The ban on cornerstone shares will soon be lifted after the “roller coaster” of stock prices. Can the new valuation anchor point of Xunzhong Communications (02597) be realized?

The stock price of Xunzhong Communications (02597), which is mired in a whirlpool of sales contract disputes with Beijing Yakang and Beijing Yunxi, has led to the judicial freezing of funds in the two bank accounts.

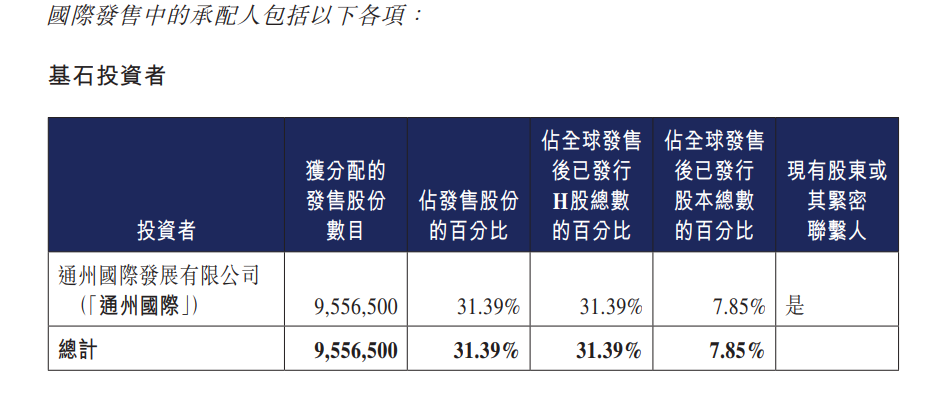

The Zhitong Finance App learned that the ban on 9.5565 million restricted shares held by XunZhong Communications Cornerstone investors will be lifted on January 9. These shares account for 31.39% of the company's total shares sold globally. If Cornerstone investors choose to cash out the profit after the ban is lifted, it may put a clear pressure on XunZhong Communications's stock price.

Stock prices are crazy “roller coasters”, sluggish trading volume, or difficult to support the exit from the cornerstone

As the first company listed in Beijing under the “3+H” (new three board+H shares) model, Xunzhong Communications was successfully listed and traded on the Hong Kong Stock Exchange on July 9, 2025. The time difference of nearly one month did not catch up with the dividends brought by the new Hong Kong stock IPO regulations that officially came into effect on August 4, so its performance during the offering phase was not outstanding.

According to the data, Xunzhong Communications sold a total of 30.44 million shares in the global sale, accounting for 25% of the company's issued shares after listing. Among them, the number of shares under the Hong Kong public offering was 3.044 million shares, accounting for 10% of the shares offered globally. The remaining 27.364 million shares were sold internationally, accounting for 90% of the shares offered globally.

Judging from the share allocation results, XunZhong Communications's Hong Kong public offering oversubscribed by 12.79 times, did not trigger a rebate mechanism, and was only 1.01 times subscribed under the international offering. Overall, it was relatively lackluster.

However, Xunzhong Communications introduced a major cornerstone investor, Tongzhou International Development Co., Ltd. (hereinafter referred to as “Tongzhou International”) in the international sale. Tongzhou International is a wholly-owned subsidiary of Beijing Tongzhou Development Group Co., Ltd. The latter is mainly engaged in industrial park construction, industrial operation, financial services, and enterprise services, and is ultimately beneficially owned by the Beijing Tongzhou District People's Government's State-owned Assets Supervision and Administration Commission. This means that the cornerstone investors introduced by Xunzhong Communications belong to the Beijing State-owned Assets Administration Commission.

It is worth noting that Dongfang Huagai, which holds 2.44% of Xunzhong Communications's interest, and Huagai Venture Capital, which holds 0.36% of Xunzhong Communications's shares, are effectively controlled by the Beijing State-owned Assets Administration Commission and hold more than 30% of the shares, so the cornerstone investor Tongzhou International is also a close contact of Xunzhong Communications's existing shareholders. It can also be seen from this that the Beijing State-owned Assets Administration Commission strongly supports the development of Xunzhong Communications.

However, as the cornerstone investor of Xunzhong Communications, Tongzhou International subscribed for 9.5565 million shares, accounting for 31.39% of the total shares sold globally. This means that more than one-third of the shares under the international offering were subscribed by Tongzhou International, while the actual share of Xunzhong Communications's tradable shares after listing reached 17.15%.

Obviously, Xunzhong Communications did not adopt the “dumb distribution” model to control the actual circulation of chips to stabilize stock prices, but instead adopted a conventional distribution method. Although the risk of breakout has increased under this model, it can maximize financing to promote the company's development and improve the liquidity of the company's stock.

Judging from the stock price performance, Xunzhong Communications broke through the market on the first day of listing. Although it was a red market at the close, its stock price fluctuated around the issue price of HK$13.55 for nearly two months. After the chips were fully replaced and settled, it only increased in volume on September 5. The biggest increase in 10 trading days was 64%, up as high as HK$22.1 per share, up more than 63% from the issue price.

However, after hitting the highest price of HK$22.1 per share on September 18, Xunzhong Communications's stock price fell all the way down. The intraday low prices on November 14, December 11, and December 30 all fell below the issue price. As of December 31, 2025, XunZhong Communications quoted HK$15.16 per share, an increase of only 11.88% from the issue price.

It can be seen from this that within six months of the listing of XunZhong Communications in Hong Kong, its stock price has taken a “crazy roller coaster,” and whether the cornerstone investors sell off after the ban is lifted will be the most central factor affecting the future stock price trend of Xunzhong Communications, because judging from the current liquidity of XunZhong Communications, it is difficult to withstand the sharp sell-off pressure.

According to Wind data, during the three months of October, November, and December, XunZhong Communications's monthly turnover was 3.96 million, 5.81 million yuan, and 33.54 million yuan respectively. December's turnover was significantly higher because December 11 alone traded 30.93 million yuan. On that day, XunZhong Communications's stock price plummeted 11.18%. Obviously, a large amount of money had already been left on this day. Excluding this unusual day, XunZhong Communications's turnover in December may be similar to October and November.

Currently, the cornerstone investor Tongzhou International holds 9.5565 million shares of Xunzhong Communications, with a total market value of about HK$145 million. Under the sluggish trading volume of XunZhong Communications, if Cornerstone investors choose to withdraw after the ban is lifted on January 9, it will not only put pressure on Xunzhong's stock price, but it is also likely that they will lose money.

Start a new story and enter a new stage in the development of two-wheel drive

The core factor that determines the “stay” of cornerstone investors is the fundamentals of XunZhong Communications and future growth expectations.

According to Frost & Sullivan data, Xunzhong Communications is one of the first providers of cloud communication services in China, and is also one of the few domestic providers that can provide AI-driven communication services. In terms of revenue in 2024, XunZhong Communications is the third-largest cloud communication service provider in China, with a 1.8% share of the Chinese cloud communication service market in 2024.

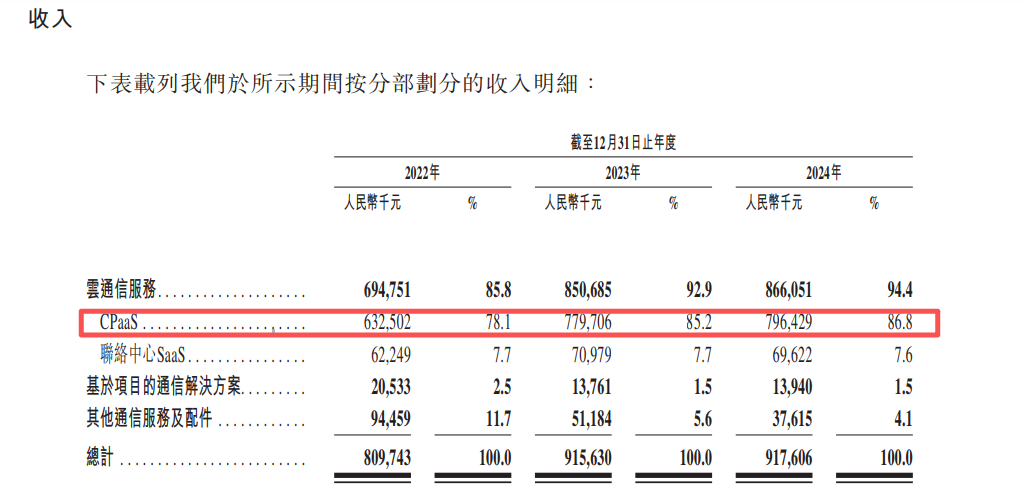

In terms of employment performance, Xunzhong Communications has shown a “fatigue state” of increasing revenue and not increasing profit from 2022 to 2024. According to the prospectus, from 2022 to 2024, Xunzhong Communications's revenue was about 810 million yuan, 916 million yuan, and 918 million yuan respectively, achieving steady growth, mainly due to the increase in CPaaS business revenue year by year.

However, looking at the profit side, Xunzhong Communications net profit from 2022 to 2024 was 759.72 million yuan, 776.21 million yuan, and 53.545 million yuan respectively. Net profit to mother declined sharply in 2024. It is worth noting that Xunzhong Communications vigorously implemented a cost reduction and efficiency strategy in mid-2024. Sales expenses, administrative expenses, and R&D expenses during the period all declined to varying degrees compared to 2023, but due to significant increases in impairment losses, other expenses and losses, financial costs, etc., this in turn encroached on the company's net profit.

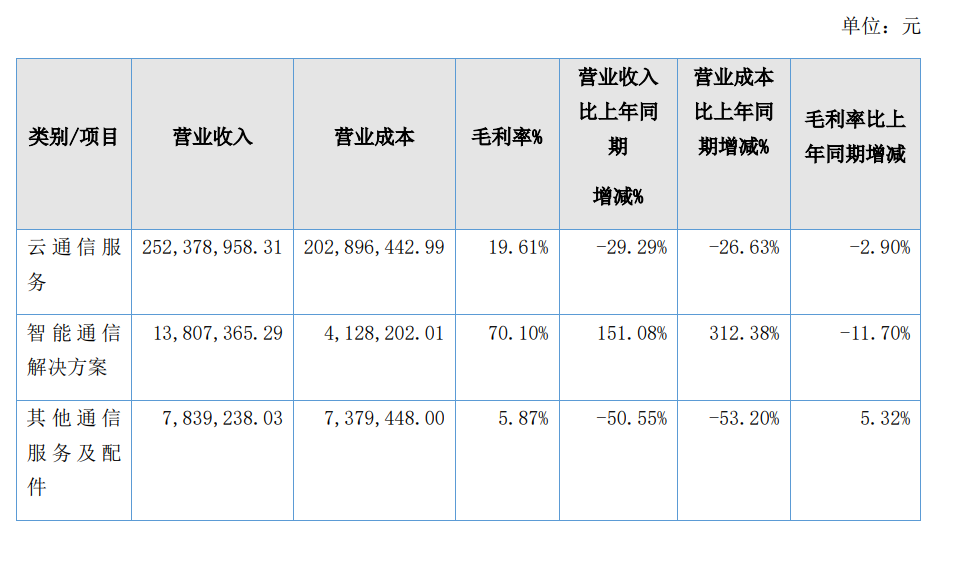

Entering the first half of 2025, the business operations of XunZhong Communications were once again impacted. During the reporting period, the total revenue of XunZhong Communications was 274 million yuan, down 27.55% from the previous year. This was mainly due to the company's targeted reduction in the business volume of some low-margin customers. Also, due to the Ministry of Industry and Information Technology's announcement in the first half of 2025 requiring SMS content providers to complete a series of revisions to their qualification information, which led to a temporary decrease in market demand for Xinzhong Communications messaging products and services. Xunzhong Communications said that the company has now completed all of the relevant policies of the Ministry of Industry and Information Technology, and it is expected that the company's operating income will return to stability in the second half of the year and will no longer be affected by the above policies.

In the mid-term financial report, which saw a sharp decline in revenue, there are also two obvious highlights. One is that thanks to the implementation of projects in scenarios such as digital cities and smart construction sites, the revenue of high-margin intelligent communication solutions surged 151.08% to 13.8074 million yuan, achieving rapid expansion; the second is that the net profit from Xunzhong Communications during the reporting period was 25.618,500 yuan, an increase of 0.61% over the previous year, and the profit side remained steady, mainly because high-margin and high-growth intelligent communication solution services became the core profit margin.

At this point, Xunzhong Communications has explained a new story to the market, namely, actively reducing low-margin business under the opportunity of the Ministry of Industry and Information Technology's qualification rectification to achieve high-quality development of core business cloud communication services to optimize the business structure; on this basis, Xunzhong Communications is devoting resources to expand intelligent communication solution services, that is, customized projects that provide high added value to the government and the public sector, turning the business into a new growth curve to stabilize the company's profits and improve cash flow. In the first half of 2025, the net cash flow from Xunzhong Communications's operating activities was 73.78 million yuan, a surge of 224.73% over the same period last year. It was corrected for the first time, reversing the net cash flow situation for three consecutive years from 2022 to 2024.

It can be seen from this that the previous development model of Xunzhong Communications, which was driven by traditional cloud communication service providers, will gradually change to a two-wheel drive model with steady development of cloud communication services and high growth in intelligent communication solutions. Furthermore, intelligent communication solutions are mainly aimed at the government and public sector, which can form good collaboration with the government shareholders of Xunzhong Communications, thereby accelerating the rapid expansion of this business. This is probably also a key reason why the Beijing State-owned Assets Administration Commission chose to act as a cornerstone investor in the global sale of Xunzhong Communications to further increase its support for Xunzhong Communications.

However, whether it can continue to deliver on the new narrative will become the core anchor point for Xunzhong Communications to reshape its value position in the capital market, and it is worth investors' continued attention.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal