A Look At Vulcan Energy Resources (ASX:VUL) Valuation After Its €1.73b Debt And Equity Financing

Vulcan Energy Resources (ASX:VUL) has secured a large private placement, combining €1.185b in debt financing with €545m in new common equity from 13 financial institutions and several funding partners.

See our latest analysis for Vulcan Energy Resources.

The fresh €1.73b funding package lands after last month’s A$972.2m follow on equity offering. It comes as the A$4.58 share price shows a 30 day share price return of 3.85%, but a 90 day share price return decline of 32.84%, with a 5 year total shareholder return of 9.70%. This suggests short term momentum has softened while the longer record remains positive.

If this financing round has you thinking about where growth stories might emerge next, it could be a good time to look at fast growing stocks with high insider ownership as well.

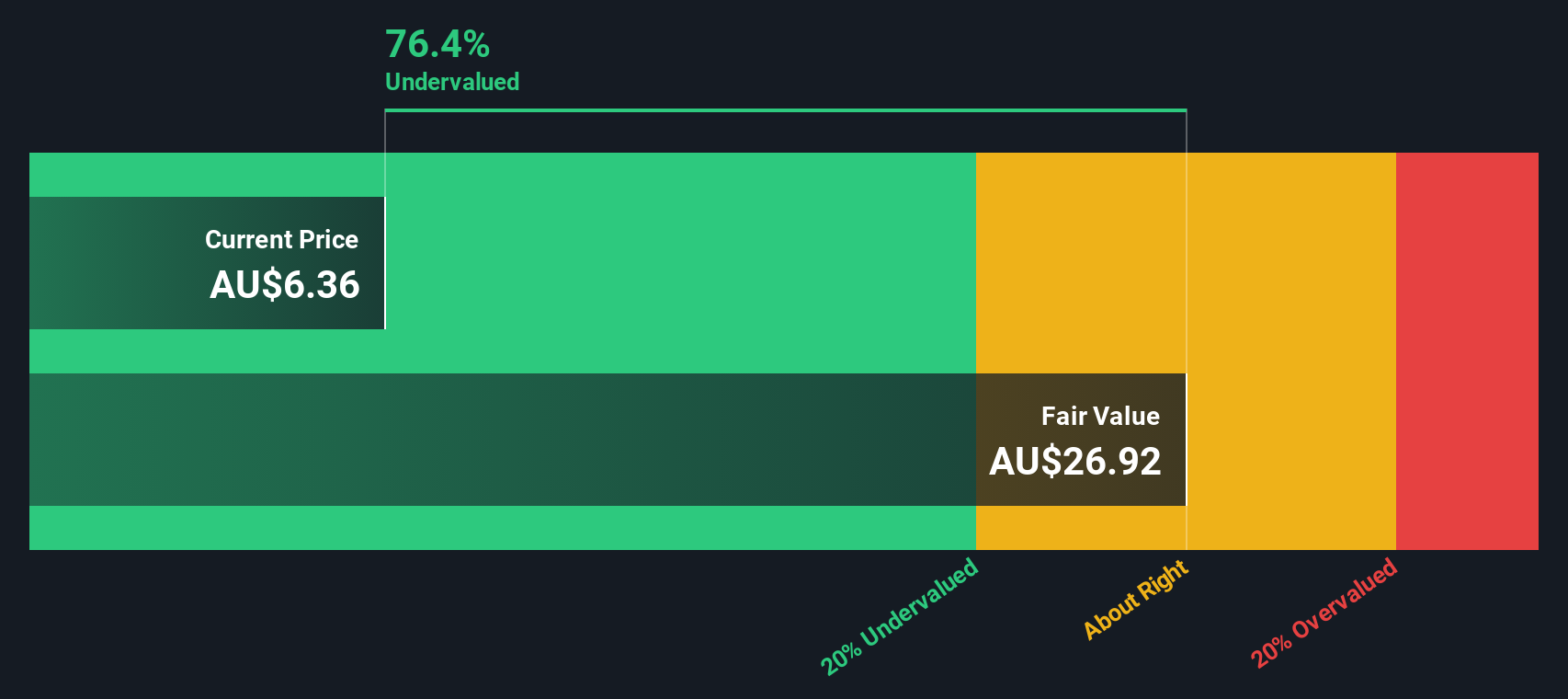

With a recent A$4.58 share price, an analyst target of about A$8.08 and an estimated intrinsic value implying a large discount, the key question is whether this signals a genuine opportunity or if the market already reflects Vulcan’s future growth.

Price to Book of 3.3x: Is it justified?

On the latest figures, Vulcan Energy Resources trades on a P/B of 3.3x, which screens as good value against peers on one measure but expensive on another.

P/B compares the company’s market value to the accounting value of its net assets. It is often used for capital heavy businesses and early stage companies that are not yet profitable.

According to the statements, Vulcan scores as good value when its 3.3x P/B is set against a peer average of 5.3x, suggesting the market is not assigning the same premium as it does to similar companies. However, when the comparison is made with the broader Australian metals and mining industry, that same 3.3x P/B sits above the 2.5x industry average, which implies the shares are priced at a higher level than many listed miners.

This contrast is important because it highlights how sensitive the valuation story is to the comparison set used, and the level the market could move towards if sentiment lines up more closely with the wider industry.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-book of 3.3x (ABOUT RIGHT)

However, there are clear risks here, including ongoing net losses of €53.7m and the possibility that recent funding will not translate into commercially viable lithium production.

Find out about the key risks to this Vulcan Energy Resources narrative.

Another View, What Does The SWS DCF Model Say?

While the 3.3x P/B suggests Vulcan Energy Resources is somewhere between peer value and industry premium, our DCF model paints a very different picture. With an estimate of fair value at A$46.04 versus a A$4.58 share price, the implied discount is very large.

If the SWS DCF model is closer to the mark than the P/B comparison, that gap could point to either mispricing or very high execution risk. The real question for you is whether the cash flow assumptions behind that fair value feel realistic enough to matter.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vulcan Energy Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vulcan Energy Resources Narrative

If you look at the numbers and reach a different conclusion, or simply prefer your own process, you can build a fresh view in minutes with Do it your way.

A great starting point for your Vulcan Energy Resources research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Vulcan has sparked your curiosity, do not stop there. Use the Simply Wall St screener to spot other opportunities that match your style and risk comfort.

- Target income focused ideas by checking out these 14 dividend stocks with yields > 3% that may fit a portfolio built around regular cash returns.

- Back big shifts in technology by scanning these 25 AI penny stocks that are tied to artificial intelligence themes.

- Hunt for potential bargains by reviewing these 870 undervalued stocks based on cash flows that might trade at prices below their estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal