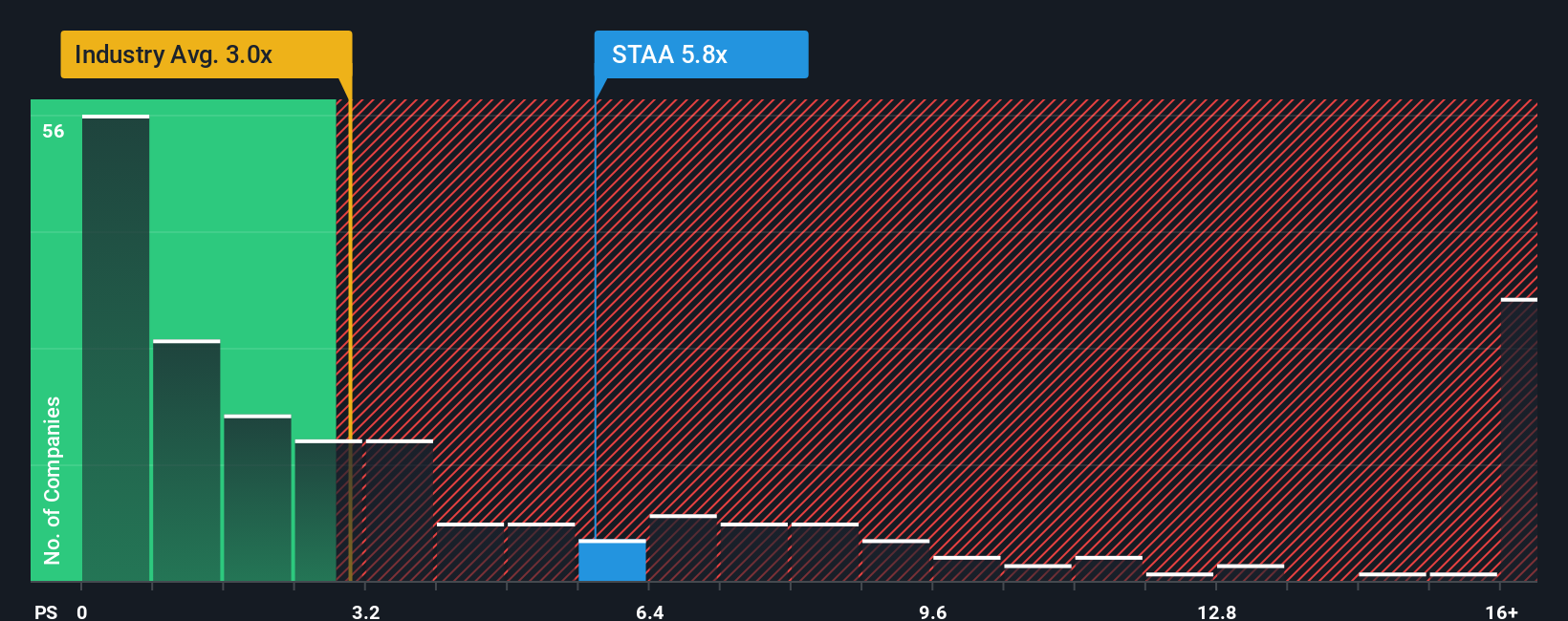

The earlier fair value work points to STAAR Surgical trading below an intrinsic estimate, yet its current P/S ratio of 5.1x sits well above the US Medical Equipment industry at 3x and the fair ratio of 3.6x. That gap suggests investors are already paying up, so the discount may not be as clear as it first appears.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own STAAR Surgical Narrative

If you look at the numbers and come to a different conclusion, or simply prefer your own research path, you can build a personalized view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding STAAR Surgical.

Looking for more investment ideas?

If STAAR Surgical has sharpened your focus on opportunities, do not stop here. The right watchlist can shape what you are ready to act on next.

- Target reliable income potential by scanning these 14 dividend stocks with yields > 3% that could help anchor a more balanced portfolio.

- Spot early movers in breakthrough technology by checking out these 29 quantum computing stocks before they hit the mainstream.

- Hunt for potential mispricings using these 878 undervalued stocks based on cash flows that may offer attractive gaps between price and fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal