A Look At ONE Gas (OGS) Valuation After A Year Of 18.35% Total Shareholder Return

ONE Gas (OGS) has been drawing attention after its recent share performance, with the stock roughly flat year to date but showing an 18.35% total return over the past year.

See our latest analysis for ONE Gas.

ONE Gas’s recent share price has eased back over the past quarter, yet the 1 year total shareholder return of 18.35% suggests momentum has been building rather than fading.

If you are weighing ONE Gas against other utilities, it can also be useful to look beyond the sector and see how it compares with broader income ideas such as pharma stocks with solid dividends.

With the shares at US$77.42, a value score of 1, mixed recent returns and analyst targets sitting higher at US$84.86, you have to ask: is ONE Gas quietly undervalued, or is the market already pricing in future growth?

Most Popular Narrative: 8.8% Undervalued

With ONE Gas last closing at US$77.42 against a narrative fair value of about US$84.86, the story centers on modest growth assumptions and a relatively full utilities style earnings multiple.

Favorable regulatory developments, particularly Texas House Bill 4384, enable full recovery of capital expenditures and reduce regulatory lag, which is anticipated to drive higher earnings and more predictable net profit margins in the coming years. Accelerating capital investment in system reinforcement and modernization (such as the Austin system project), in response to both safety and demand, expands the regulated rate base, resulting in higher allowed returns and EPS growth.

Want to see what earnings path and margin profile sit behind that fair value gap? The narrative leans on measured revenue growth, firmer profitability, and a richer future P/E multiple. Curious how those ingredients combine to justify today’s valuation tension?

Result: Fair Value of $84.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh the risk that heavy capital spending and inflation driven cost pressures could squeeze cash flows if regulators are slower to approve recovery.

Find out about the key risks to this ONE Gas narrative.

Another View: What The Market Multiple Is Saying

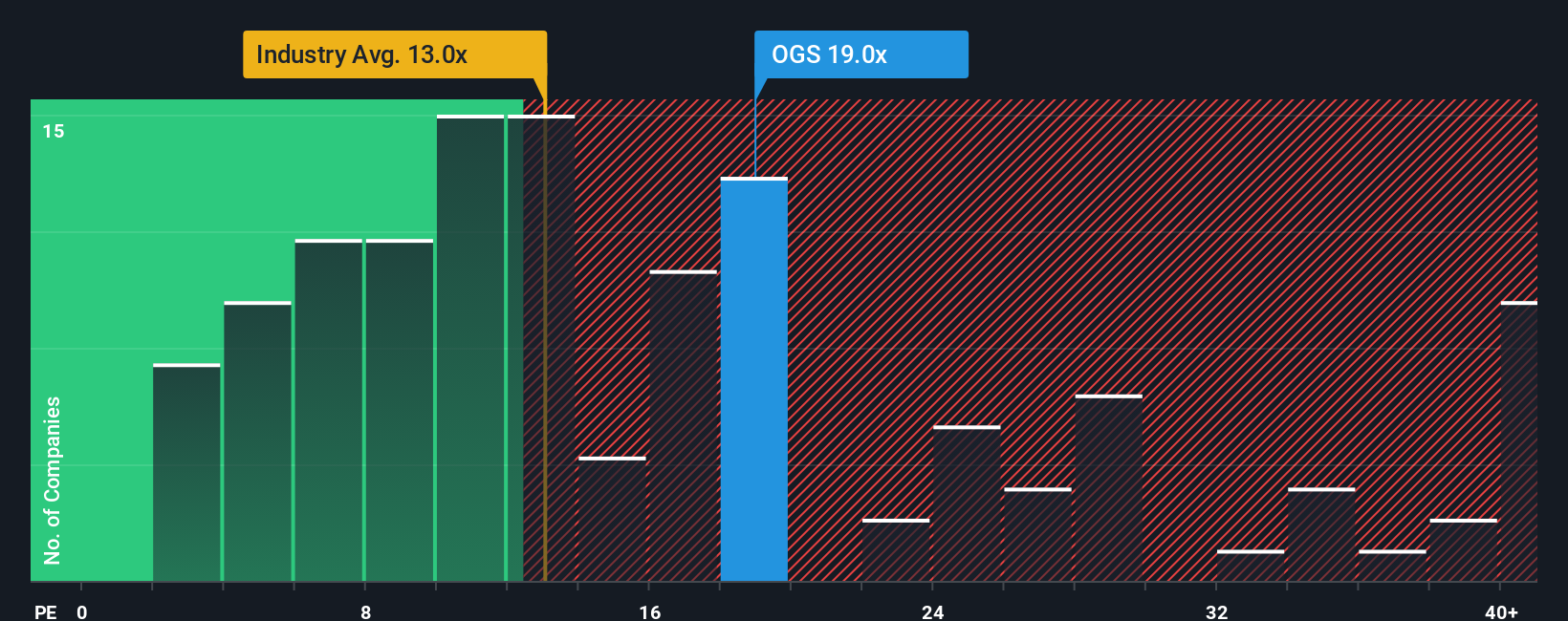

While the fair value narrative points to an 8.8% discount, the current P/E of 18.2x tells a different story. It sits just above the peer average of 18.1x and well above the global gas utilities average of 14x, which suggests less room for error if growth or regulation disappoints.

At the same time, that 18.2x P/E is in line with the fair ratio of 18.2x. In other words, the market price already matches what our model suggests the ratio could move toward. That mix of a premium versus the industry, but fair versus the model, raises the question of whether you are being paid enough for the risks you are taking.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ONE Gas Narrative

If you look at the numbers and see a different story, or simply prefer running your own checks, you can build a custom view in minutes with Do it your way.

A great starting point for your ONE Gas research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one company. Use the same framework across a few different angles so you can see where ONE Gas really stands in your wider watchlist.

- Hunt for potential mispricing by checking out these 870 undervalued stocks based on cash flows that line up with your return and risk expectations.

- Zero in on consistent income ideas by scanning these 14 dividend stocks with yields > 3% that might complement or contrast with a regulated utility.

- Cast a wider net across digital assets by reviewing these 79 cryptocurrency and blockchain stocks that could bring a different risk and correlation profile to your holdings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal