Rubrik (RBRK) Valuation In Focus After Recent Share Price Cooling

Why Rubrik stock is on investor radars

Rubrik (RBRK) has been drawing attention after recent share price moves, with the stock down about 1% over the past week and 3% over the past month, prompting closer scrutiny of its fundamentals.

See our latest analysis for Rubrik.

Those recent share price declines sit against a flat year to date share price return and a 10.18% total shareholder return over the past year, which hints that momentum has cooled even as longer term holders remain in positive territory.

If Rubrik has you thinking more broadly about cybersecurity and data-focused tech, this could be a good moment to scan other high growth tech and AI names using high growth tech and AI stocks.

With Rubrik posting 18.31% annual revenue growth, a loss of US$376.751 million and a value score of 2, the key question is whether recent share weakness signals a buying opportunity or if the market already prices in future growth.

Most Popular Narrative: 33.8% Undervalued

Rubrik's most followed narrative pegs fair value at about US$114 per share versus the last close of US$75.47. On that view, the stock is framed as materially underpriced.

The fair value estimate has edged down slightly from approximately $115.20 to about $114.05 per share, reflecting modestly more conservative assumptions. The discount rate has risen slightly from around 8.39% to roughly 8.67%, modestly increasing the required return applied to Rubrik's future cash flows.

Want to see what is behind that higher fair value? The narrative leans on strong top line expansion, rising margins, and a rich earnings multiple years from now. Curious how those moving parts fit together into that single target?

Result: Fair Value of $114.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upbeat story could be knocked off course if competitive pressure in cyber resilience bites harder than expected or if AI and cloud products see slower adoption.

Find out about the key risks to this Rubrik narrative.

Another view: market pricing looks richer on sales

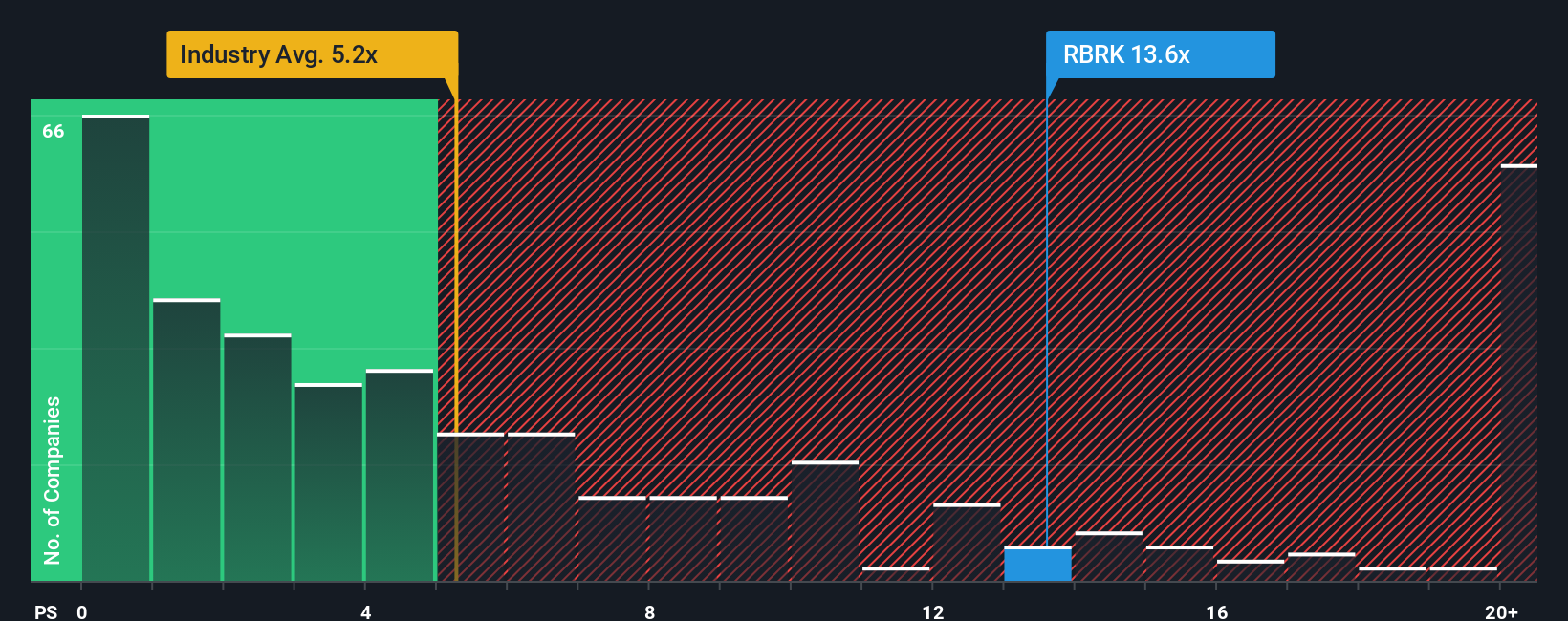

While the narrative and fair value work suggest Rubrik is undervalued, the P/S ratio tells a tighter story. At 12.6x sales versus a fair ratio of 10.4x, the shares trade at a premium, and they also sit above the US Software industry at 4.7x and peers at 8.5x. Is that extra pricing cushion or extra valuation risk in your view?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rubrik Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to run your own checks, you can build a custom Rubrik view in just a few minutes with Do it your way.

A great starting point for your Rubrik research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Rubrik has sharpened your interest, do not stop here. Broaden your watchlist with other focused ideas that could suit different goals and risk levels.

- Target potential mispricing by checking out these 870 undervalued stocks based on cash flows that match your preferred quality and return profile.

- Explore the AI theme more selectively by focusing on these 25 AI penny stocks shaping key areas across software, chips, and infrastructure.

- Add diversification with income potential by scanning these 14 dividend stocks with yields > 3% that may fit a more cash focused approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal