Walker & Dunlop (WD) Valuation Checked After Recent Share Price Weakness

Walker & Dunlop stock moves invite a closer look

Walker & Dunlop (WD) has been drawing attention after a stretch of weaker share performance, with the stock showing negative returns over the past week, month, past 3 months, and year.

See our latest analysis for Walker & Dunlop.

The 1 day share price return of 2.38% and 30 day return of 7.13% add to a 90 day share price decline of 26.99%. In contrast, the 1 year total shareholder return of 35.67% and 5 year total shareholder return of 25.04% point to pressure that has built over time as investors reassess growth prospects and risk around commercial real estate financing.

If Walker & Dunlop’s recent weakness has you rethinking your exposure to financials, this could be a good moment to broaden your search with fast growing stocks with high insider ownership.

With WD trading at US$58.72 against an analyst price target of US$84.00 and carrying a low value score of 1, you have to ask: is this weakness an opening, or is future growth already priced in?

Most Popular Narrative: 30.1% Undervalued

With Walker & Dunlop’s fair value framed at US$84 against a last close of US$58.72, the most followed narrative suggests a sizable valuation gap worth unpacking.

Entry into international markets (notably Europe) and the scaling of new verticals (such as data center financing) expand addressable markets and diversify revenue streams, creating new opportunities for revenue growth and reducing reliance on traditional mortgage banking.

Want to see what is sitting behind that valuation gap? The narrative focuses on expectations for faster earnings, firmer margins, and a higher future P/E multiple. Curious which assumptions really carry the weight here? The full story explains how those elements combine into that fair value estimate.

Result: Fair Value of $84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to weigh up the risk that weaker commercial real estate demand or shifts in GSE policy could cut into origination volumes and fee margins.

Find out about the key risks to this Walker & Dunlop narrative.

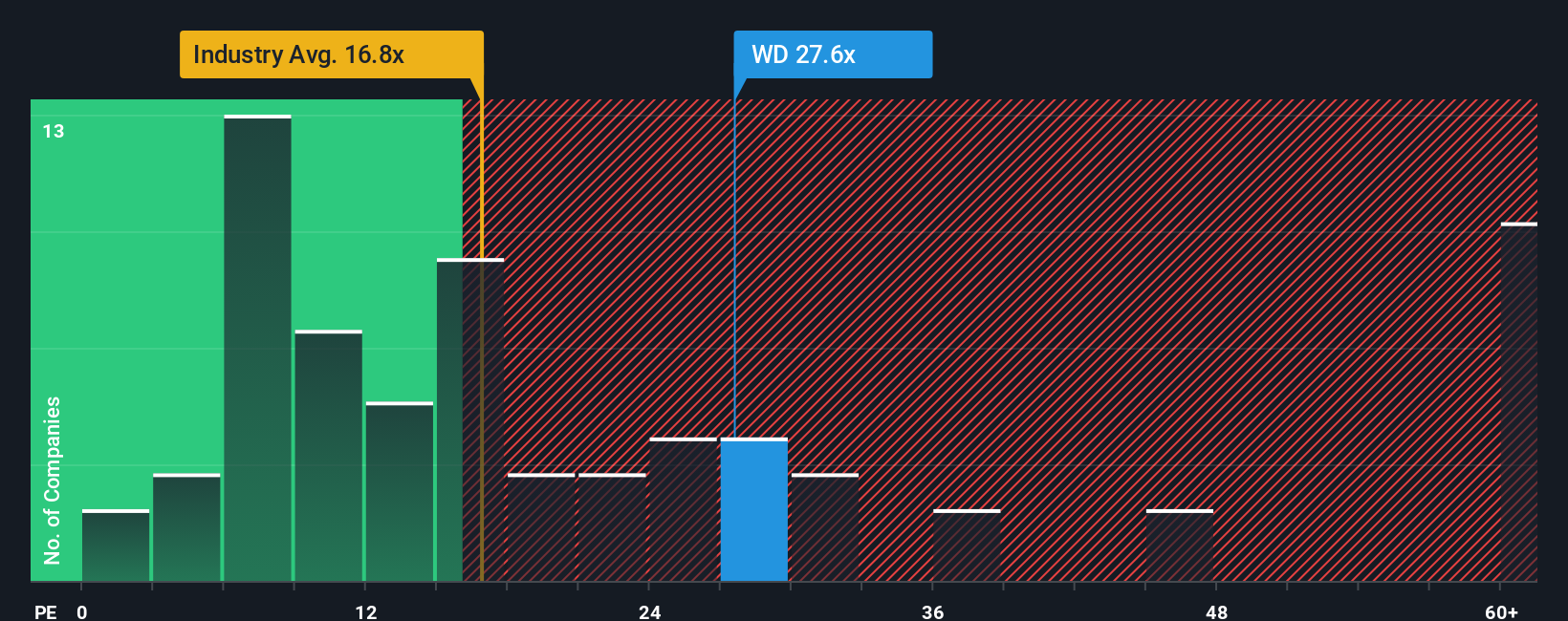

Another View: Earnings Multiple Sends A Different Signal

That 30.1% discount to the US$84 fair value hinges on growth and margin assumptions, but the current P/E of 17.8x tells a tougher story. It sits above the estimated fair ratio of 16.8x, above the US Diversified Financial industry on 13.7x, and above peers at 8.6x.

Put simply, the share price already carries a richer earnings tag than both the modelled fair ratio and comparable companies. This raises the risk that any slip in growth or margins could hit the valuation quickly. Do you see that premium as justified, or as extra downside risk to factor in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Walker & Dunlop Narrative

If you are not sold on these conclusions or prefer to weigh the numbers yourself, you can pull the data together and shape your own view in just a few minutes, then Do it your way.

A great starting point for your Walker & Dunlop research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Walker & Dunlop has sharpened your thinking, do not stop here. Use the Simply Wall St screener to quickly surface other ideas that match your style.

- Target potential value opportunities by scanning these 870 undervalued stocks based on cash flows that may trade below what their cash flows suggest.

- Explore technological change by filtering for these 25 AI penny stocks that are active in artificial intelligence.

- Find income-focused ideas with these 14 dividend stocks with yields > 3% that offer yields above 3% for potential cash return.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal