Assessing Alignment Healthcare (ALHC) Valuation After Strong Growth In Customers Earnings And Free Cash Flow

Alignment Healthcare (ALHC) has been drawing fresh attention as investors react to its recent customer growth of 41.2% over two years, along with sustained improvements in earnings per share and free cash flow.

See our latest analysis for Alignment Healthcare.

The recent business progress appears to sit alongside constructive price action, with a 90 day share price return of 19.08% and a 1 year total shareholder return of 78.62%, suggesting momentum has been building rather than fading.

If Alignment Healthcare has caught your eye, it can also be useful to see what else is moving across the sector, starting with healthcare stocks.

With customer growth running at 41.2% over two years, earnings per share rising 30.1% a year and free cash flow now positive, is Alignment Healthcare still mispriced or is the market already baking in future growth?

Most Popular Narrative Narrative: 3.9% Undervalued

Compared with the narrative fair value of about US$21.04 and the last close at US$20.22, the gap is modest but still meaningful for valuation watchers.

Alignment's robust, technology-enabled care model and investments in administrative automation, workflow standardization, and digital health platforms position the company to significantly lower SG&A expenses and improve scalability, likely powering both margin expansion and earnings growth over the next several years. Ongoing expansion into existing counties and new states, combined with low market penetration and favorable demographic trends from a rapidly aging population, create a long-term runway for outsized membership and revenue growth as the Medicare-eligible population swells.

Curious what kind of revenue ramp and margin shift sit behind that valuation gap? The narrative leans on aggressive top line growth and a richer earnings profile. Want to see how those moving parts stack up across membership, profitability and valuation multiples over the next few years? The full narrative pulls those assumptions together into one cohesive view.

Result: Fair Value of $21.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still real swing factors here, including potential shifts in Medicare Advantage reimbursement and tougher competition that could pressure member growth and margins.

Find out about the key risks to this Alignment Healthcare narrative.

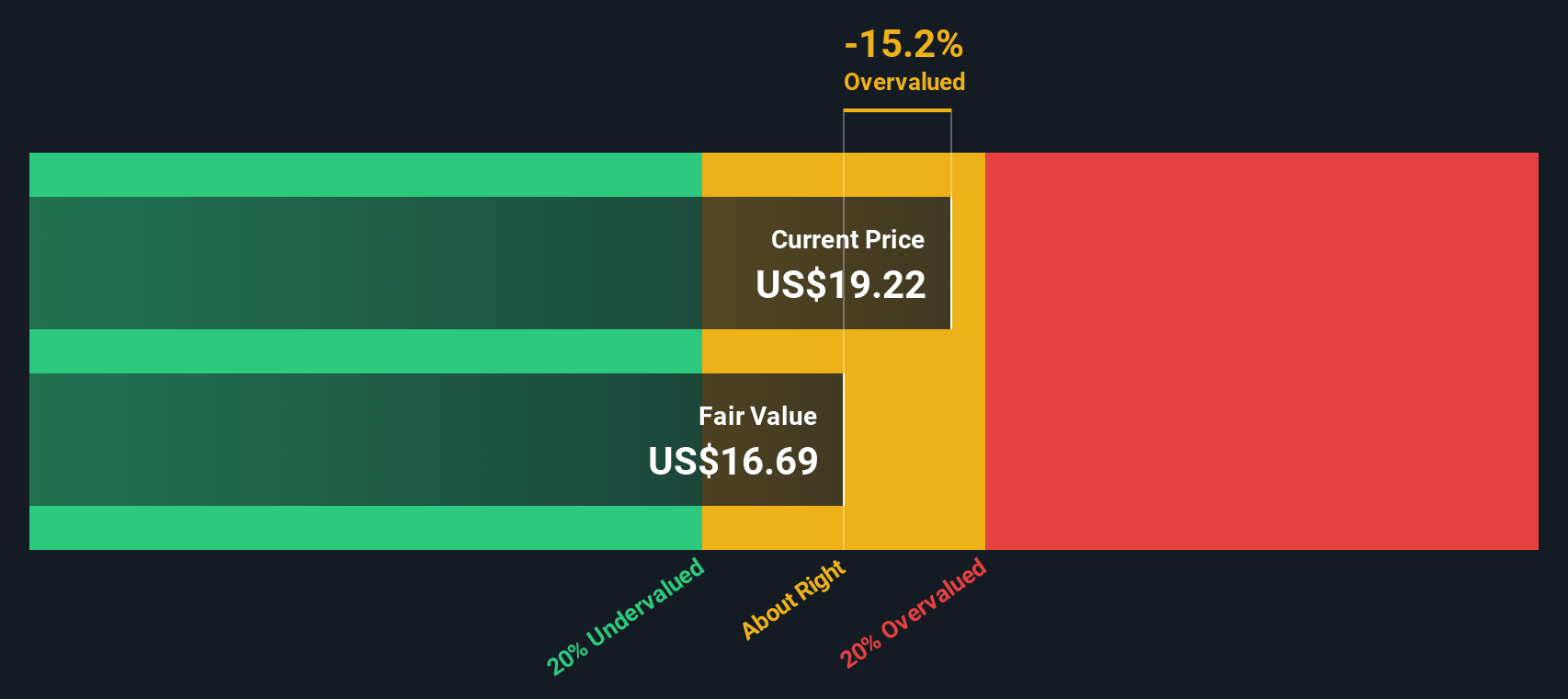

Another View: SWS DCF Model Flags Overvaluation

The narrative fair value suggests Alignment Healthcare is 3.9% undervalued, but our DCF model tells a different story. With the share price at US$20.22 versus a DCF fair value of US$17.42, the stock screens as overvalued instead. Which set of assumptions do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alignment Healthcare for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alignment Healthcare Narrative

If you look at the numbers and reach a different conclusion, or just prefer to test your own assumptions, you can build a custom view in a few minutes with Do it your way.

A great starting point for your Alignment Healthcare research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If Alignment Healthcare has sharpened your thinking, do not stop here. Casting a wider net across different themes can help you spot opportunities you might otherwise miss.

- Scan for potential high-upside moves by checking out these 3564 penny stocks with strong financials that already have the numbers to back them up.

- Zero in on future focused themes by reviewing these 25 AI penny stocks that sit at the intersection of technology and fast changing business models.

- Put value front and center by focusing on these 870 undervalued stocks based on cash flows that currently trade below what their cash flows suggest they could be worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal