Assessing Pop Mart International Group (SEHK:9992) Valuation After Recent Share Price Moves

Why Pop Mart International Group is on investors’ radar today

Pop Mart International Group (SEHK:9992) has attracted fresh attention after recent share price moves, with the stock up 1.6% over the past day but showing weaker performance over the past month and past 3 months.

See our latest analysis for Pop Mart International Group.

While the 1-day share price return of 1.61% to HK$196.2 has caught attention, the weaker 30-day and 90-day share price returns suggest momentum has cooled recently. Even so, the 1-year total shareholder return above 100% and the very large 3-year total shareholder return point to a strong longer term story.

If Pop Mart’s moves have you rethinking where growth could come from next, this is a good moment to widen your search with fast growing stocks with high insider ownership.

With Pop Mart trading at HK$196.2 and metrics such as an intrinsic value gap and a discount to analyst targets in play, the question is whether it remains undervalued or whether the market is already pricing in future growth.

Price-to-Earnings of 34.5x: Is it justified?

On a P/E of 34.5x at HK$196.2, Pop Mart trades at a clear premium while separate fair value work suggests the shares are trading at a discount.

The P/E ratio tells you how much investors are currently paying for each unit of earnings, which matters a lot for a profitable, consumer facing retailer like Pop Mart. A higher multiple usually reflects strong earnings growth expectations or a perception that those earnings are high quality and repeatable.

Here, the company screens as expensive on a straight P/E comparison. Its 34.5x multiple is above the estimated fair P/E of 24.5x that our fair ratio work points to as a level the market could move toward over time. That gap suggests investors are currently paying more for each unit of earnings than this fair ratio implies.

Against peers, the premium is even starker. The same 34.5x P/E is more than double the peer average of 16.3x and well above the Hong Kong Specialty Retail industry average of 10.9x, which reinforces how much extra investors are currently paying for Pop Mart’s earnings compared with sector alternatives.

Explore the SWS fair ratio for Pop Mart International Group

Result: Price-to-Earnings of 34.5x (OVERVALUED)

However, the sharp 30 and 90 day share price declines, along with the premium 34.5x P/E versus peers, could quickly unwind if sentiment on growth cools further.

Find out about the key risks to this Pop Mart International Group narrative.

Another View: DCF points in the opposite direction

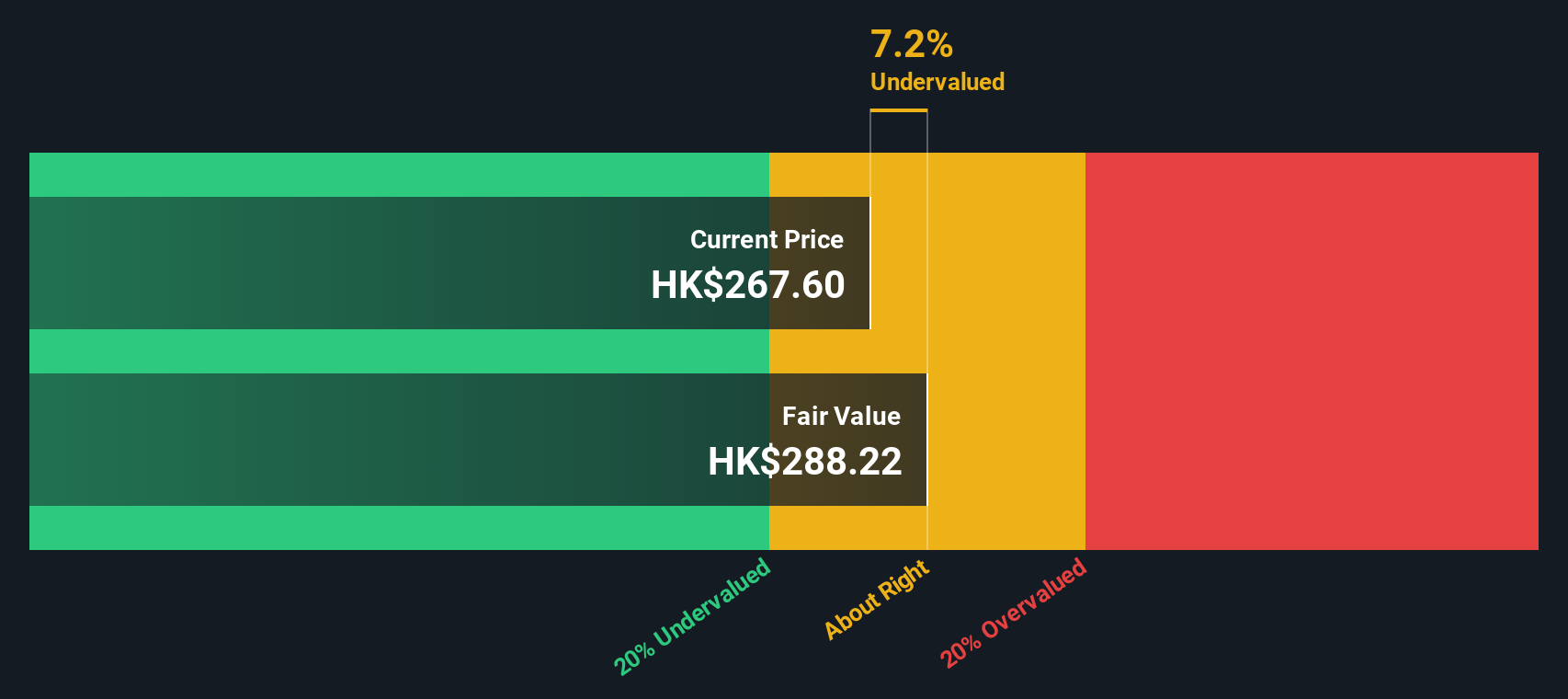

While the 34.5x P/E makes Pop Mart look expensive against peers and our 24.5x fair ratio, our DCF model suggests something different. At HK$196.2, the shares sit about 32.5% below an estimated fair value of HK$290.86, which frames today’s price as a potential discount rather than a premium.

When one method flags overvaluation and another flags undervaluation, it raises a simple question for you as an investor: which set of assumptions about future cash flows and earnings feels more realistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pop Mart International Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pop Mart International Group Narrative

If you look at these numbers and draw a different conclusion, or simply prefer to test the assumptions yourself, you can build a custom view in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Pop Mart International Group.

Looking for more investment ideas?

If Pop Mart has sharpened your thinking, do not stop here. Broaden your watchlist now so you are not kicking yourself over missed opportunities later.

- Spot companies that might be flying under the radar by checking out these 870 undervalued stocks based on cash flows that could suit a value focused approach.

- Ride the next wave of digital transformation by reviewing these 25 AI penny stocks that tap into real world applications of artificial intelligence.

- Position yourself for potential growth in digital assets by scanning these 79 cryptocurrency and blockchain stocks tied to blockchain, payments, and related infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal