JPMorgan Chase (JPM) Valuation Check As Recent Momentum Meets A Near Fair Value Price Tag

Without a specific news headline driving attention today, JPMorgan Chase (JPM) is attracting interest based on its recent share performance, business scale, and profitability. This is prompting investors to reassess how the stock currently trades.

See our latest analysis for JPMorgan Chase.

At a latest share price of $325.48, JPMorgan Chase’s 30-day share price return of 3.31% and 90-day share price return of 5.78% sit alongside a 1-year total shareholder return of 37.29%. This suggests that momentum has been building over a longer stretch.

If JPMorgan’s run has you thinking more broadly about financial exposure, it could be worth widening your search and checking out fast growing stocks with high insider ownership.

With the shares near $325 and an intrinsic value estimate that is lower by around 13%, plus a small 1% gap to the average analyst target, you have to ask: Is JPMorgan still a buying opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 1% Undervalued

With JPMorgan Chase last closing at $325.48 and a most popular narrative fair value of about $328.09, the gap is small but still meaningful for valuation watchers.

Management's confidence in organic and inorganic growth, ongoing capital deployment into new business lines (e.g., innovation economy middle market banking, international expansion), and ability to reinvest at high ROTCE levels, create a platform for structurally higher long-term revenue and earnings, even as regulatory frameworks evolve.

Curious what sits behind that confidence in long term earnings power? The narrative leans heavily on measured revenue growth, steady margins, and a richer future P/E than the sector. Want to see how those pieces fit together into that fair value?

Result: Fair Value of $328.09 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also have to weigh cyber and data security exposure, along with tighter capital and regulatory rules. These factors could pressure profitability and challenge that earnings narrative.

Find out about the key risks to this JPMorgan Chase narrative.

Another View: Multiples Tell a Different Story

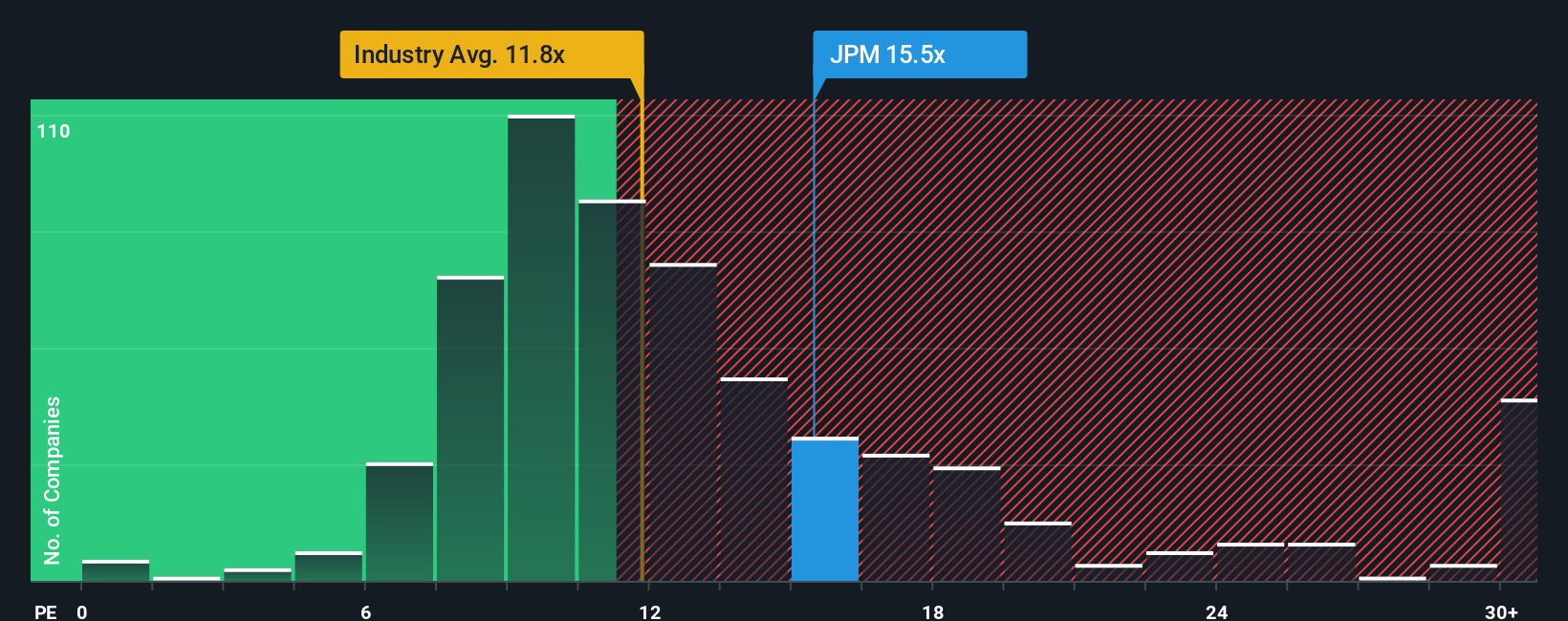

Our fair value estimate of about $328.09 suggests JPMorgan Chase is roughly in line with intrinsic value, but the P/E picture is less forgiving. At 15.6x earnings versus 14.4x for peers and 11.8x for the wider US Banks group, the shares carry a clear premium.

The fair ratio for JPMorgan is 16.1x, only slightly above the current 15.6x. That gap may limit upside if sentiment cools, while the premium to peers could compress if expectations ease. The key question for you is whether this premium feels earned or already stretched.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own JPMorgan Chase Narrative

If you are not fully aligned with these views or prefer to test the numbers yourself, you can build a fresh story in minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding JPMorgan Chase.

Looking for more investment ideas?

If JPMorgan has your attention, do not stop there. Broaden your watchlist with a few focused stock ideas that could help you think about opportunity and risk.

- Start with value and check out these 100+ undervalued stocks based on cash flows, which currently screen as priced below their estimated cash flow potential.

- Hunt for growth by scanning these 25 AI penny stocks, which are tied to artificial intelligence themes across different parts of the market.

- Target income by reviewing these 14 dividend stocks with yields > 3%, which aim to offer yields above 3% while still passing basic fundamental checks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal